Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

THE Qs GET CRUSHED

$QQQ Worst one-week decline in over three months. Source: Trend Spider

⚡ The carnage is real.

Yesterday was Nasdaq 100 $QQQ worst day since December 2022. Source: Trend Spider

The "ChatGPT era"...

The Nasdaq 100 post-ChatGPT at just over 400 days is now up more than it was following any of the other major technological releases of the last half-century. But if we are to follow the Netscape blueprint we have a lot of more bull left... Source: Bespoke, TME

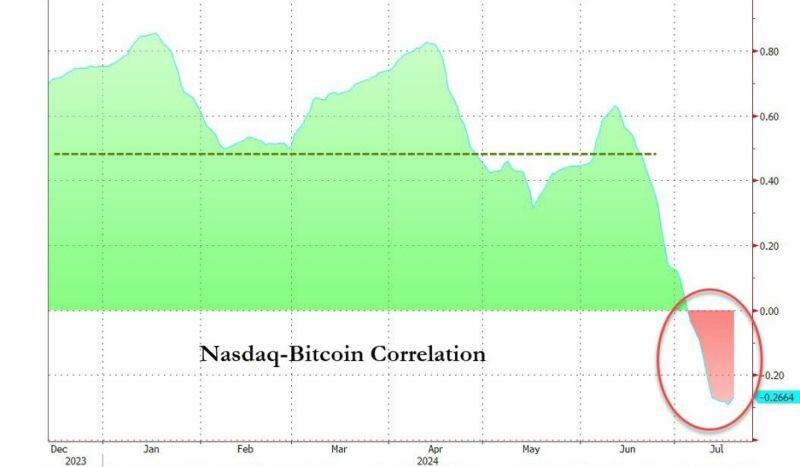

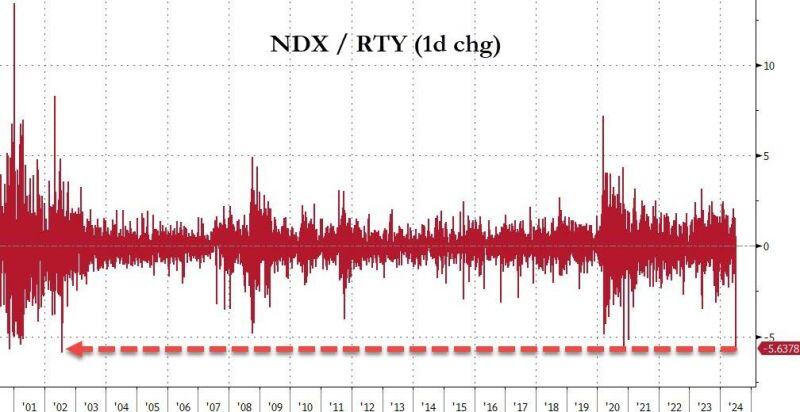

That RTY (Russell 2000) / NDX (Nasdaq 100) spread was over 600bps at its peak today.

By the close it was the biggest relative outperformance of the Russell 2000 over Nasdaq 100 since 2002... Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks