Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

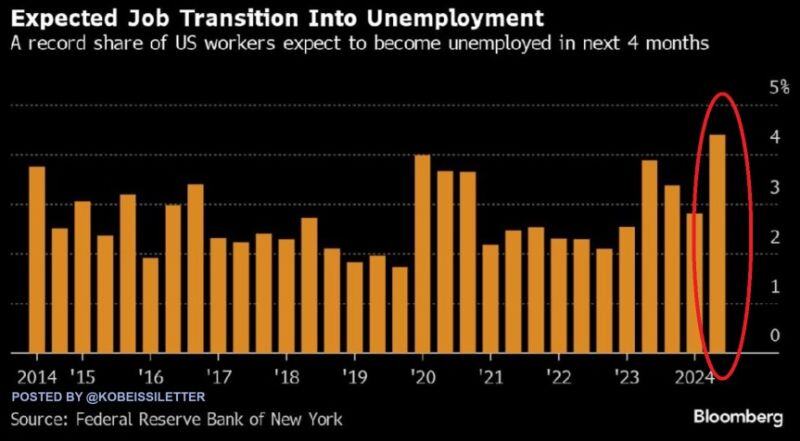

BREAKING: The share of people who believe they will become unemployed in the next 4 months jumped to 4.4%, the highest on record

This is a significant surge from the 2.8% share seen in March 2024, according to the NY Fed job situation and outlook survey. At the same time, the share of workers who reported searching for a job in the last 4 weeks increased to 28.4%, the highest since the survey began in 2014. This was also up 9 percentage points from 19.4% recorded in July 2023. Further evidence the labor market is weakening. Source: The Kobeissi Letter, Bloomberg

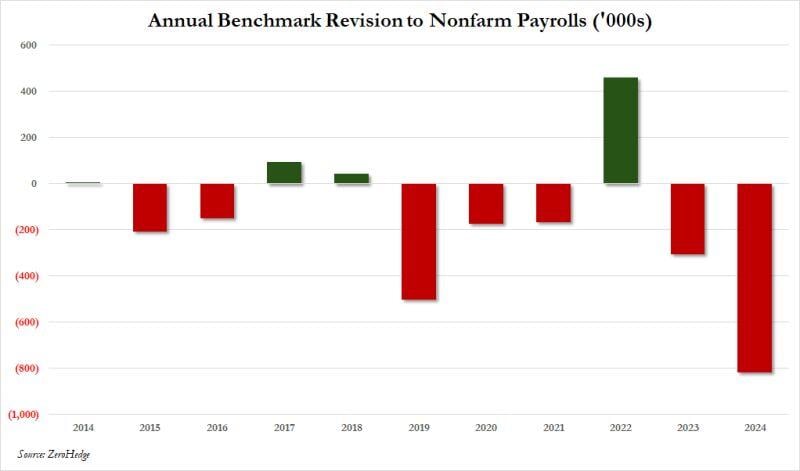

The US Labor Department revises 12-month job growth down by a massive 818,000 jobs

In other words, the US economy actually created 818,000 LESS jobs than initially reported. Furthermore, the US economy LOST 192,000 jobs in Q3 2023 and added 344,000 jobs in Q4 2023, according to the BED survey released by BLS. On the other hand, nonfarm payrolls data showed that the US labor market added 663,000 and 577,000 new jobs in Q3 and Q4 2023. This is a jaw dropping 1,088,000 difference in job count over just two quarters. This is the BIGGEST negative revision to payrolls since the global financial crisis. Crucially, it took place in an election year and was meant to pad the numbers, making the economy appear much stronger than it was. Source: The Kobeissi Letter

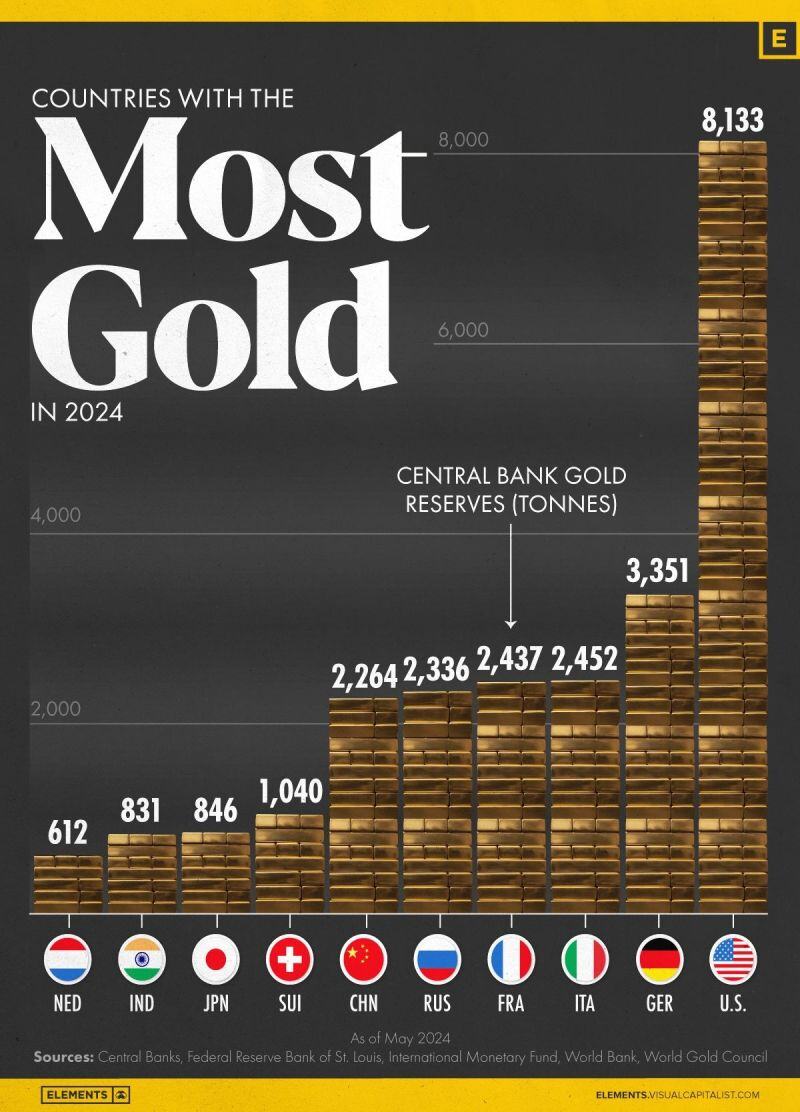

The Top 10 Countries by Gold Reserves in 2024

The country with the most gold is the United States, holding 8,133 tonnes valued at $628 billion. Half of the country’s reserves are stored at the United States Bullion Depository, commonly known as Fort Knox, a United States Army installation in Kentucky. Germany ranks second with 3,351 tonnes, followed by Italy with 2,452 tonnes. Source: Visual Capitalist

Major retail stores are cutting prices to lure custormers as inflation soars.

Source: Foxbusiness.com

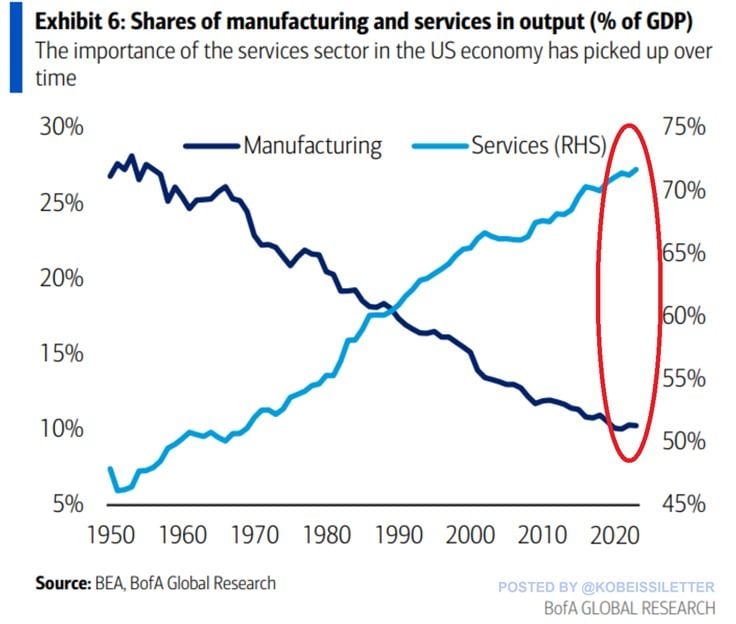

The U.S. economy is now almost entirely driven by the services sector

The services industry now accounts for ~72% of US GDP, up from ~60% in 1990. By comparison, in the 1950s, services reflected just 47% of the US economy. On the other hand, the manufacturing sector's share in US GDP has declined from ~27% in the 1950s to ~10% currently. Meanwhile, the ISM Manufacturing PMI index has shrunk in 20 of the last 21 months, marking 22 months without two consecutive readings of an expansion, the longest streak since the 1990s. Services are keeping the US economy alive. Source: The Kobeissi Letter, BofA

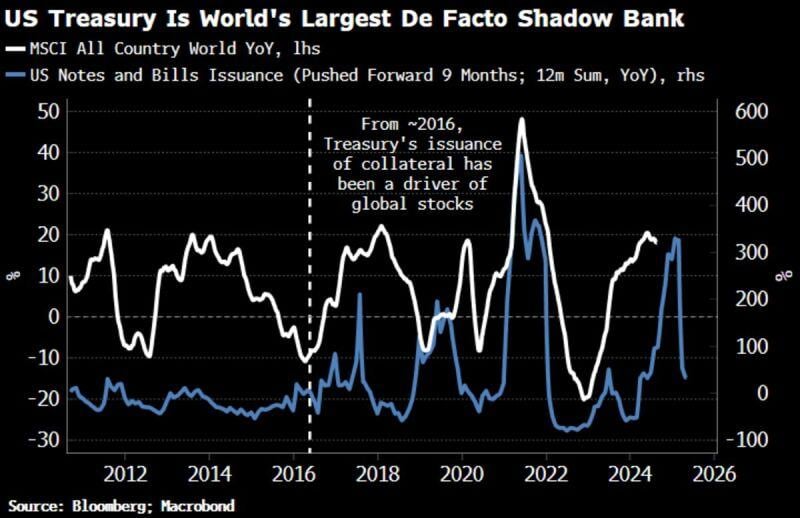

The US Treasury has become a key driver of stocks and other asset markets through its pro-cyclical issuance of debt and the increasing depth and liquidity of repo markets

Writes net treasury issuance leads global equity prices by about 6-9mths due to repo markets. The rise in the volume of collateralized lending, i.e. repo, facilitated by the increase in the supply of USTs is increasingly influential for the behavior of asset prices. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks