Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

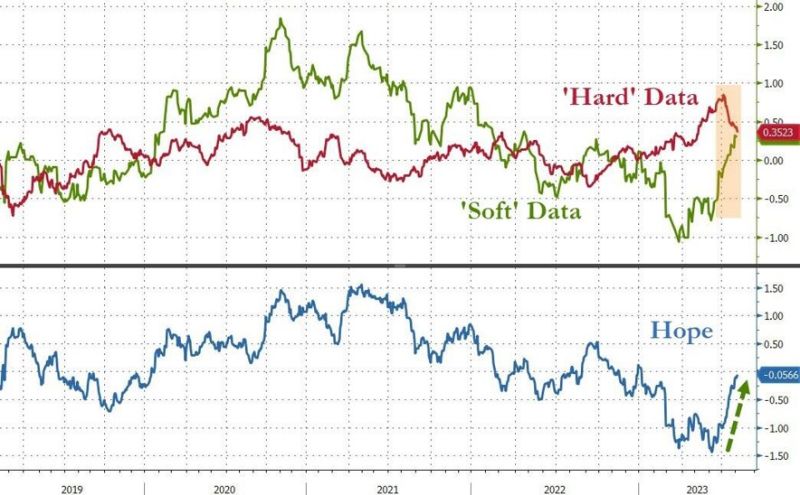

The Citi US Economic Surprise Index is at the highest levels since early 2021

That being said, there has been some divergence recently between "hard" and "soft" data. Indeed, 'Hope' has been in charge of macro data recently with 'soft' survey data surging back in its mean-reverting manner as 'hard' real data has been fading (led down by industrial, personal finance, and housing data)... Source: Bloomberg, www.zerohedge.com

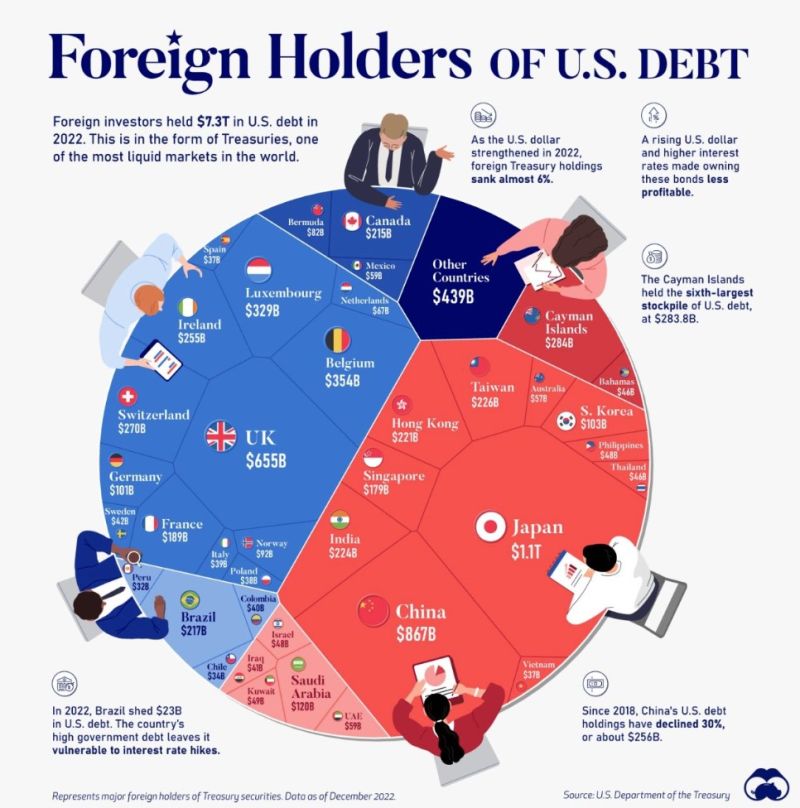

Which Countries Hold the Most U.S. Debt (which just got downgraded)?

With $1.1 trillion in Treasury holdings, #japan is the largest foreign holder of U.S. debt. Japan surpassed China as the top holder in 2019 as China shed over $250 billion, or 30% of its holdings in four years. the United Kingdom is the third highest holder, at over $655 billion in Treasuries. Across Europe, 13 countries are notable holders of these securities, the highest in any region, followed by Asia-Pacific at 11 different holders. A handful of small nations own a surprising amount of U.S. debt. With a population of 70,000, the Cayman Islands own a towering amount of Treasury bonds to the tune of $284 billion. There are more hedge funds domiciled in the Cayman Islands per capita than any other nation worldwide. In fact, the four smallest nations in the visualization above—Cayman Islands, Bermuda, Bahamas, and Luxembourg—have a combined population of just 1.2 million people, but own a staggering $741 billion in Treasuries. Source: Visual Capitalist

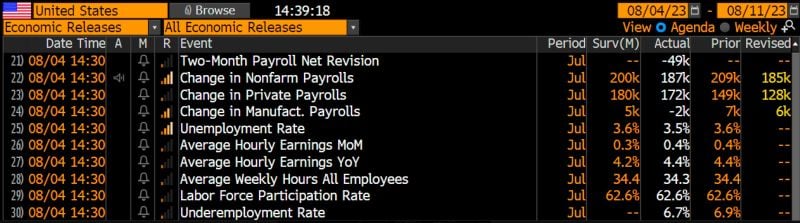

A mixed message from the July US jobs report: the US economy added 187k jobs according to Establishment survey, a tiny bit below Street’s +200k forecast

According to the Household survey, the number of employed people rose by 268k. Because of this 268k number, unemployment rate dipped to 3.5%, down from 3.6% in June and below estimated 3.6%. Wages ran hot, coming in at +4.4% YoY (vs Street +4.2% and vs +4.4% in June). Source: HolgerZ, Bloomberg

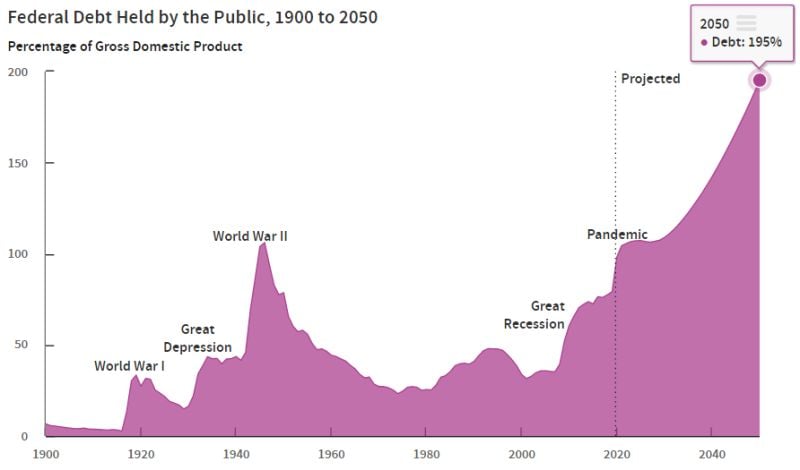

Total US debt levels are expected to rise from 98% of GDP in 2023 to 118% of GDP in 2033

By 2053, Debt-to-GDP in the US is expected to hit an alarming 195%. Hopefully yesterday's downgrade of the US credit rating brings some more attention to this topic. Source: The Kobeissi Letter

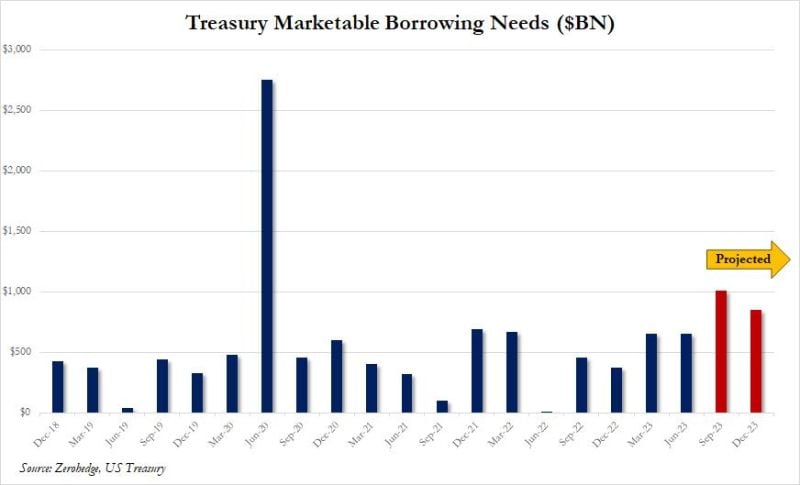

Debt Tsunami Begins: US To Sell $1 Trillion In Debt This Quarter, 2nd Highest In History, As Budget Deficit Explod

The $1.007 trillion in upcoming marketable borrowing is the second highest on record; only the $2.753 trillion in Q2 2020 surpasses it. Source: www.zerohedge.com, US Treasury

Investing with intelligence

Our latest research, commentary and market outlooks