Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Michael Burry is an outstanding contrarian investor and did exceptionally well during the 2006-2008 US housing crash

However, performance is not always repeatable and his next bets haven't paid off that well (at least the market views shared publicly - hedge fund long-term performance looks quite strong on a sharper ratio basis). Adam Khoo had a look at all of Michael Burry's recent predictions and he shared it with a chart on X. Here's a summary: In 2005, Predicted the collapse of the subprime mortgage market -> Housing market crashes in 2008, Global Financial Crisis. On Dec 2015, he predicted that the stock market would crash within the next few months. -> SPX +11% Next 12 months. On May 2017, he predicted a global financial meltdown-> SPX +19% Next 12 months. On Sept 2019, he predicted that the stock market would crash due to a bubble in index ETFs -> SPX +15% Next 12 months. Source: Adam Khoo Trader

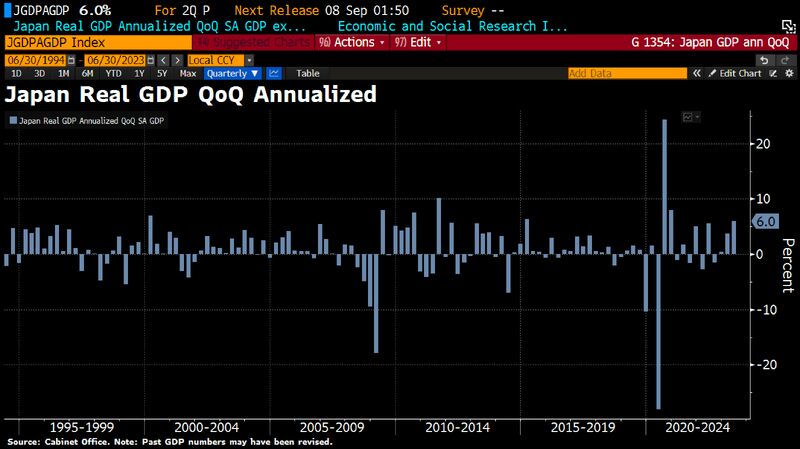

Japan GDP grew 6%, handily beating expectations on robust exports - but domestic demand disappoints

Japan Q2 GDP improves to 1.5% QoQ vs 0.8% expected and 0.1% prior, meaning Japan grows 6.0% on annualized basis, far more than expected (+2.9% yoy). However, some details of the report weren’t as impressive as the headline. As pointed out by analysts in CNBC report, nearly all of the increase in output was driven by a 1.8%-pts boost from net trade. That marked the second-largest contribution from net trade in the 28-year history of the current GDP series, with only the bounce back in exports from the first lockdown at the beginning of the pandemic providing a larger boost. Exports rebounded 3.2% from the previous quarter — largely driven by the spike in car shipments — while imports plunged 4.3% over the time period. Source: Bloomberg, HolgerZ, CNBC

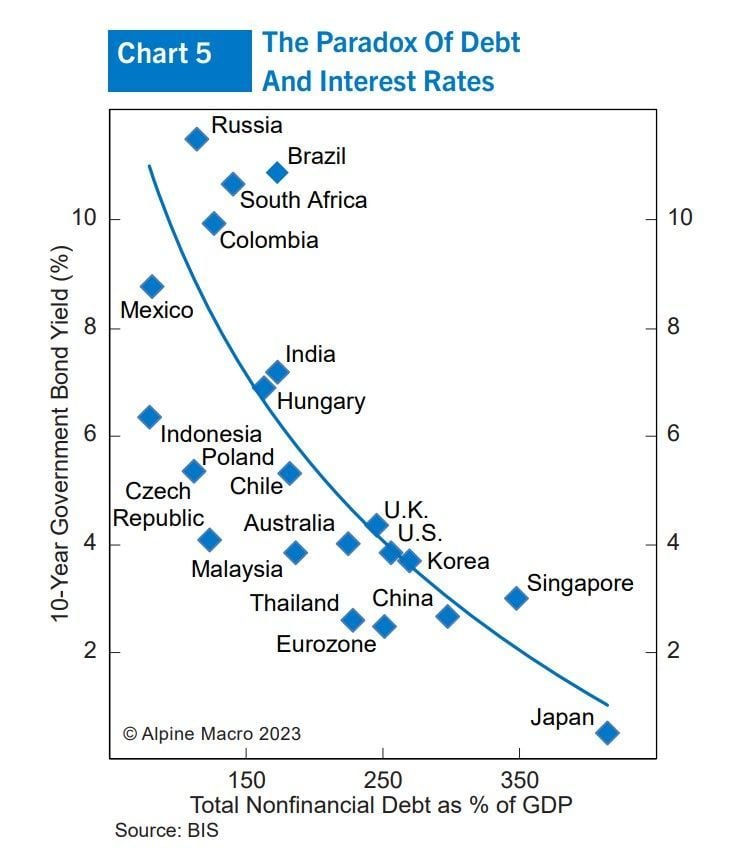

The countries that have rarely borrowed, such as Brazil or Mexico, often pay much higher interest rates than those that have much higher debt ratios, like Japan or China.

Intriguing chart by Alpine Macro

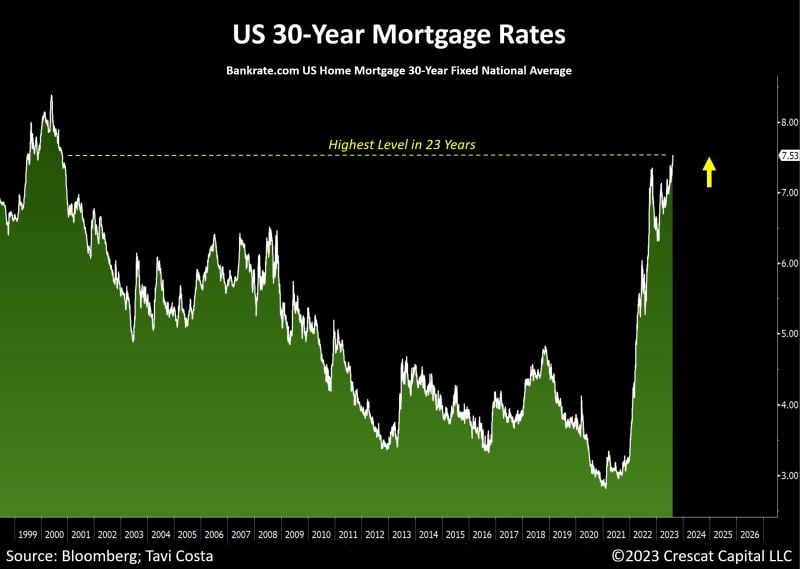

US average mortgage rates just surged above 7.5% for the first time in 23 years

There are some reasons why US house prices haven’t crashed: 1. Buyers can’t afford the rates; 2. Sellers would be insane to sell a home with a significantly lower rate to buy another at 7.5%. Market is frozen. The economy is currently experiencing a significant tightening of financial conditions, largely driven by the persisting fragility in the Treasury market. The bill will come due at some point. Source: Crescat Capital, The Wolf of All Streets

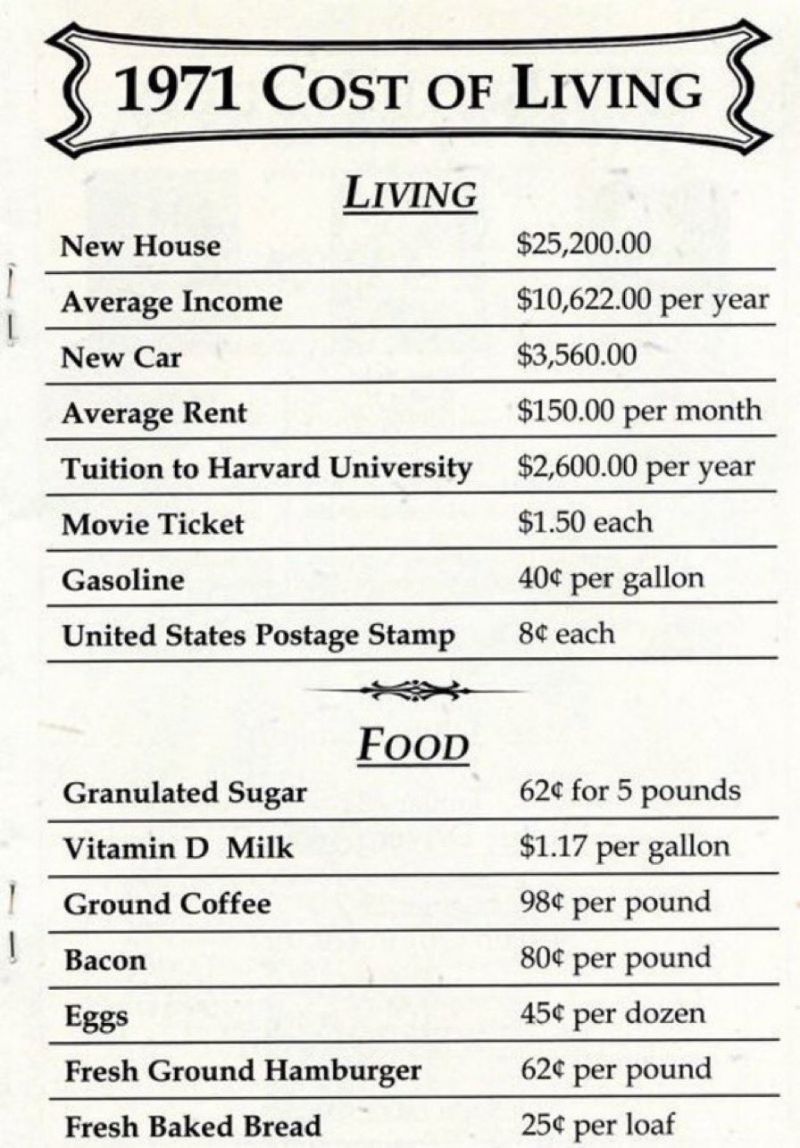

1971 vs NOW

The average U.S. annual income in 1971 paid off a house in ~2.5 years, could buy 3 new cars in a year, send 4 kids to Harvard in a year and easily afford food, shelter, necessities and entertainment. Does the older generation understand the difficulties the young face today? Source: Gabor Gurbacs

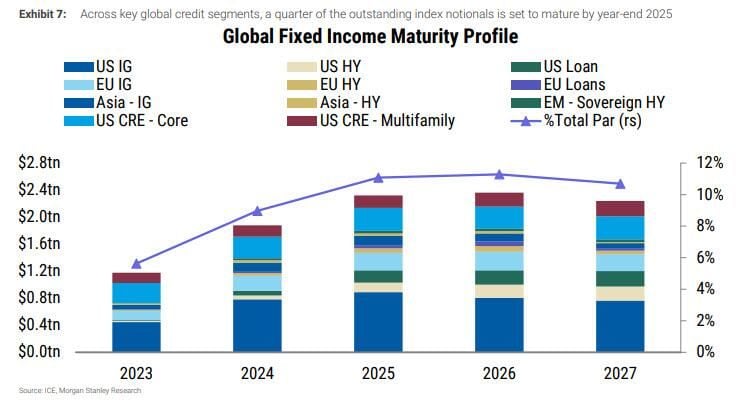

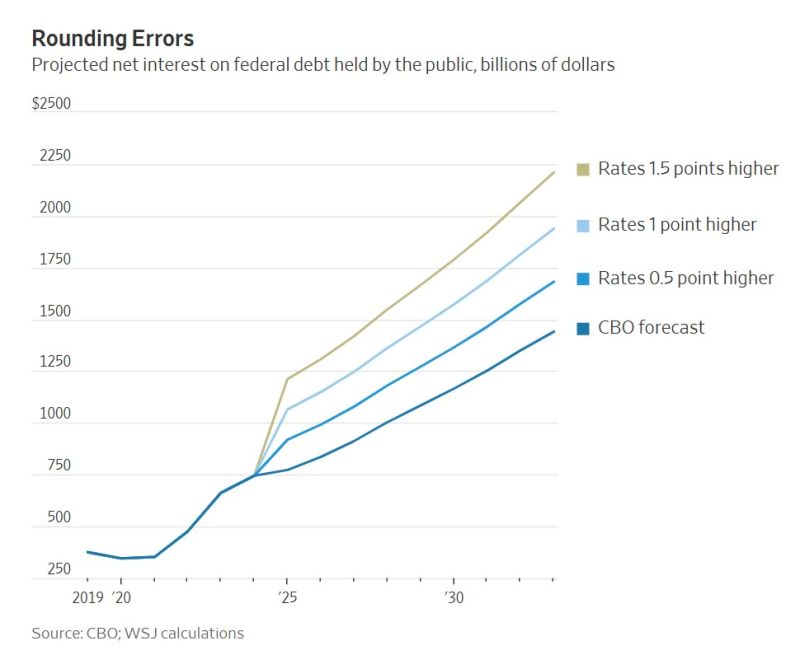

Very interesting WSJ article: "The Scary Math Behind the World’s Safest Assets. Washington has laid the seeds of a crisis that Wall Street can no longer ignore"

Here's an extract: "Consider that around three-quarters of Treasuries must be rolled over within five years. Say you added just 1 percentage point to the average interest rate in the CBO’s forecast and kept every other number unchanged. That would result in an additional $3.5 trillion in federal debt by 2033. The government’s annual interest bill alone would then be about $2 trillion. For perspective, individual income taxes are set to bring in only $2.5 trillion this year. Compound interest has a way of quickly making a bad situation worse—the sort of vicious spiral that has caused investors to flee countries such as Argentina and Russia. Having the world’s reserve currency and a printing press that allows it to never actually default makes America’s situation far better, though not consequence-free. Just letting rates rise high enough to attract more and more of the world’s savings might work for a while, but not without crushing the stock and housing markets. Or the Fed could step in and buy enough bonds to lower rates, rekindling inflation and depressing real returns on bonds".

Investing with intelligence

Our latest research, commentary and market outlooks