Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

BREAKING: Is the BoJ capitulating?

The Bank of Japan Deputy Governor says they WON’T raise rates when the market is unstable. The Yen is getting absolutely destroyed…and the Nikkei is up nearly +3%, Nasdaq Futures is up +1.2% A wild start of August... Source: TradingView

BREAKING: The S&P 500 closes 3.0% lower erasing $1.4 TRILLION of market cap today, posting its worst day since September 2022.

The S&P 500 is now just 1.4% away from correction territory. The Nasdaq 100 is in correction territory and will enter a bear market if it falls 7.5% from current levels. In less than one month, the S&P 500 has erased $5 TRILLION in market cap. Source: The Kobeissi Letter

NASDAQ FUTURES CLOSE TO TRIGGERING CIRCUIT BREAKER.

The limit-down level for the current $NQ contract is at 17,265.25, or a 6.9% drop from Friday's close. This has not happened since the COVID selloff in March 2020. Source: Trend Spider

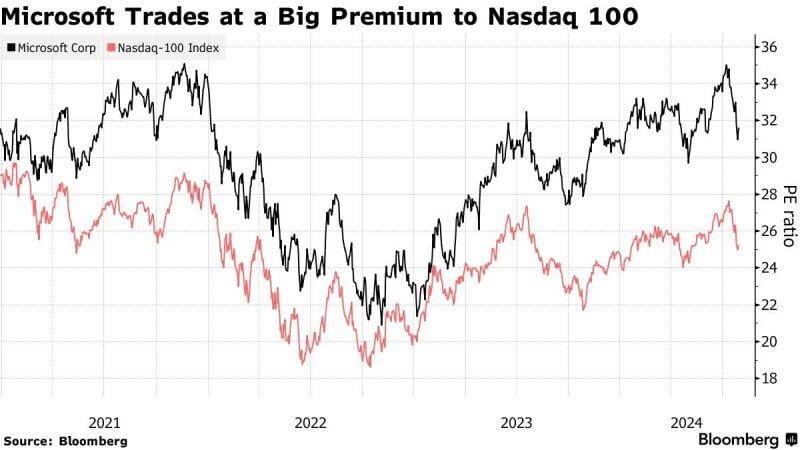

$MSFT trades at quite a large premium to the NASDAQ 100. Will the premium shrink after yesterday's earnings release?

Source: Bloomberg

A critical week ahead for the Nasdaq 100 QQQ which is sitting at critical trendline support at the time of FOMC meeting + $AAPL $MSFT $AMZN $META earnings...

Source; Trend Spider

Nasdaq has underperformed Russell 2000 for 11 of the last 12 days, erasing YTD outperformance for the big-tech index

Source: Bloomberg, www.zerohedge.com

Nasdaq 100 QQQ ETF just hit the upper band of the long-term rising channel (monthly chart).

Is it due for a deeper correction now? Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks