Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

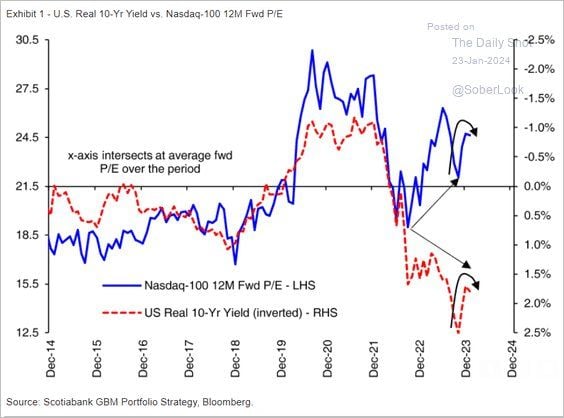

'The Nasdaq 100 valuation has disconnected from real rates.'

Source: The Daily Shot, Win Smart

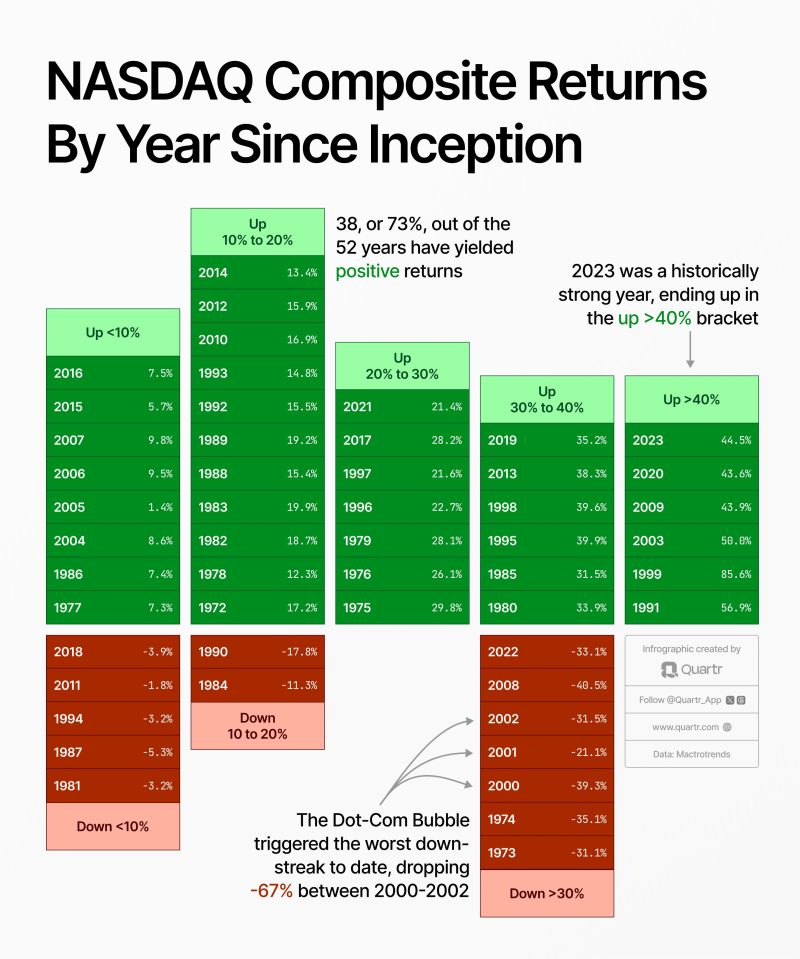

Fortune favors the patient investor. NASDAQ Returns By Year Since Inception

by Quartr

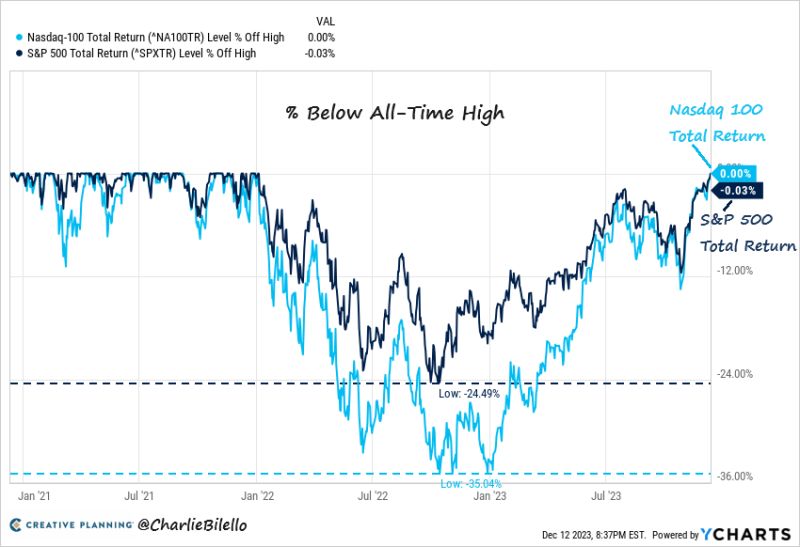

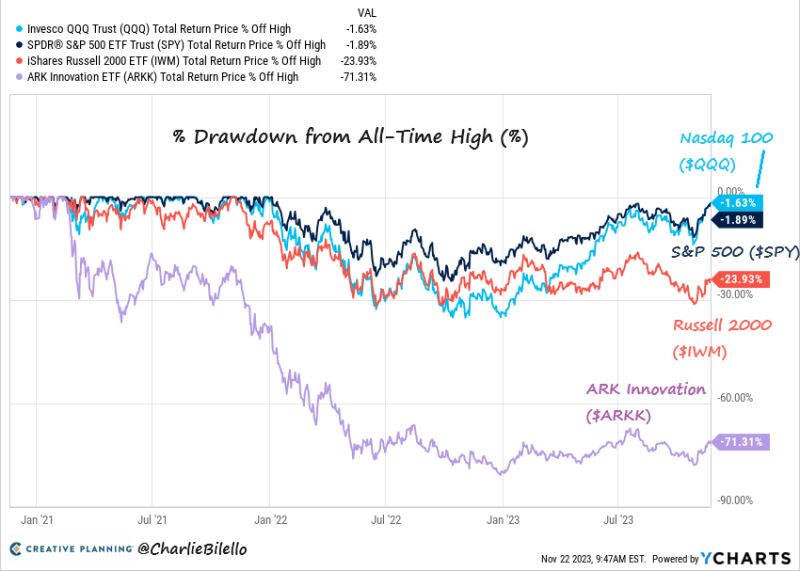

The Nasdaq 100 total return index closed at a new all-time high yesterday for the first time since December 27, 2021 (715 days)

S&P 500 total return index is 3 bps away from a new all-time closing high. Source: Charlie Bilello

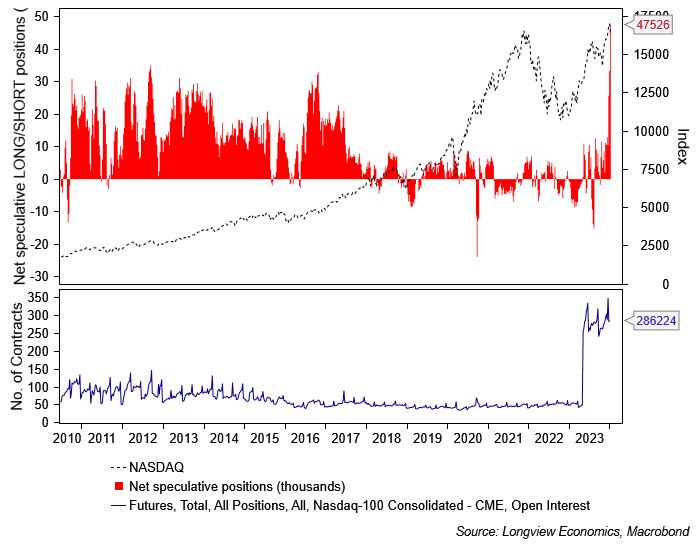

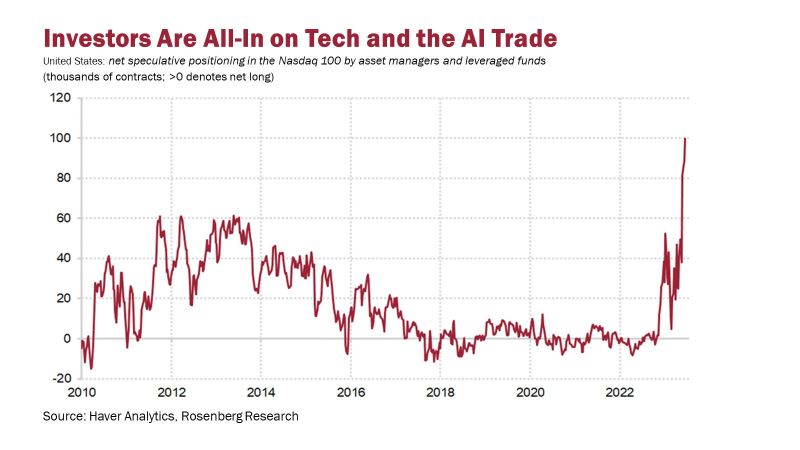

The net long positioning on the Nasdaq 100 by asset managers and leveraged funds is at a record high

When a trade becomes this crowded, how long until things reverse course? Source: Rosenberg Research

Nasdaq has now listed 0DTE Options (Zero Days to Expiry) for ETFS tracking silver, gold, oil, natural gas, and treasuries. Let the games begin! 🎰

Financial Times >>> "Trading in a controversial type of derivative known as “zero-day” options is spreading to Treasury and commodity markets, as Nasdaq and other exchange groups try to replicate a boom that has transformed trading in US stock indices. Nasdaq this week listed a series of new options contracts tracking some of the most popular exchange traded funds investing in gold, silver, natural gas, oil and long-term Treasuries. Options contracts give investors the right to buy or sell an asset at a fixed price by a given date. Trading a contract on the day it expires is known as zero-day trading and can be used to bet on or hedge against extremely short-term market moves. Zero-day trading in options tied to the S&P 500 index boomed in popularity during the coronavirus pandemic. Initially viewed as a temporary phenomenon driven by speculative retail traders, the surge sparked concern among some analysts and regulators that it could create systemic risk by exacerbating market moves. Source: FT, Barchart

Investing with intelligence

Our latest research, commentary and market outlooks