Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

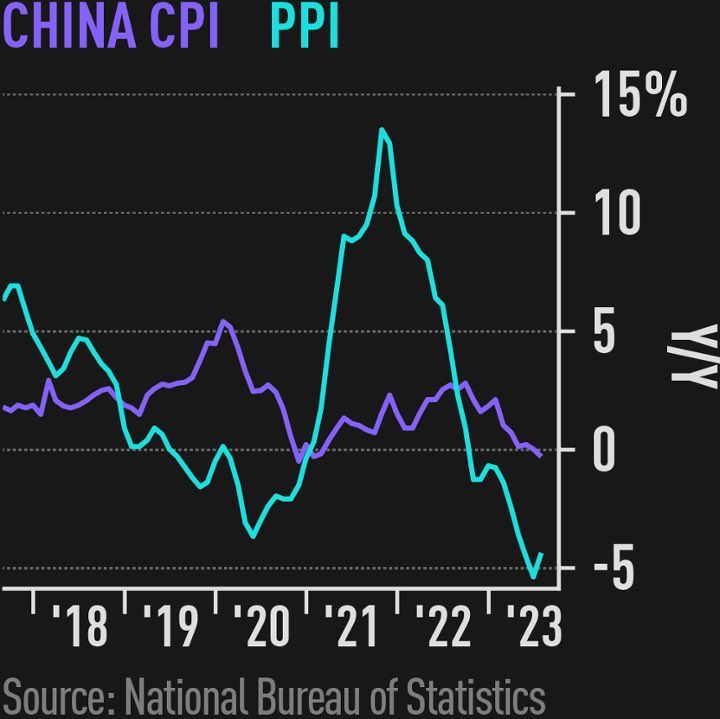

China's consumer and producer prices both declined in July for the first time since November 2020, a sign of deflation pressure amid weakening demand

CPI dipped 0.3% from a year earlier while PPI retreated for a 10th consecutive month, sliding 4.4%. "China is in deflation for sure," said Robin Xing at Morgan Stanley. "The question is how long." The statistics bureau attributed the CPI decline to the high base of comparison, saying the dip is likely to be temporary. Source: J-C Gand

Total credit card indebtedness increased by $45 billion in the April-through-June period, an increase of more than 4%

That took the total amount owed to $1.03 trillion, the highest gross value in Fed data going back to 2003. The increase in the category was the most notable area as total household debt edged higher by about $16 billion to $17.06 trillion, also a fresh record. As card use grew, so did the delinquency rate. The Fed’s measure of credit card debt 30 or more days late rose to 7.2% in the second quarter, up from 6.5% in Q1 and the highest rate since the first quarter of 2012 though close to the long-run normal, central bank officials said. Total debt delinquency edged higher to 3.18% from 3%. Source: CNBC

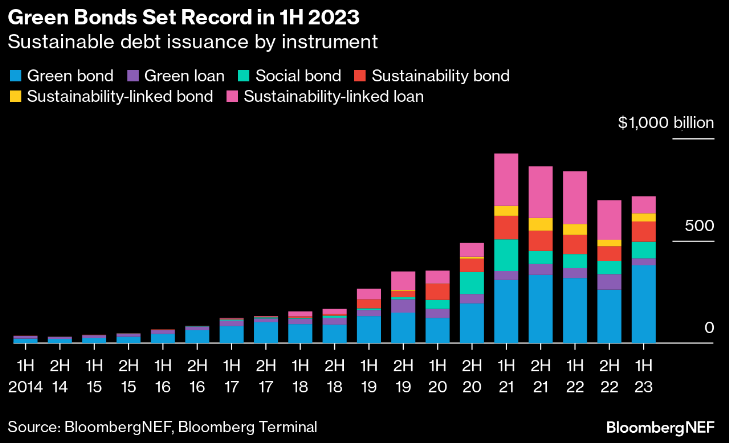

Record green bond sales lift outlook for ESG debt

Green bonds issuance globally hit a record $380 billion in the first half of 2023, rebounding from $261 billion during the prior six months.

Governments and financials are the main contributors. Germany, Italy and Hong Kong governments in combination sold $52 billion green bonds, 150% more than each half of 2022.

Source: Bloomberg

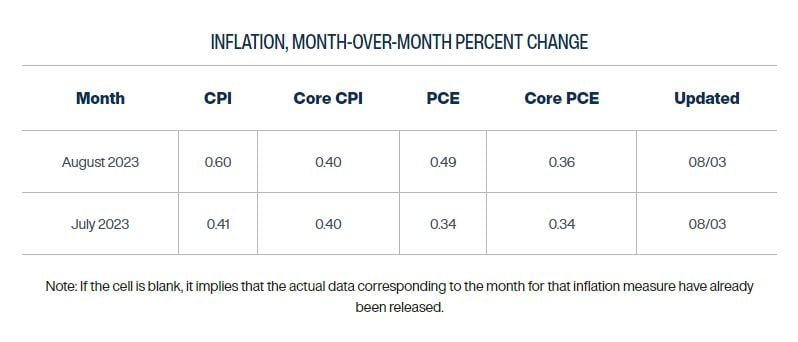

Consumer price inflation is creeping higher again on a month-over-month basis, driven in part by higher gas prices, according to the Cleveland Fed's forecast

Source: Lisa Abramowicz

Investing with intelligence

Our latest research, commentary and market outlooks