Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

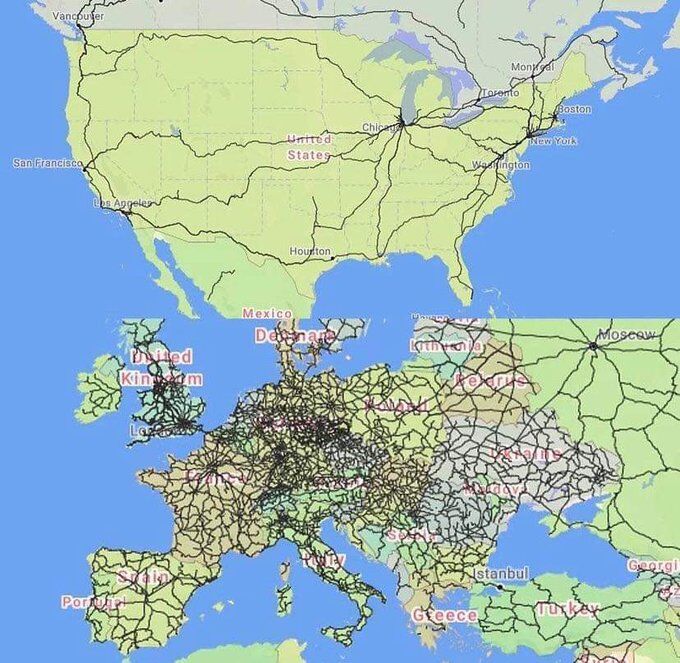

Passenger train lines in the USA vs Europe

Source: Massimo @Rainmaker1973

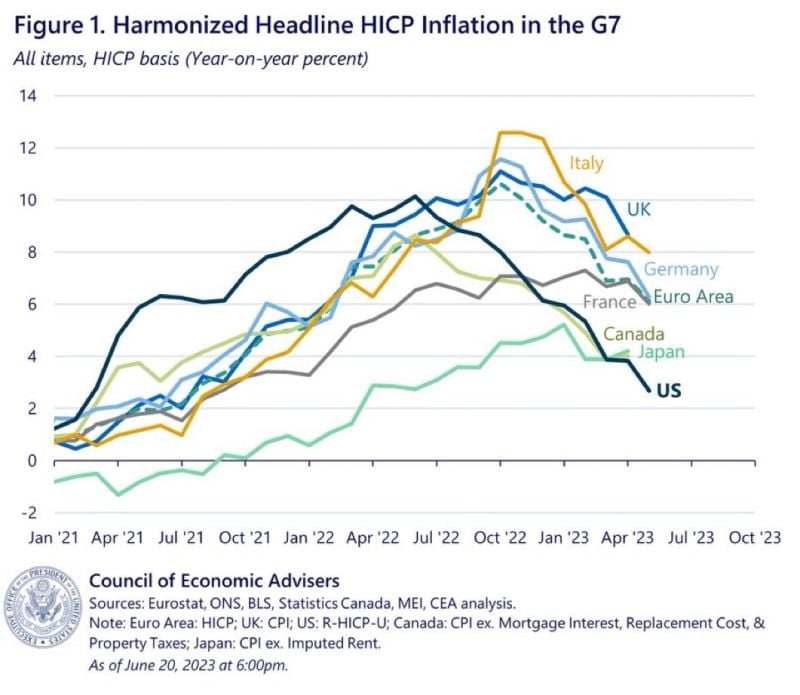

What’s the best explanation for why inflation has fallen so much more in the United States than any other G7 country?

Source: Erik Brynjolfsson @erikbryn on X

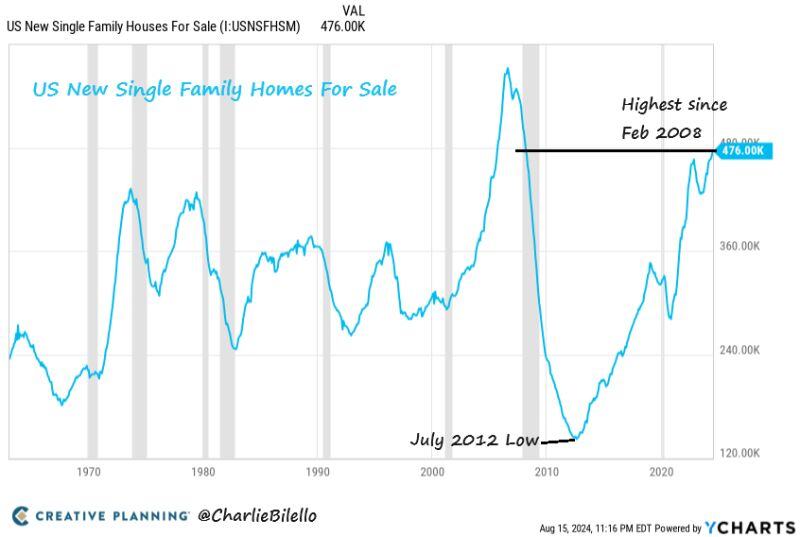

There are now 476,000 new homes for sale in the US, the highest inventory since February 2008.

Source: Charlie Bilello

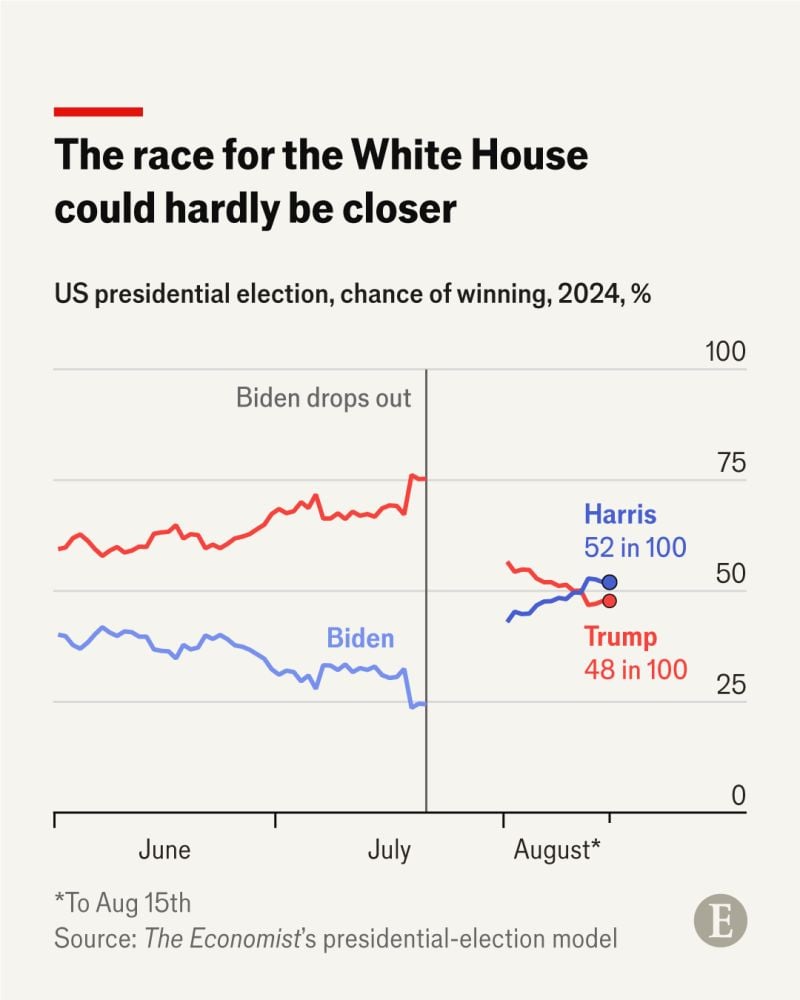

The Economist revised forecast shows the presidential election between Kamala Harris and Donald Trump is, in effect, a toss-up.

Source: The Economist

Investing with intelligence

Our latest research, commentary and market outlooks