Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

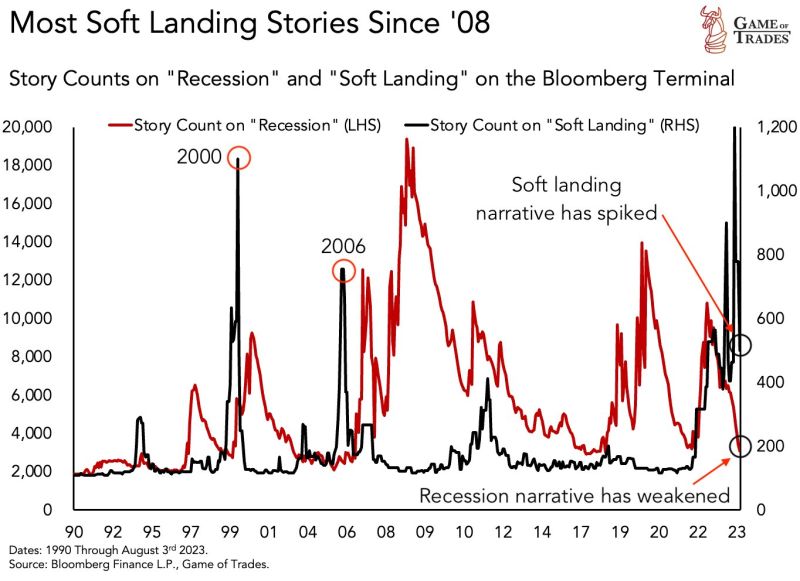

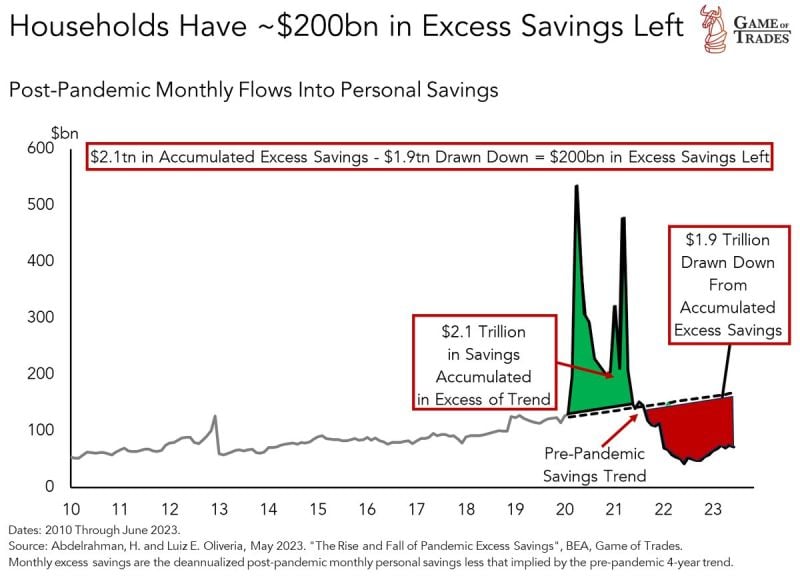

"Soft landing" narrative is now the consensus. This also happened in 2000 and 2006...

Source: Game of Trades

Wage inflation: UPS workers approve massive new labor deal with big raises. The deal passed with 86.3% of votes, the highest contract vote in the history of Teamsters at UPS, according to the union

Under the new agreement: 1. Part time workers will make no less than $21/hour, up from a minimum of $15.50 currently, 2. Full time workers will average $49/hour. Current workers will get $2.75 more an hour this year and $7.50 an hour more over the five-year contract. 3. UPS drivers will average $170,000/year 4. Contract impacts ~340,000 workers 5. The company cut its full-year revenue and margin forecasts, citing the “volume impact from labor negotiations and the costs associated with the tentative agreement.” UPS has put $30 billion aside for this new contract

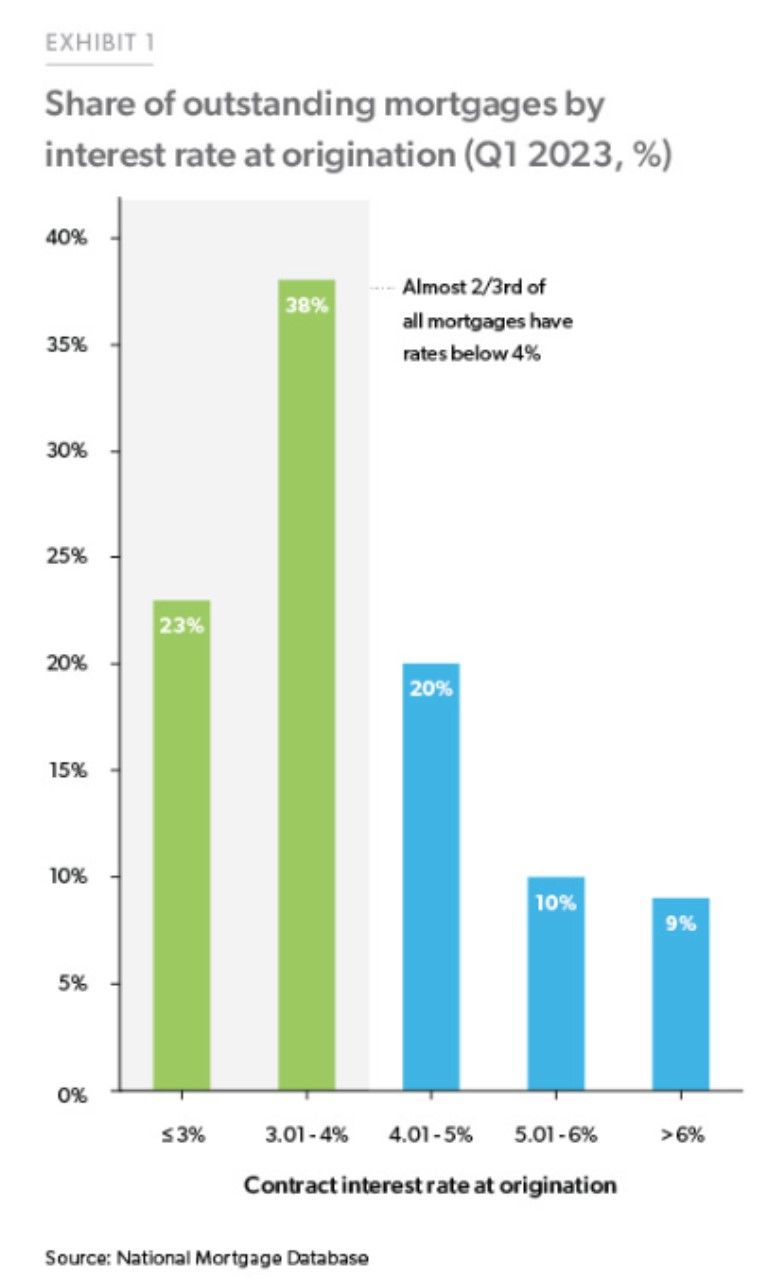

Over 60% of outstanding US mortgages have an interest rate below 4%. Current average 30y mortgage rate is north of 7.5%...

This is the 1 factor driving the limited housing supply as many of these homeowners can't afford to move... Source: Charlie Bilello, National Mortgage Database

Disinflationary forces are intensifying in Germany

Producer Prices drop for 1st time since 2020, a good leading indicator for Consumer Prices. In July, producer prices (PPI) fell by 6.0% YoY, the biggest decline since October 2009, when the financial crisis has caused prices to collapse. Last year, the prices received by manufacturers for their goods had at times risen at a record rate of 45.8%. Source: HolgerZ, Bloomberg

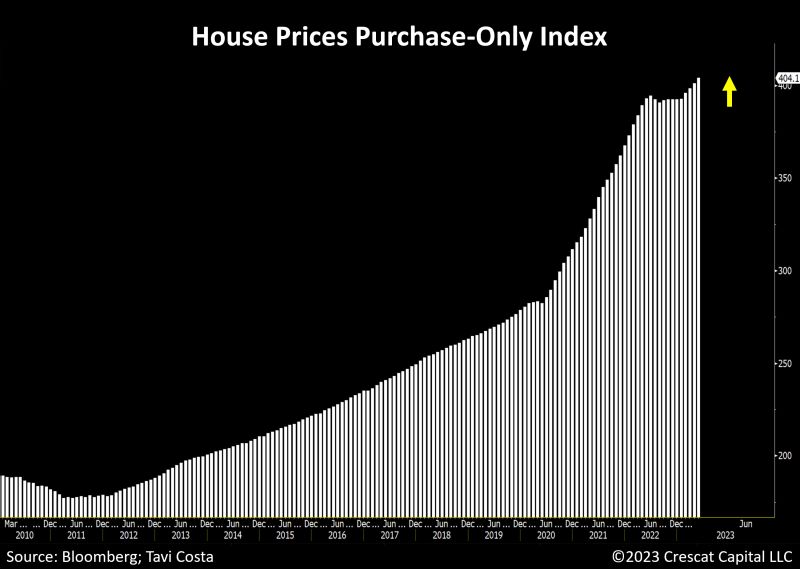

Looking at the recent sales transactions, house prices have accelerated significantly in the last 4 months to record levels, now growing at almost a 10% annualized rate

As a remainder, shelter costs / rents jave been putting upward pressure on core CPI and are expected to ease. Really? Source: Tavi Costa, Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks