Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

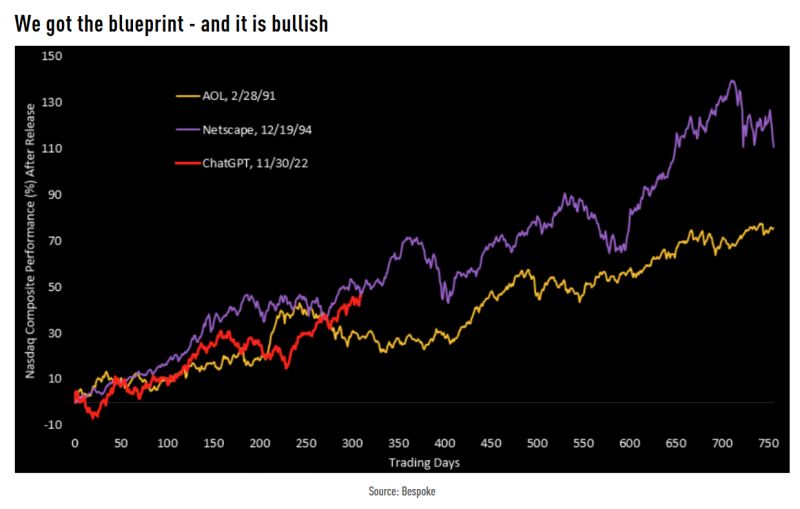

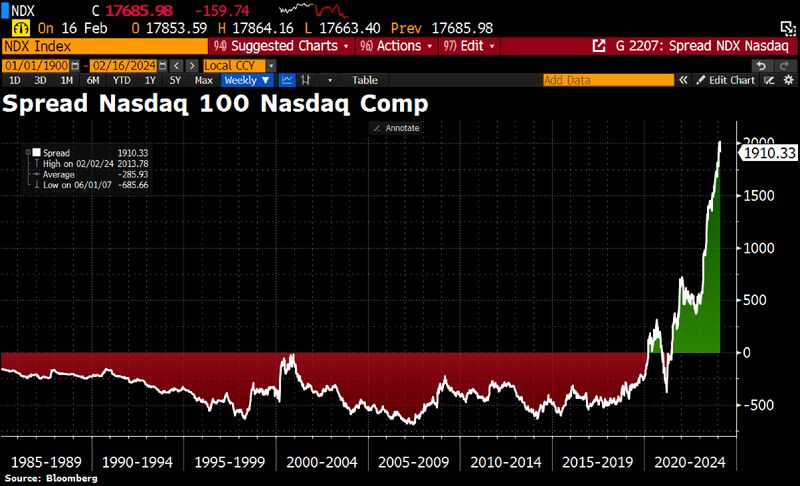

It's been 309 trading days since ChatGPT was released on 11/30/22 and the Nasdaq is up 46.07%.

In the 309 trading days after Netscape (the first web browser) was released in December 1994, the Nasdaq was up 45.9%. Source: TME

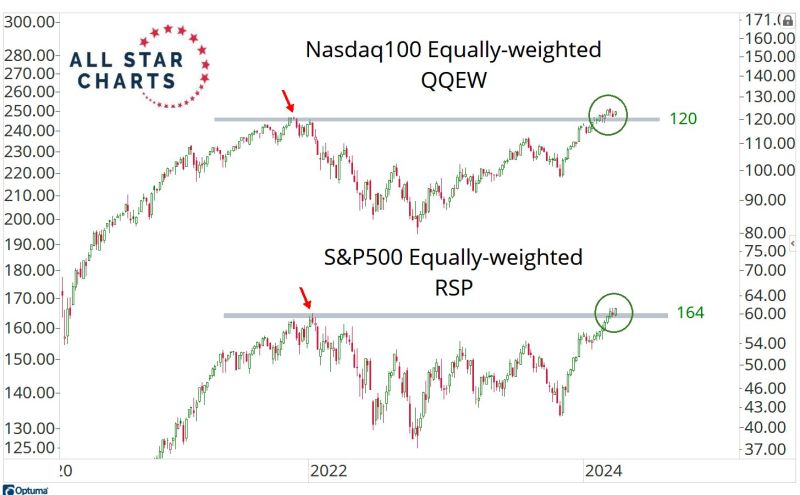

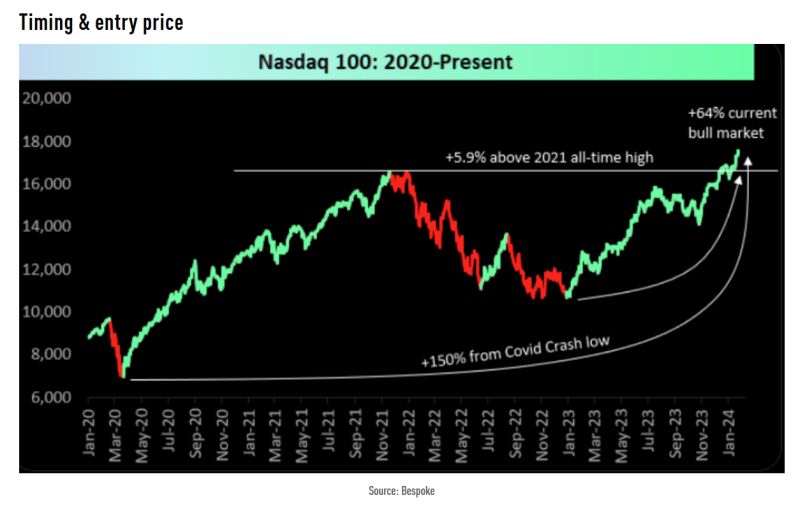

The Nasdaq 100:

- if you bought at the December 2022 low, you are up 64% - if you bought at the 2021 high. you are up 5%. - if you bought at March 2020 lows, you are up 150% Source: Bespoke, TME

Investing with intelligence

Our latest research, commentary and market outlooks