Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- markets

- bitcoin

- Asia

- technical analysis

- investing

- europe

- Crypto

- geopolitics

- performance

- tech

- gold

- Commodities

- AI

- nvidia

- ETF

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- magnificent-7

- nasdaq

- apple

- china

- emerging-markets

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- microsoft

- amazon

- ethereum

- meta

- bankruptcy

- Turkey

- Healthcare

- Industrial-production

- Global Markets Outlook

- africa

- brics

- Market Outlook

- Asset Allocation Insights

- Flash

- Focus

After posting its worst and best day in over a year, the S&P 500 just closed the week down 2 POINTS.

That's a 0.04% decline in a week when the $VIX hit 65... Source: The Kobeissi Letter, Bloomberg

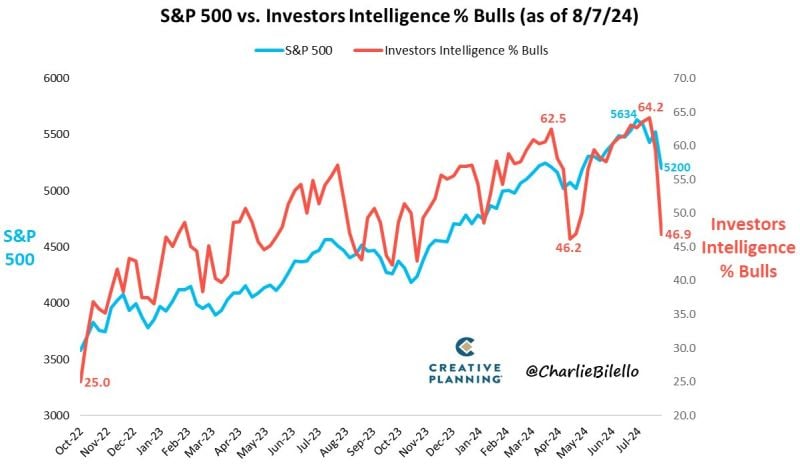

The % of Bulls in the Investors Intelligence Sentiment Index moved down over 17% in the past 2 weeks (from 64.2% to 46.9%)

That's the biggest 2-week % drop in Bulls since the October 1987 crash. Source: Charlie Bilello

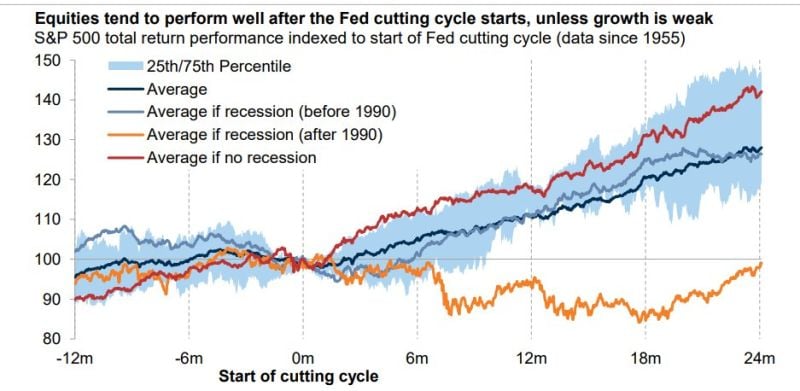

Equities tend to perform well after the Fed cutting cycle starts, unless growth is weak

Source: Goldman Sachs, Mike Z.

There is no free lunch in finance

Funds designed to protect investors from volatility failed to protect investors during periods of high volatility Source: FT, Barchart

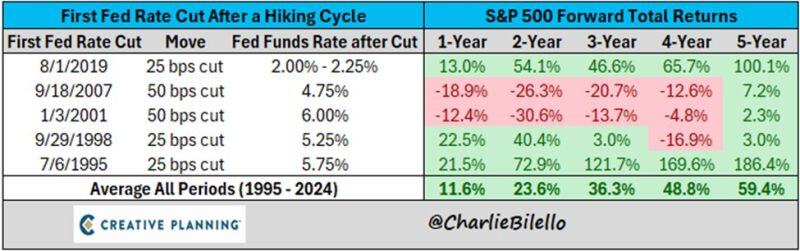

The market is pricing in a 50 basis point rate cut next month.

Market returns following rate cuts have been positive except for periods when the market is generally in crisis. Source: Charlie Bilello, Peter Mallouk

Investing with intelligence

Our latest research, commentary and market outlooks