Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

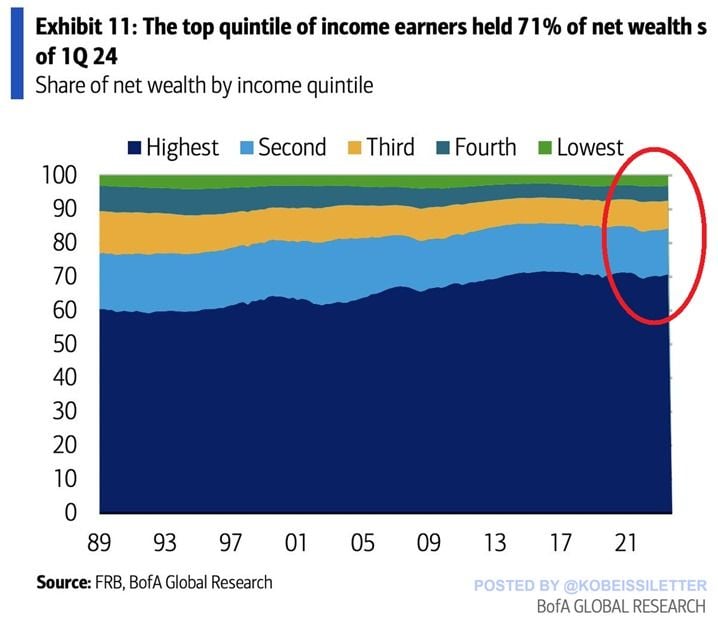

The rich are getting richer faster than ever before

The top 40% of US income earners hold 83% of the total net worth, near an all-time record. The top 20% account for 71% of the total net worth, up 10 percentage points over the last 2 decades. On the other hand, the bottom 40% of income households hold only 8% of the wealth. Moreover, the bottom 20% of earners reflect just 3% of total US wealth. Over the last few years, the rich have gotten a lot richer. Most consumers are struggling. Source: The Kobeissi Letter, BofA

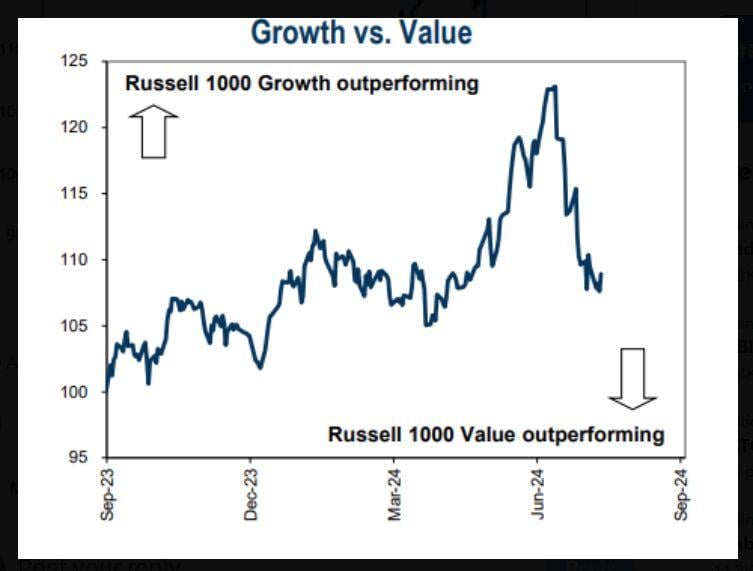

Growth vs Value: a clear trend shift since July

Source: Mike Z., Goldman Sachs

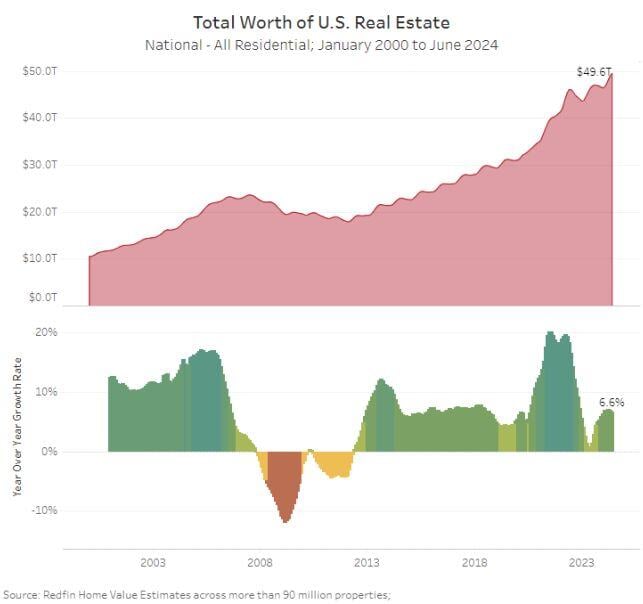

Value of U.S. Housing Market hits all-time high of $49.6 Trillion

Source: Barchart

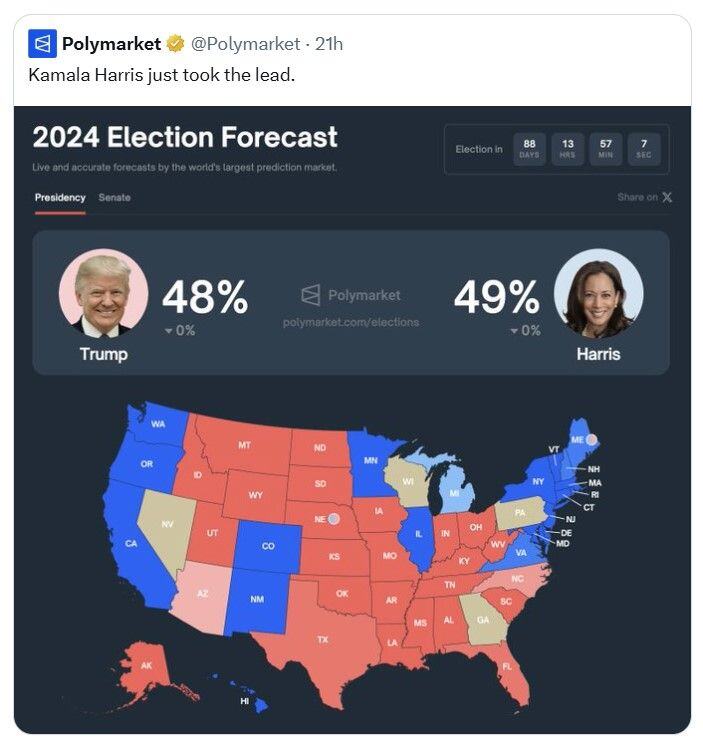

BREAKING: For the first time ever, Kamala Harris is leading Donald Trump in Polymarket's 2024 election odds.

At one point, prediction markets saw a 10+ percentage point lead by Donald Trump. Source: The Kobeissi Letter

Donald Trump said the Fed has "gotten a lot wrong," and "US Presidents should have a say in Fed actions."

“I think I have a better instinct than, in many cases, people that would be on the Federal Reserve or the chairman" What do you think? Source: Stocktwits

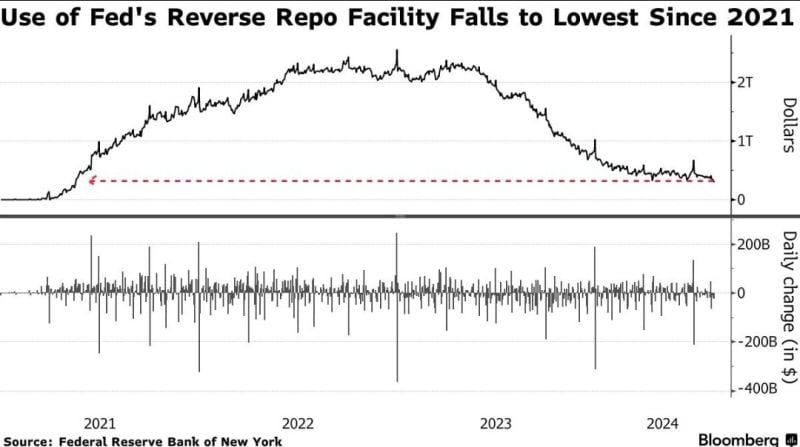

Use of Fed's Reverse Repo Facility Falls to Lowest Since 2021

Analysts said investors may have pulled their money from the reverse repo market and placed cash in the overnight repo market, where banks and financial firms such as hedge funds borrow short-term cash using Treasuries or other debt securities as collateral. In addition, a large rise in the supply of Treasury bills on Tuesday and Thursday, is likely to further drain cash from the RRP facility, analysts said. Source: Win Smart, Bloomberg, Yahoo finance

Investing with intelligence

Our latest research, commentary and market outlooks