Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- tech

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- china

- russia

- assetmanagement

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

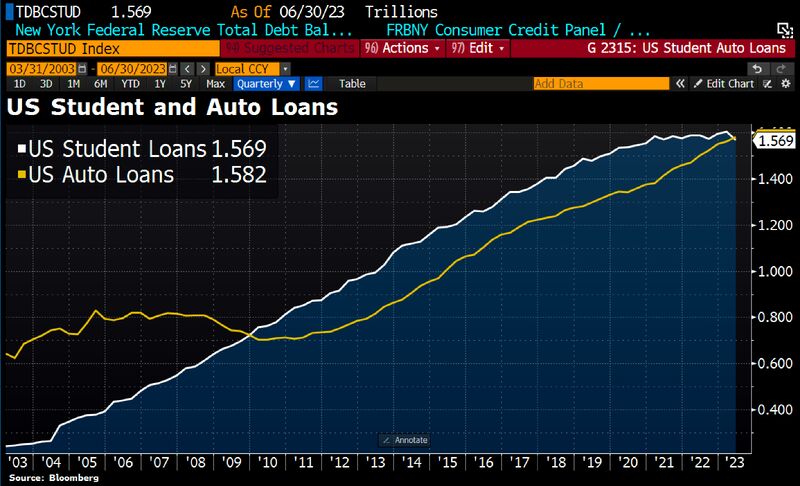

From October onwards, US consumers face a double whammy: student loans + auto loans...

Suspended Student loan payments helped fuel the auto market over the last several years. Auto loans pass Student loans in consumer debt load for the first time in 13yrs, which means consumers face a double-whammy starting in October w/existing auto payments & resumed student loan obligations. Auto loan delinquencies are on the rise and more consumers could fall behind if unemployment increases. Source: Bloomberg, HolgerZ

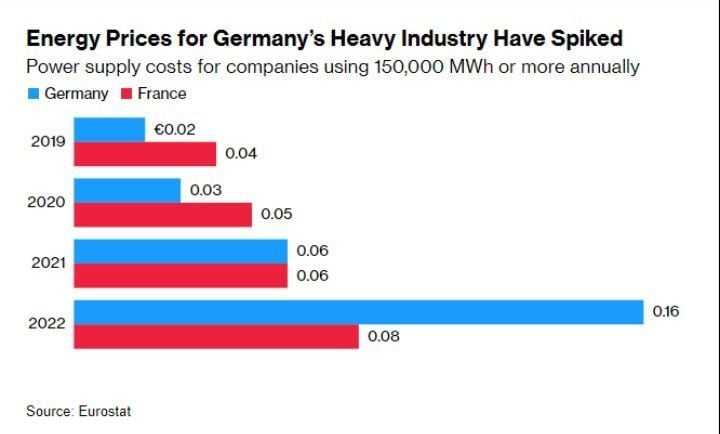

Why German industrial model is at risk in one chart...

Without reliable access to affordable power, Germany fears energy-intensive companies will invest elsewhere, and “we will lose this industrial base,” vice-chancellor Robert Habeck said. Source: Eurostat, Gustavo Philippsen Fuhr

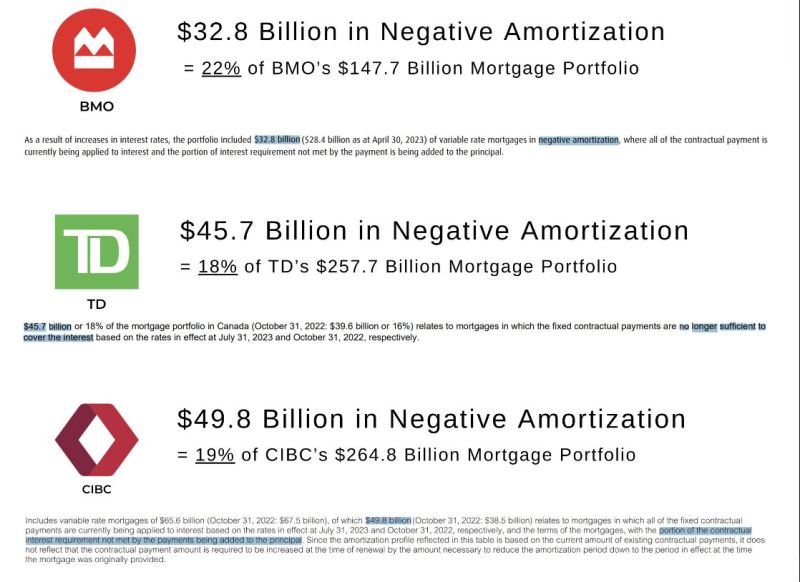

Have you ever heard about mortgages in negative amortization?

As highlighted by The Kobeissi Letter, three of Canada's largest banks are seeing ~20% of their outstanding mortgages in negative amortization. What does this mean? Monthly payments on ~20% of mortgages at BMO, TD, and CIBC are no longer enough to cover interest expense. This means you end up owing more than your original loan amount over time. Typically, variable rate mortgages with fixed payments experience this in a rapidly rising interest rate environment. These homeowners may begin to foreclose over the next few months. This is an important trend worth watching.

Investing with intelligence

Our latest research, commentary and market outlooks