Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- china

- Alternatives

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

US Treasuries sold off yesterday and are now on the verge of a breakdown from support

The chart below courtesy of Crescat Capital / Tavi Costa is a reminder of the divergence between rising yields and the highly valued Nasdaq index. Is this divergence sustainable? Source: Bloomberg, Tavi Costa

The Nasdaq-100's rebalancing in one chart from Goldman

On July 24, the weight of the largest 7 stocks in the index will be reduced from 56% to 44%. Apple and Microsoft will remain the largest constituents but their index weights will be reduced to 12% and 10%, respectively. Alphabet, Amazon and Nvidia come next. Broadcom’s index weight will increase the most (by 60 basis points to 3%). It is estimated that roughly $260 billion in mutual funds and ETFs AUM are benchmarked to the Nasdaq 100 $NDX while hedge funds have an estimated $20 billion of net short exposure. Source: David Kostin thru Oktay Kavrak, CFA

NASDAQ is trading in the upper part of the steep trend channel

NASDAQ is trading in the upper part of the steep trend channel. Note the shooting star candle today, a classical candle that should be observed closely post strong short term trends. One candle doesn't make a "case", but watch for a possible confirmation session. Source: TME, Refinitiv

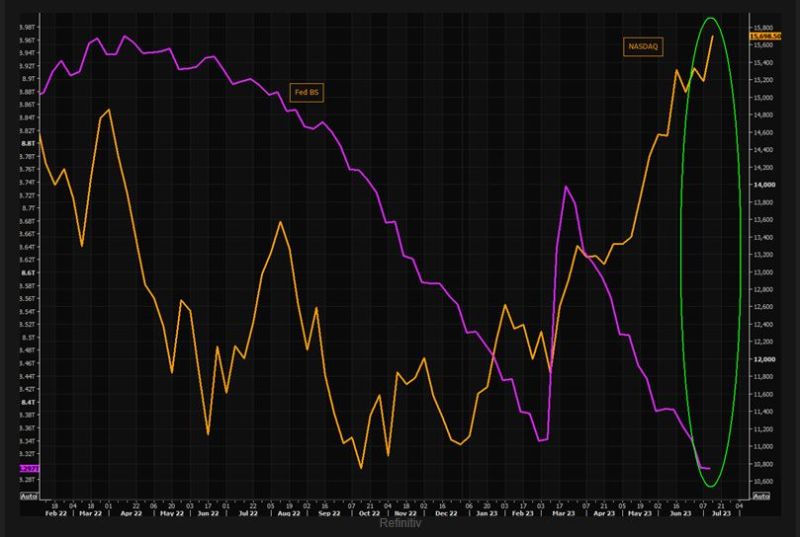

The NASDAQ (in yellow) has been massively decoupling from the FED balance sheet (in purple)

Source: The Market Ear, Refinitiv

Investing with intelligence

Our latest research, commentary and market outlooks