Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- macro

- equities

- Food for Thoughts

- sp500

- Central banks

- Bonds

- Asia

- bitcoin

- markets

- technical analysis

- investing

- europe

- Crypto

- Commodities

- geopolitics

- tech

- performance

- gold

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- banking

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- trading

- tesla

- sentiment

- china

- russia

- Money Market

- assetmanagement

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- africa

- Market Outlook

- Flash

- Focus

Germany has significantly lagged behind the US in economic growth over the past 30yrs

Since 1980, the US econ has expanded tenfold, while Germany's has only grown fivefold. This disparity is partly due to faster population growth in the US. However, the underperformance since the 1990s is no accident. The US has capitalized on digitalization far more effectively, driving economic gains, whereas Germany has been slower to embrace technological transformation. A clear example of this is Volkswagen, which highlights Germany's cautious approach to modernization. Source: HolgerZ, Bloomberg

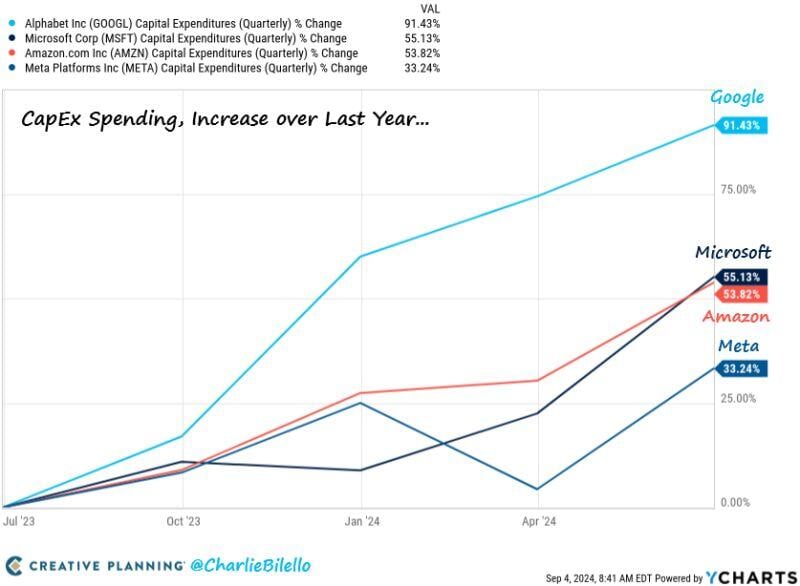

Increase in CapEx spending over the last year...

-Google $GOOGL: +91% -Amazon $AMZN: +55% -Microsoft $MSFT: +54% -Meta $META: +33% Source: Charlie Bilello

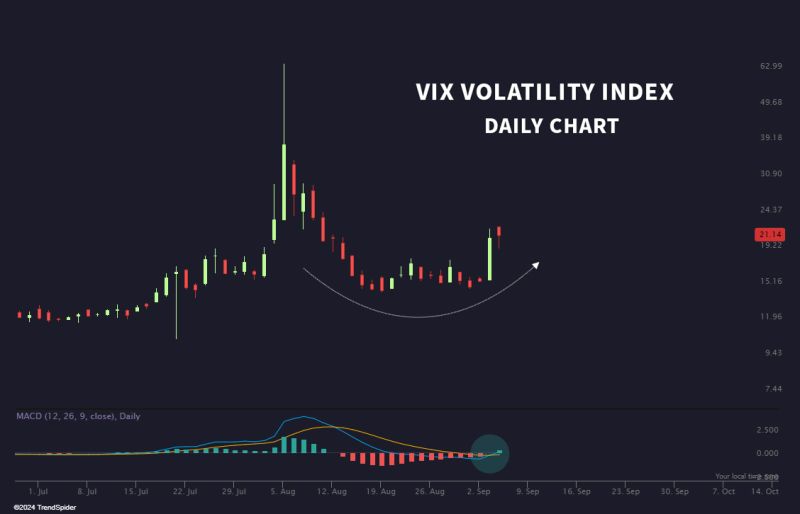

Is the VIX preparing for another pop?

$VIX During an election year, it is the norm for volatility to pick up in September. Source: Trend Spider

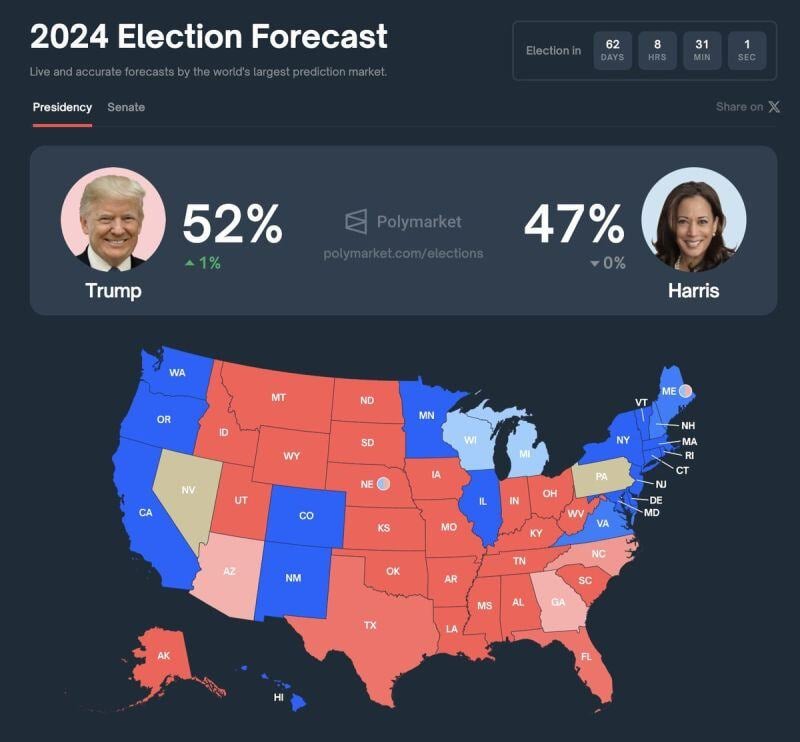

US ELECTION UPDATE >>> Donald Trump is now leading Kamala Harris by 5 percentage points in 2024 election odds, according to Polymarket's prediction markets.

Just one month ago, Harris was leading Trump by 10 percentage points on the same platform. The election is 2 months out. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks