Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Is the US job market finally cooling down?

The JOLTs report for July showed a huge drop in job openings (8.82mln vs the Street 9.5mln), and June was revised meaningfully lower to 9.16mln from previous 9.58mln Source: Bloomberg, HolgerZ

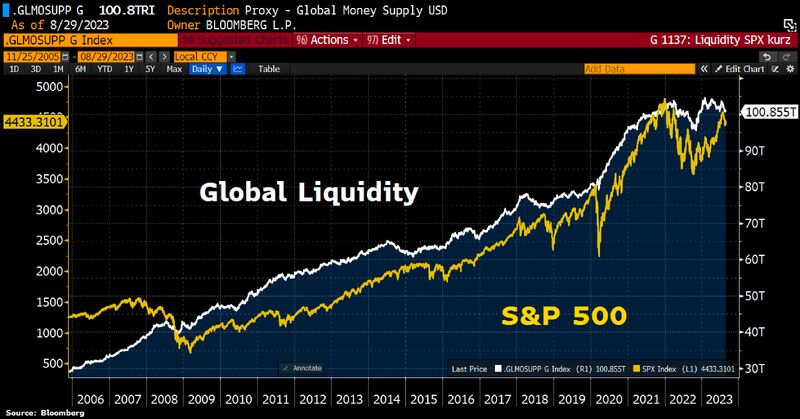

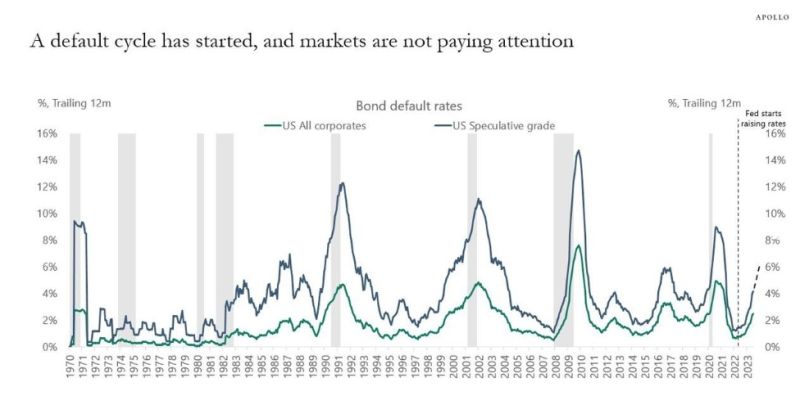

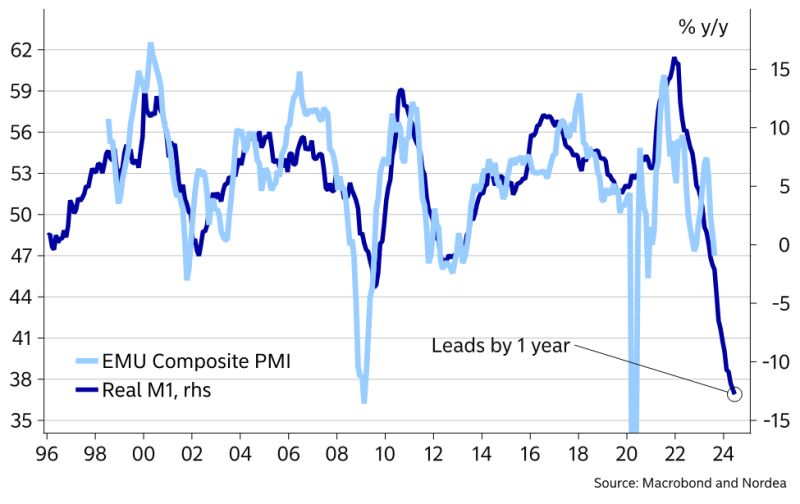

Investors predict that the coming years will be marked with defaults and spending cuts as a larger portion of corporate, household and state income goes into financing debt

A stark indicator of the approaching sea change is the gap between what governments and companies globally are currently paying in interest and the amount they would pay if they refinanced at today’s levels. Apart from a few months around the global financial crisis, the gauge has always been below zero. Now it’s hovering around a record high of 1.5 percentage points. Source: Bloomberg

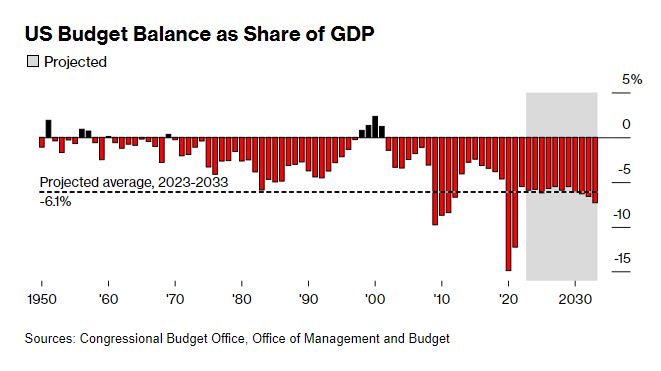

US Budget Deficits Are Exploding Like Never Before

Some economists and investors warn that the Biden administration’s fiscal spending—it’s pouring hundreds of billions of dollars into programs to bolster domestic manufacturing of electric cars and semiconductors, and to repair roads and bridges—could rekindle inflation and make it hard for the Fed to dial back its rate hikes. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks