Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- tech

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- china

- russia

- assetmanagement

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

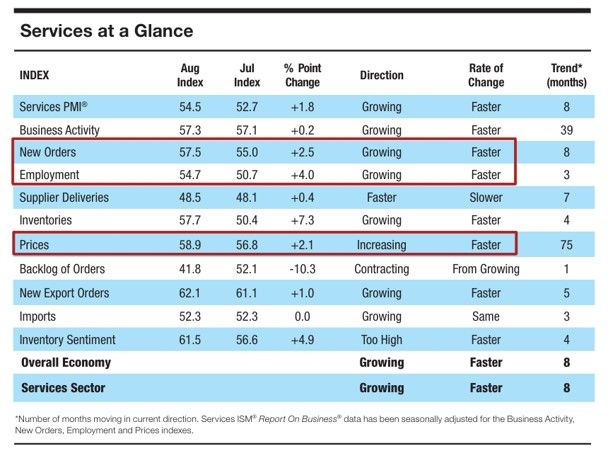

One key development of the week (beyond brent hitting $90) has been stronger than expected macroeconomic data - e.g the ISM services (see data table below from Markets & Mayhem)

Indeed what we are seeing in the last ISM Services PMI reading may not be the best news for the inflation situation: 1) New orders growing faster 2) Employment growing faster (from being nearly flat m/m) 3) Prices rising faster And the market reaction - stocks pulling back - means that good macro news is bad news for the market again. Indeed, while a growing economy supports rising corporate profits (which is a positive), a too strong economy would imply a more hawkish FED than it is currently anticipated by the market.

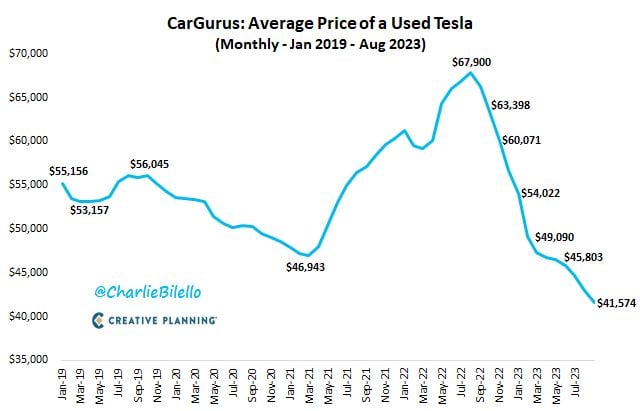

At least there is deflation somehwre...

The average price of a used #Tesla has declined 13 months in a row, moving from a record high of $67,900 in July 2022 to a record low of $41,574 in August 2023 (-39%). Source: Charlie Bilello

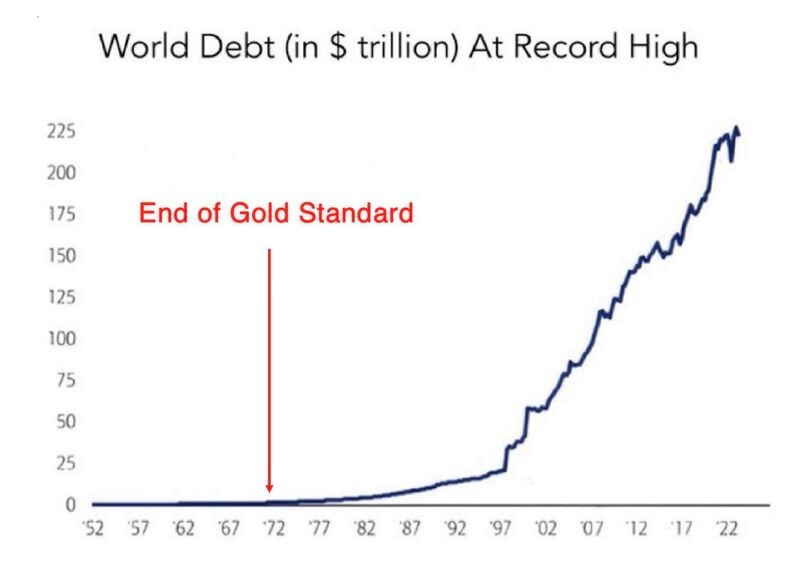

Total Global Debt is now estimated to be over $300 Trillion and has been rising exponentially since 1971

Source: TheBTCTherapist

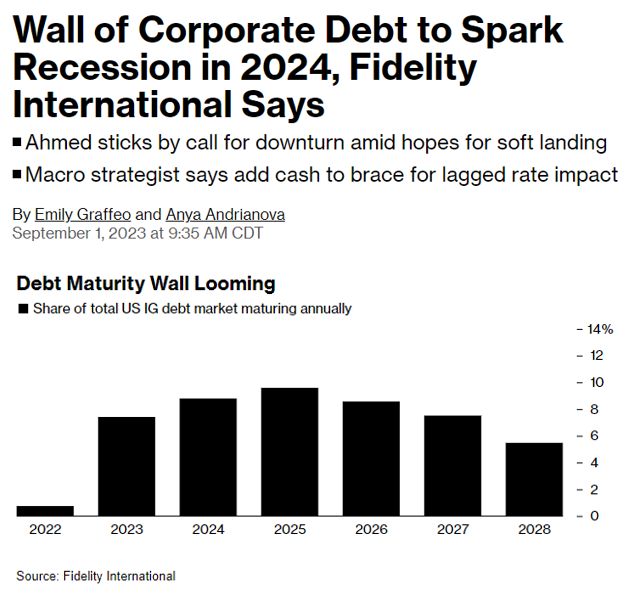

A wave of corporate debt refinancing over the next 6 months will spark a recession in 2024 warns Fidelity International

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks