Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- tech

- gold

- performance

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- magnificent-7

- Volatility

- nasdaq

- apple

- emerging-markets

- energy

- Alternatives

- china

- switzerland

- tesla

- trading

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

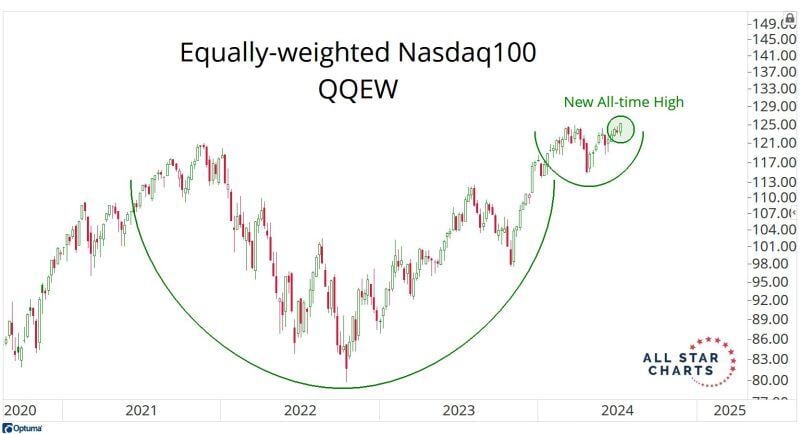

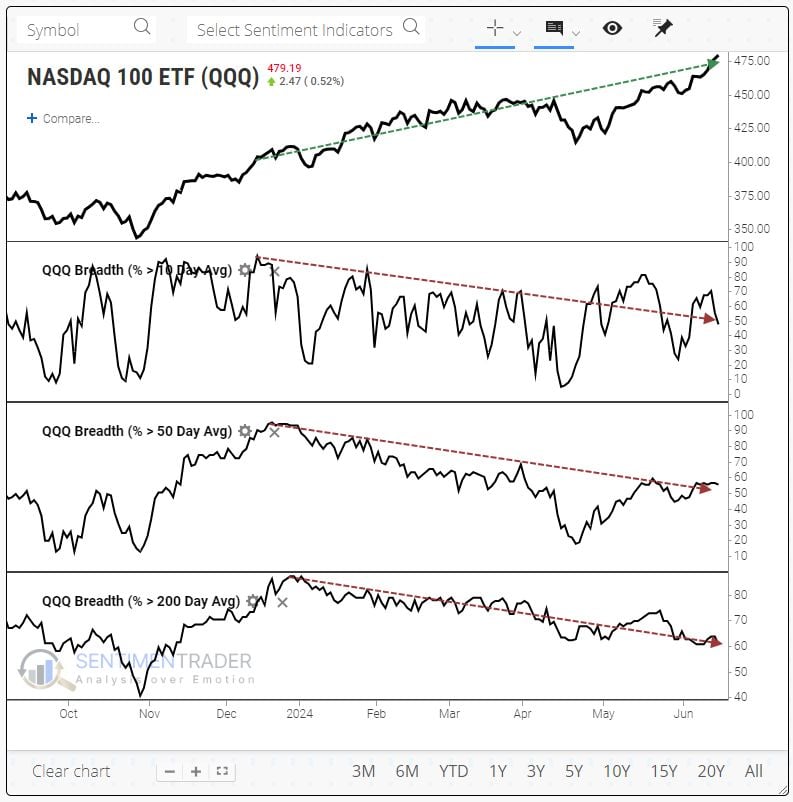

As highlighted by Sentiment Trader, market breadth for Nasdaq 100 QQQ is indeed a growing concern

The Nasdaq 100 continues to notch record high after record high. Many of its stocks are not only lagging, but they're falling to monthly, quarterly, or even yearly lows and below their 10-, 50-, and 200-day moving averages. This is not normal. In fact, it's never happened before to this degree. There is a possibility that the average stock will catch up to the index, that is not how things usually pan out. Almost never, in fact. Risk is high in that index.

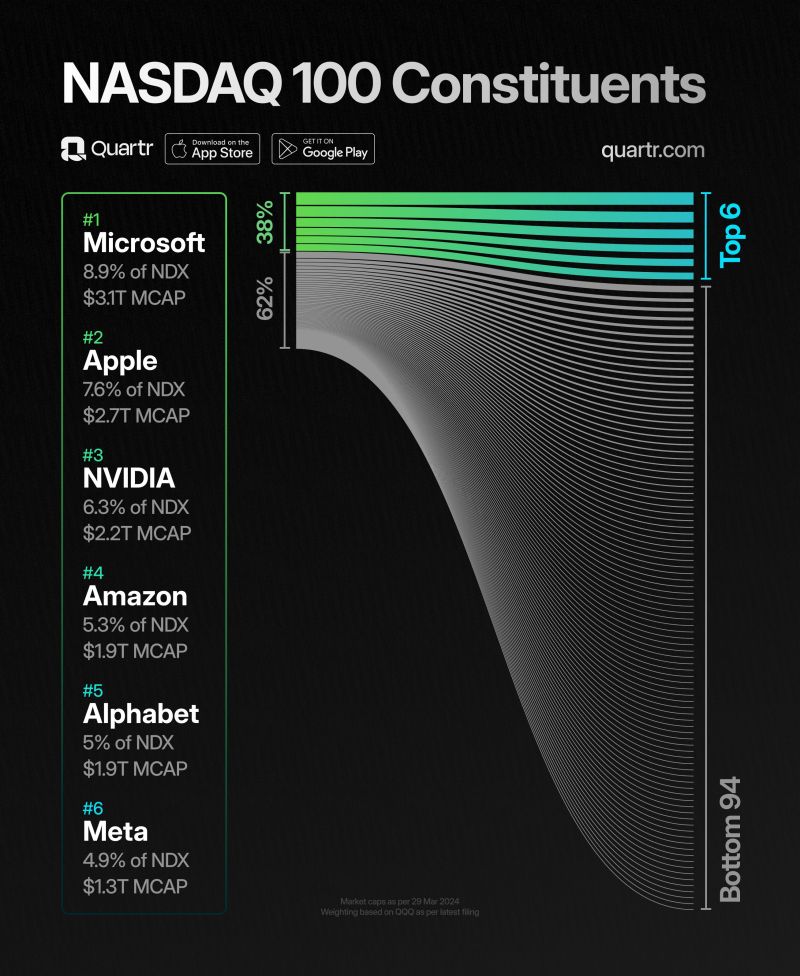

Amazing chart by Quartr.

It's quite astonishing: despite the NASDAQ 100's special mid-2023 rebalancing, the combined weight of $MSFT, $AAPL, $NVIDIA, $AMZN, $GOOGL, and $META still constitutes a substantial 38% of the index. Without this rare adjustment, the second of its kind in the last 25 years, these companies would currently represent 58% of the index.

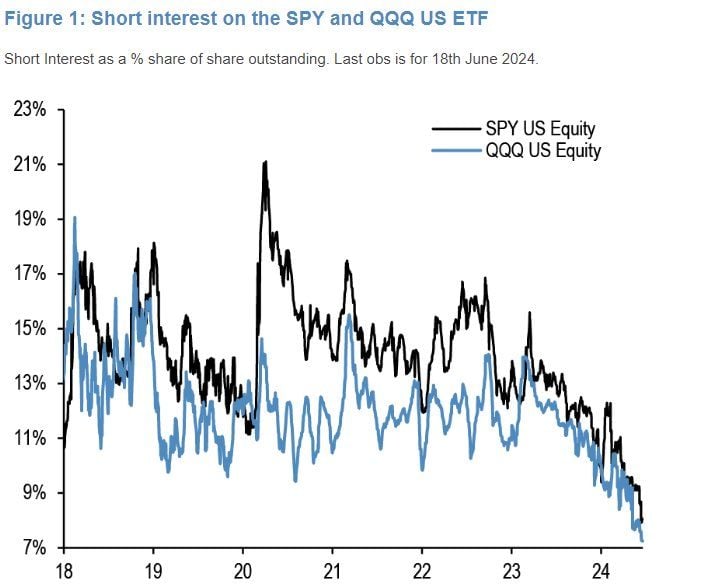

Maybe we have hit the pain threshold...

i,e the hashtag#nasdaq green line) can not move higher as the number of rate cuts expected for this year (red line) keeps decreasing... Source: www.zerohedge.com, Bloomberg

BREAKING: The Nasdaq Composite index is officially up 30% from its October 2023 low.

That's a 30% gain in 5 months or an average of 6% per month since October. To put this in perspective, the median ANNUAL return for the S&P 500 is 10%. This means that the Nasdaq has TRIPLED the median sp500 return in just 5 months. The top 10% of stocks in the S&P 500 also now reflect 75% of the index. Tech stocks have never been more powerful. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks