Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

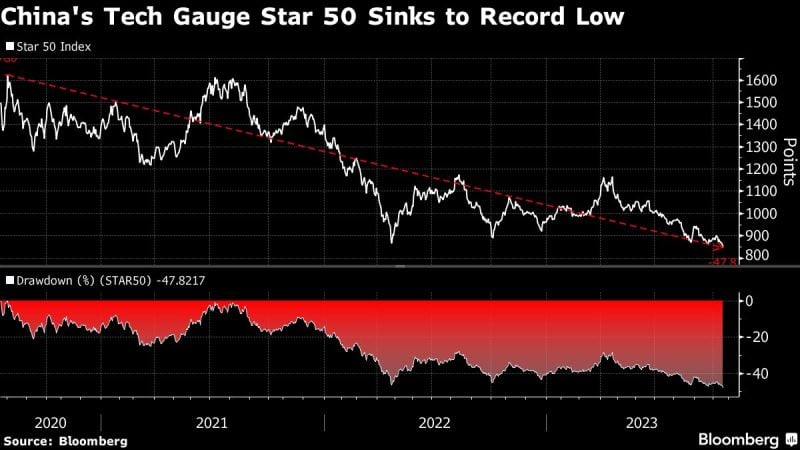

China’s Nasdaq-Style Index falls to record low:

Star 50 index, which tracks manufacturers, chipmakers & biggest comps on Star Board, falls to lowest since its inception >3yrs ago as investors’ confidence wanes. Set for 6 straight mths of decline. Source: HolgerZ, Bloomberg

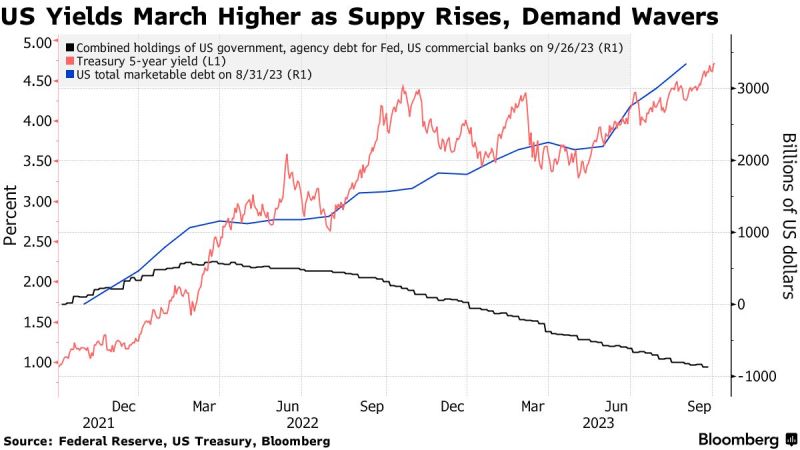

BREAKING: 30-Year Treasury Yield hits 5% for the first time in 16 years while the 10-year hits 4.8%

Macro fundamentals and inflation fears are not the only culprit. Indeed, the slide in Treasuries now seems excessive given recent economic data and Federal Reserve policy. This could suggest it’s instead being driven by fears over the swelling US deficit. As show on teh chart below (Bloomber), the supply/demand balance context is clearly not favroable to US Treasuries. The recent move shows rising alarm at what fiscal policymakers are doing. Concerns over U.S. debt levels and large Treasury issuance have prompted investors to demand more compensation for the risk of holding long term bonds, driving long-term yields higher. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks