Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

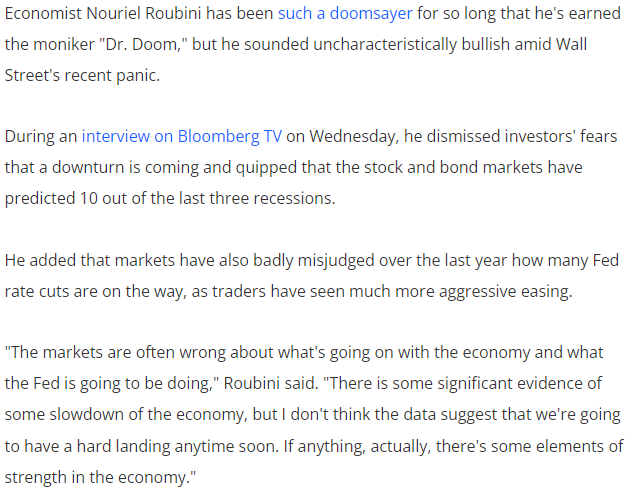

BREAKING: Elon Musk will interview Donald Trump at 8pm ET tonight on X.

Ahead of the interview, the European Commission issued a letter to Elon Musk demanding that he CENSOR Donald Trump in their upcoming interview. They are even threatening him with "legal obligations" if he fails to stop the "disinformation"... They talk about "ensuring freedom of expression" and of "information being protected"... Source: www.zerohedge.com

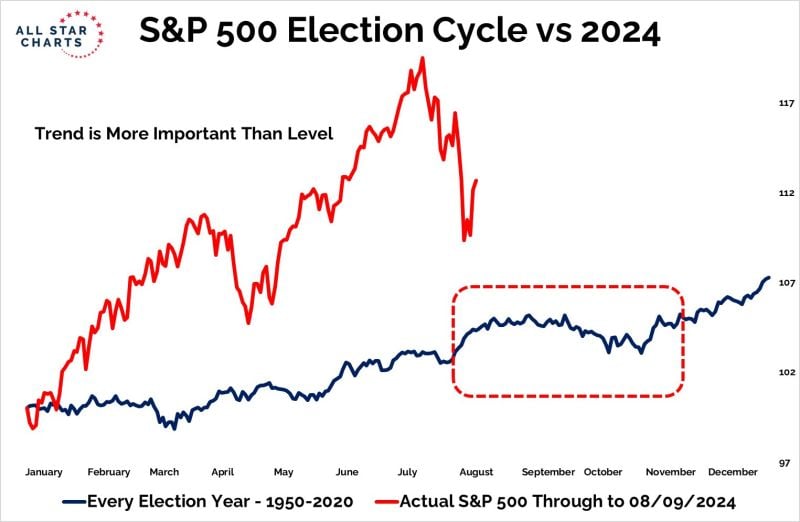

On average with the 4-year cycle... the next few months are sideways at best...

Source: Grant Hawkridge

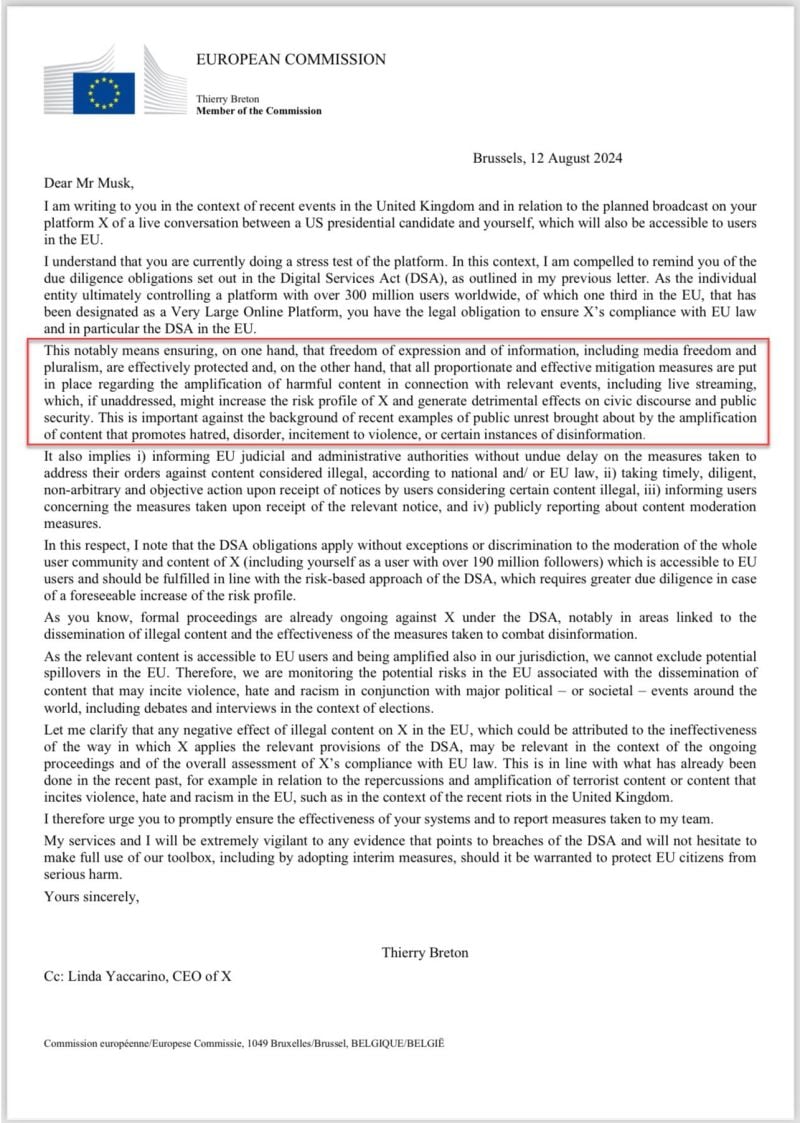

The view from Apollo: Still no signs of a recession in the US

Source: Apollo

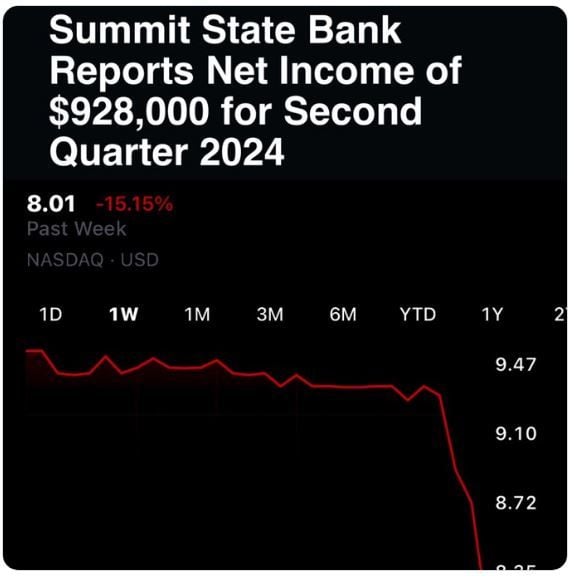

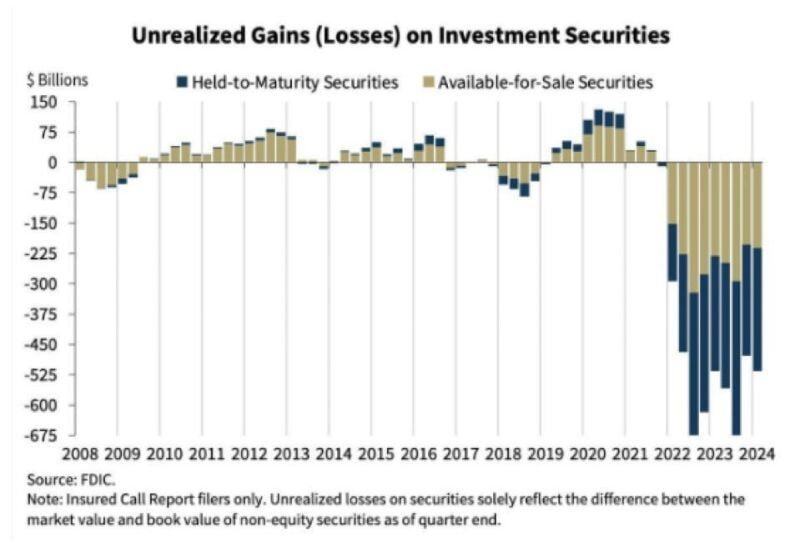

US banks are facing $517 Billion of Unrealized Losses - nobody wants interest rate cuts more than them

Source: Barchart, BofA

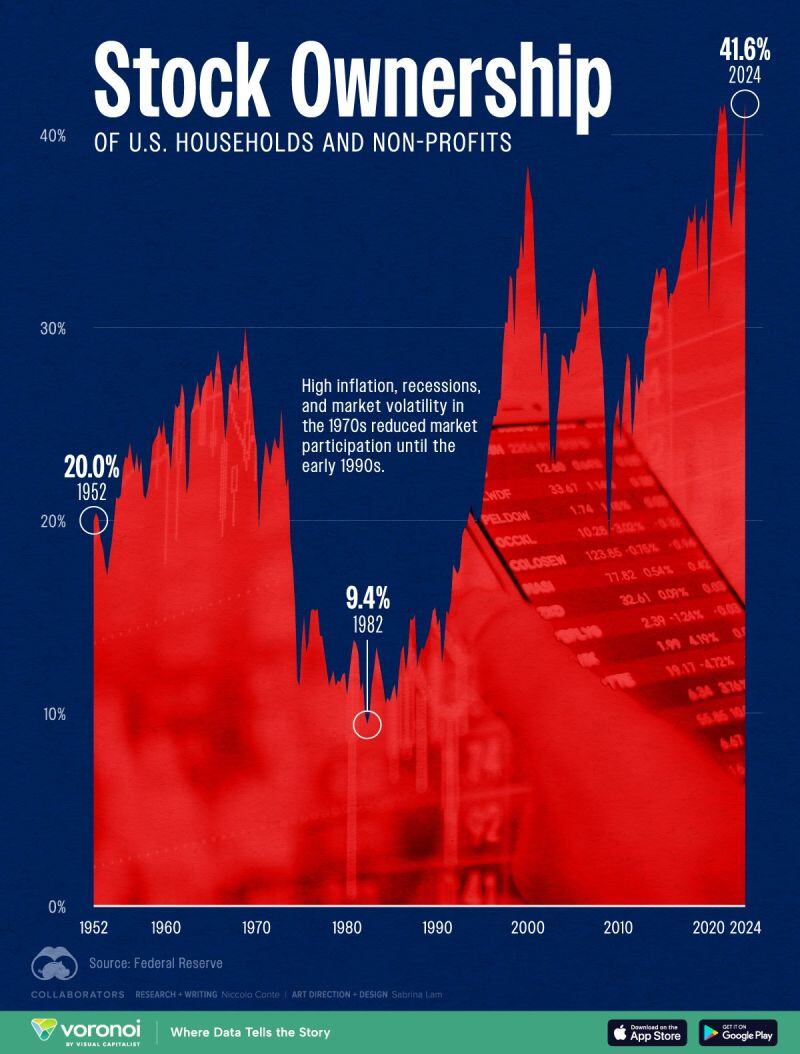

American stock ownership is back at all-time highs

Source: Markets & Mayhem, Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks