Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- tech

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- china

- russia

- assetmanagement

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

Is wage pressure in the US here to stay?

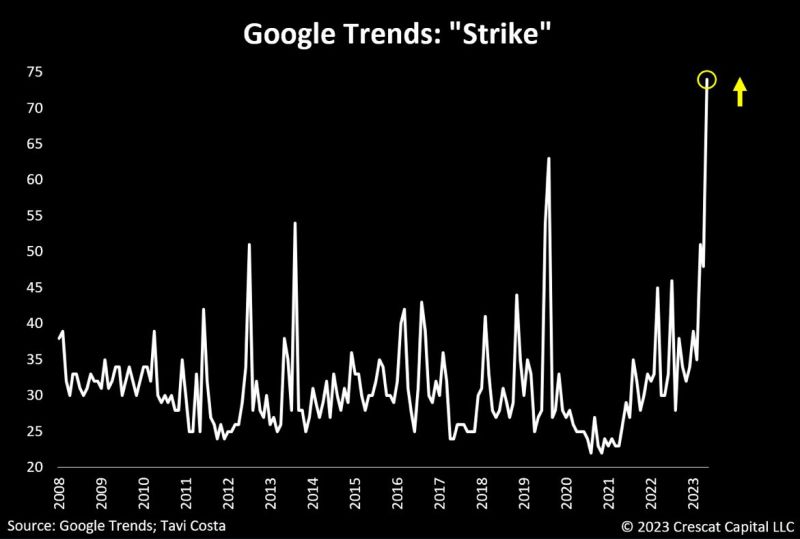

A highlighted by Tavi Costa, the word "strike" recently surged to record levels on Google trends. This surge implies a growing pressure among workers to secure improved compensation deals with their employers. Labor strikes are becoming a regular occurrence in society, reminiscent of their prevalence in the 1970s. The rising cost of living is placing significant pressure on wages to rise. Source: Crescat Capital, Google Trends

French CPI a little hotter than expected, rising 50bp in August

This was all due to energy (including higher regulated prices) and the end of the summer sales, but services inflation is still easing driven by transports and "other services". FRENCH CPI YOY NSA PRELIM ACTUAL 4.8% (FORECAST 4.6%, PREVIOUS 4.3%) FRENCH CPI MOM NSA PRELIM ACTUAL 1% (FORECAST 0.8%, PREVIOUS 0.1%) FRENCH HICP MOM PRELIM ACTUAL 1.1% (FORECAST 1%, PREVIOUS 0.0%) FRENCH CONSUMER SPENDING MOM ACTUAL 0.3% (FORECAST 0.3%, PREVIOUS 0.9%) Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks