Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

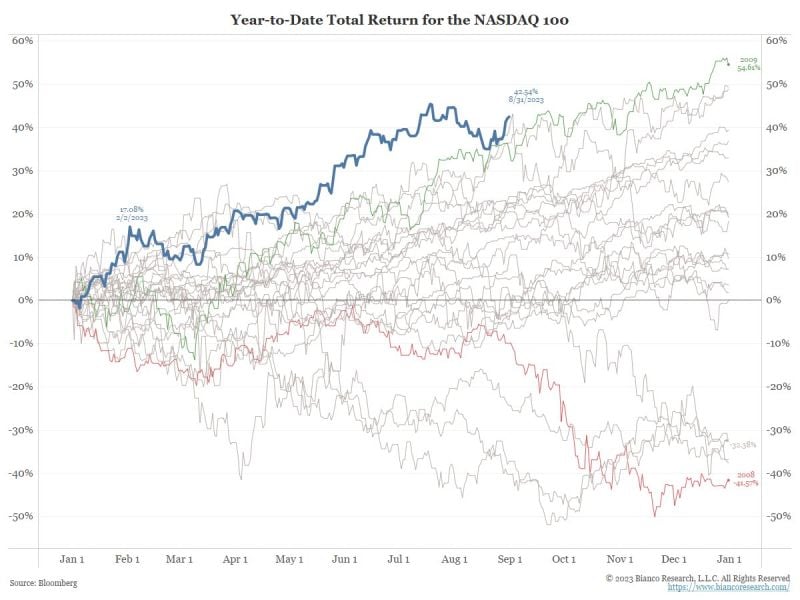

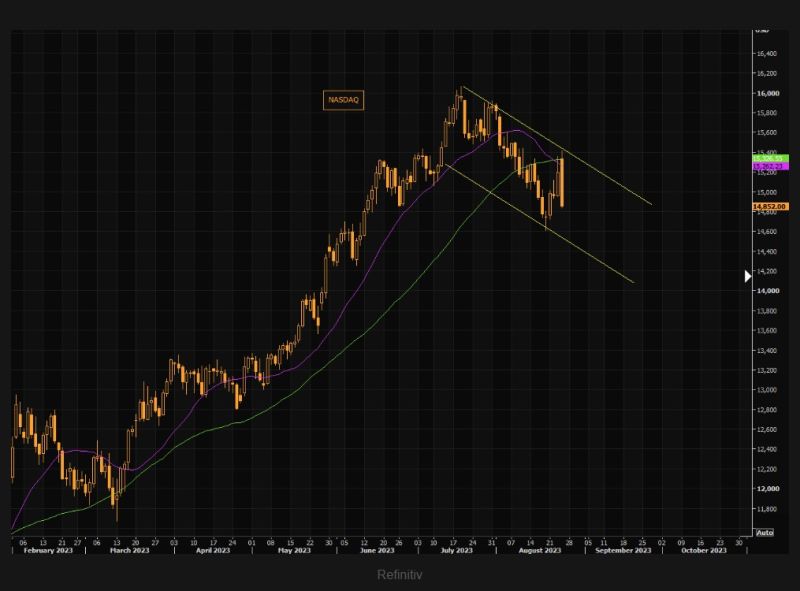

To put things into perspective: Nasdaq 100 now down ~9% from high, largely in the ‘zone’ of recent NDX drawdown episodes over the last 1 year

Source: Bloomberg, HolgerZ

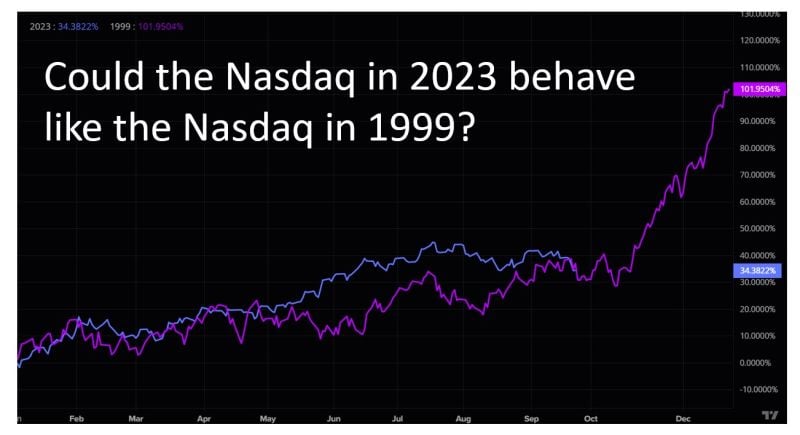

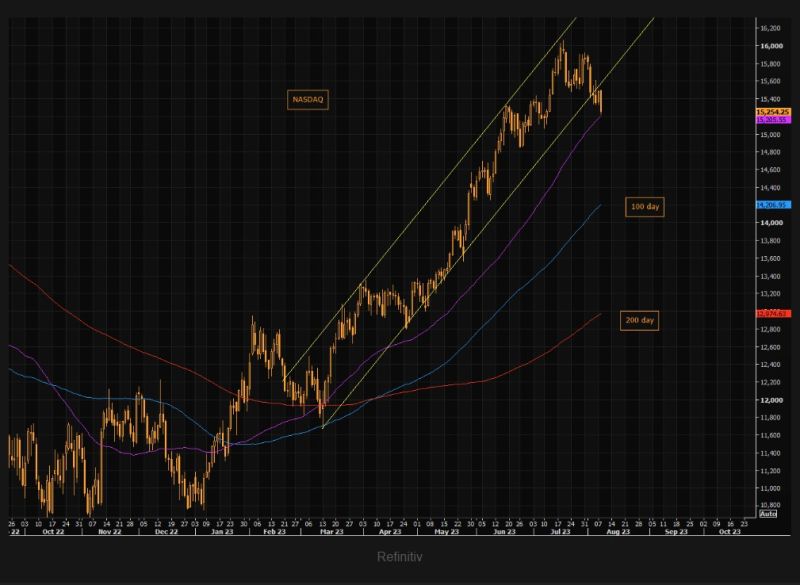

NASDAQ's 1999 analogy chart isn't perfect but given the amount of shorting by hedge funds and short gamma selling by dealers, a squeeze in Q4 (the historically strongest quarter) is a possibility

Source: TME

NASDAQ's bearish cross. The 21 day has now crossed the 50 day moving average.

NASDAQ futures putting in the biggest down candle in a long time and it looks like we have a new short term trend channel to watch. Source: TME

Strange day on Wall Street. Despite Nvidia blockbuster earnings the Nasdaq is in the red

Within $SPX the pockets of strength are in real estate, utilities, financials, healthcare, and consumer defensives. Low vol is outperforming high beta. There are rotations to safer parts of the market happening underneath the surface. Source: Markets Mayhem, Bloomberg

NASDAQ is currently trading right on the 50 day moving average

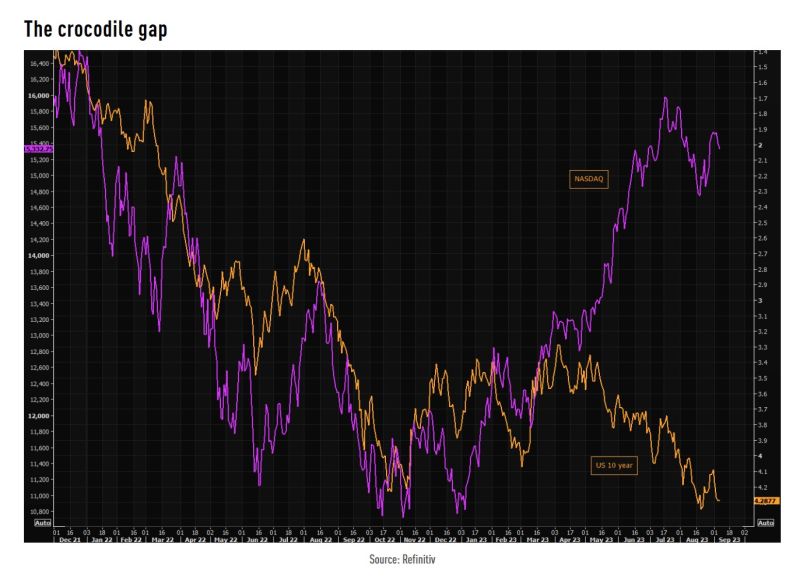

15200 is a short term level to watch, but the bigger support is at 15k. NASDAQ is now established "well" below the channel. Source: The Market Ear, Refinitiv

Investing with intelligence

Our latest research, commentary and market outlooks