Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

July US CPI fell to 2.9%, below expectations of 3.0%

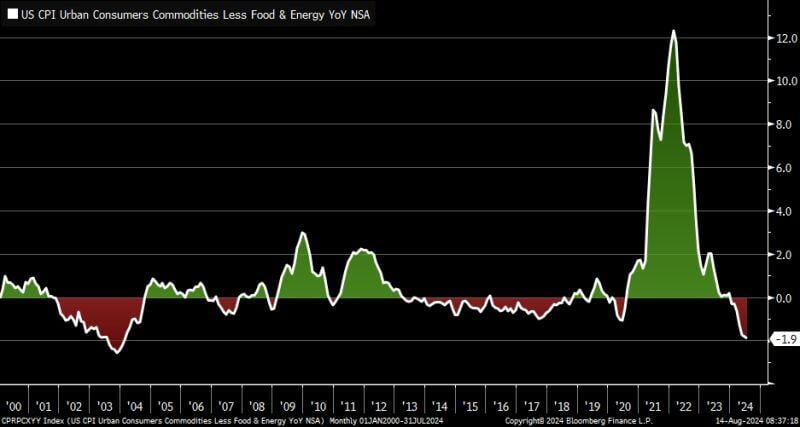

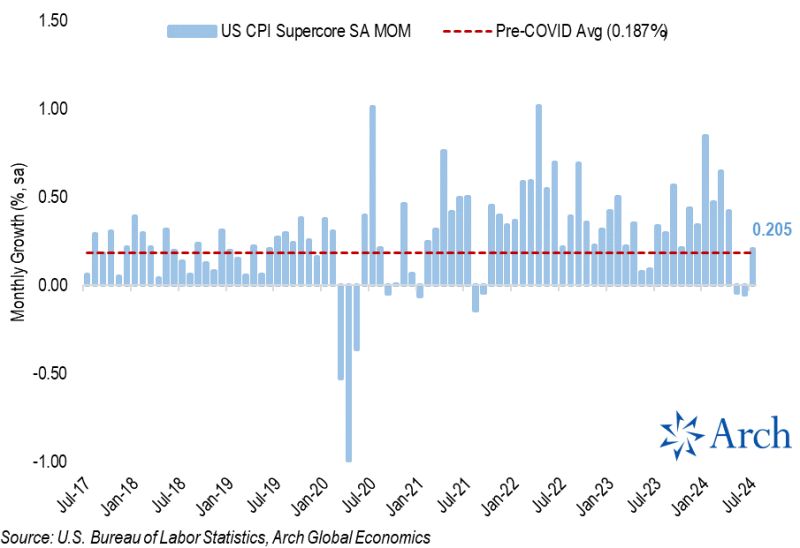

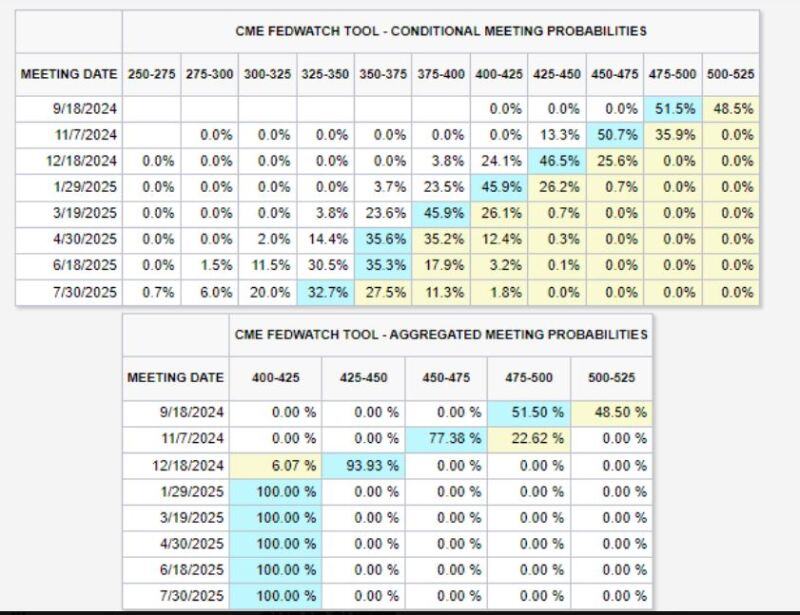

ore CPI inflation fell to 3.2%, in-line with expectations of 3.2%. This marks the first month with CPI inflation below 3.0% since March 2021. However, Supercore inflation snapped back to just above the pre-COVID average after two months of outright declines. Shelter inflation also surged back to a 0.38% m/m gain after an unusual decline to 0.17% in June. This is not the perfect report the hashtag#Fed would be looking for. However, there is nothing overly concerning from what we've seen thus far. The first rate cut since 2020 is probably coming next month.

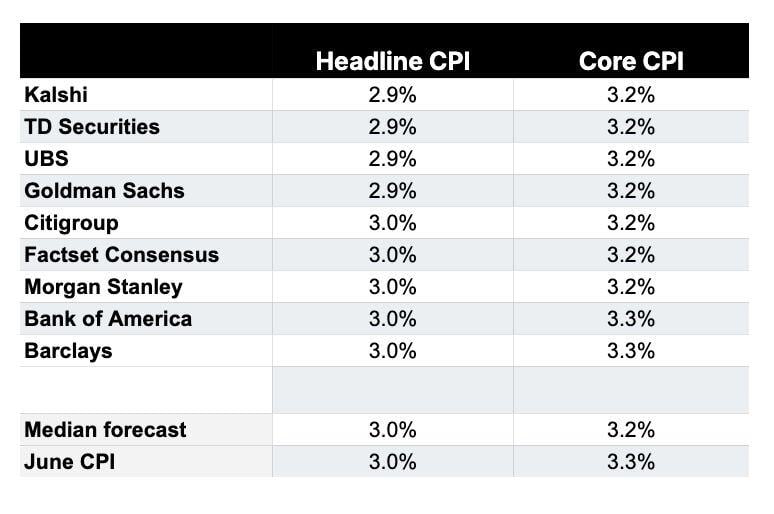

US July CPI inflation expectations:

1. Kalshi: 2.9% 2. TD Securities: 2.9% 3. UBS: 2.9% 4. Goldman Sachs: 2.9% 5. Citigroup: 3.0% 6. Morgan Stanley: 3.0% 7. Bank of America: 3.0% 8. Barclays: 3.0% The median July CPI expectation shows headline inflation at 3.0% and Core CPI inflation at 3.2%. If today CPI inflation comes in at 2.9% or lower, it will mark the first month with inflation under 3.0% since March 2021. Today's CPI report could solidify a hashtag#fed September rate cut. Source: The Kobeissi Letter

$SBUX Starbucks replaces CEO Laxman Narasimhan with $CMG Chipotle CEO Brian Niccol

$CMG Chipotle's stock is up 773% since Brian Niccol became CEO in March 2018 Just 9 S&P 500 stocks have performed better than $CMG since March 2018 $SBUX must have paid him the star bucks... Source: Stocktwits

The European Commission has denied that its internal market commissioner had approval from Ursula von der Leyen to send the letter

one EU official saying, 'Thierry has his own mind and way of working and thinking'. Source: FT

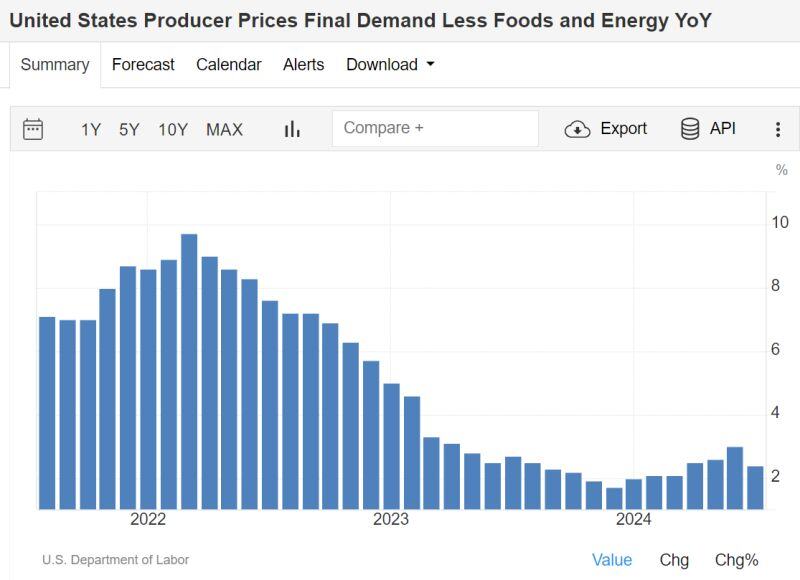

BREAKING: US July PP inflation falls to 2.2%, below expectations of 2.3%

Core PPI inflation falls to 2.4%, below expectations of 2.7%. This is the first drop in Core PPI YoY since December last year... In another constructive sign, PPI inflation is now at its lowest level since March 2024. A September hashtag#fed rate cut seems to be on its way. PPI numbers in a nutshell: - PPI 0.1% MoM, Exp. 0.2% - PPI Core 0.0% MoM, Exp. 0.2% - PPI 2.2% YoY, Exp. 2.3% - PPI Core 2.4% YoY, Exp. 2.6% Source: The Kobeissi Letter, US Department of Labor, Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks