Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

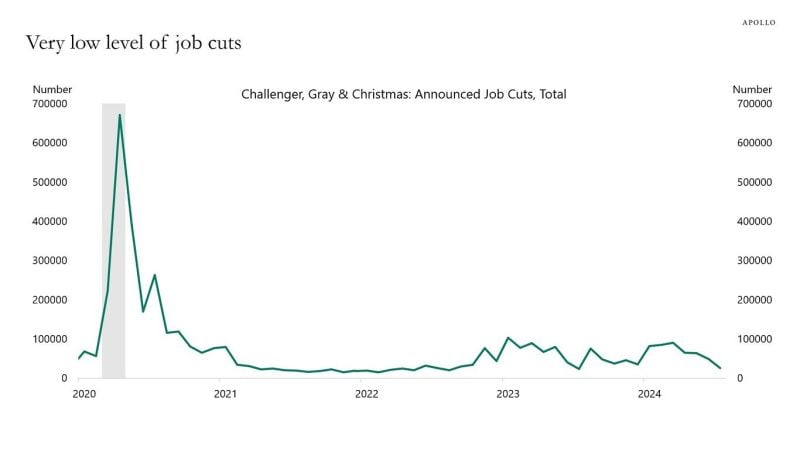

A very important chart which goes AGAINST hard landing scenario

"The source of the rise in the us unemployment rate is not job cuts but a rise in labor supply because of rising immigration. That is the reason why the Sahm rule doesn’t work. The Sahm rule was designed for a decline in labor demand, not a rise in immigration." - Torsten Slok (Apollo) Source: Mike Z. on X

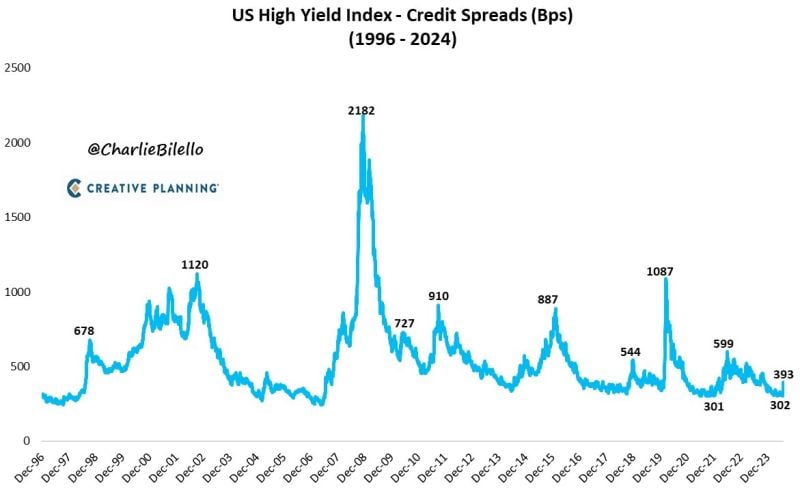

2 weeks ago, US High Yield credit spreads were nearly at their tightest levels since 2007 (302 bps).

Spreads have since increased 91 bps to their widest levels since Nov 2023 (393 bps). The last 3 recessions all saw spreads move over 1,000 bps at some point. We're not close to pricing in that scenario today. Source: Charlie Bilello

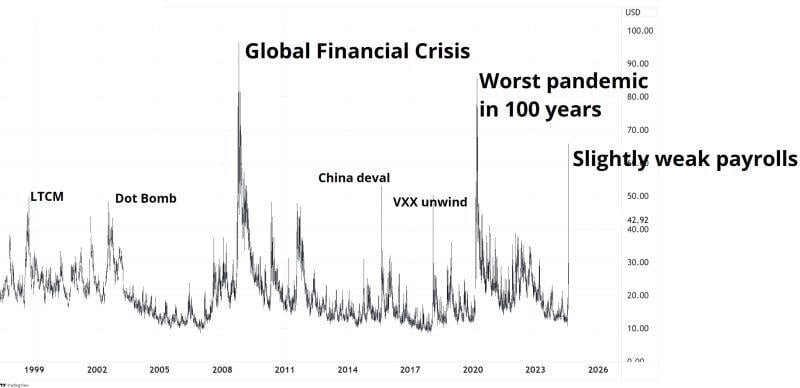

Putting yesterday's VIX intra-day high at 65 into historical perspective...

Source: Bloomberg, RBC

Investing with intelligence

Our latest research, commentary and market outlooks