Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

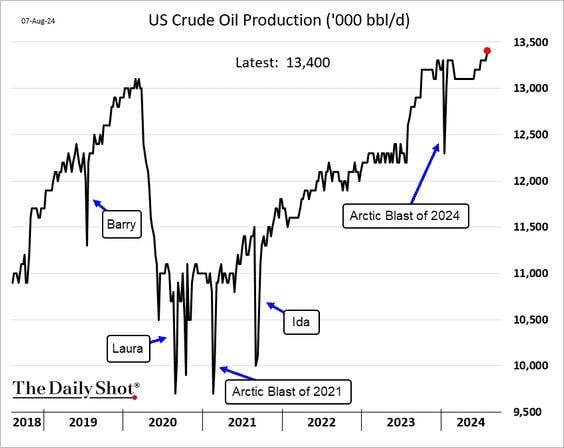

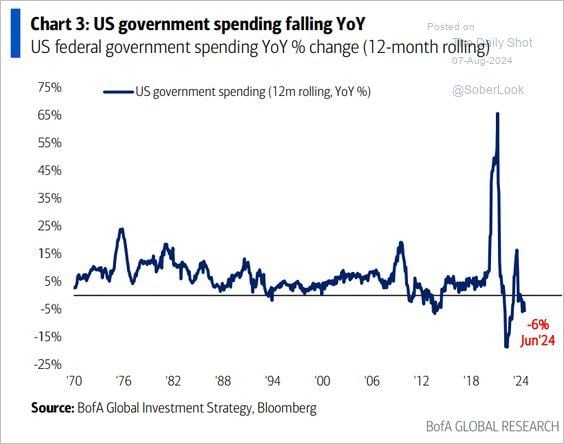

The main reason the economy has been able to avoid a recession over the last 2-years

was due to the massive spending from the inflation reduction and CHIPs Acts. However, the rate of that spending is declining which could potentially weigh on economic growth going forward. Source: BofA, The Daily Shot, Lance Roberts

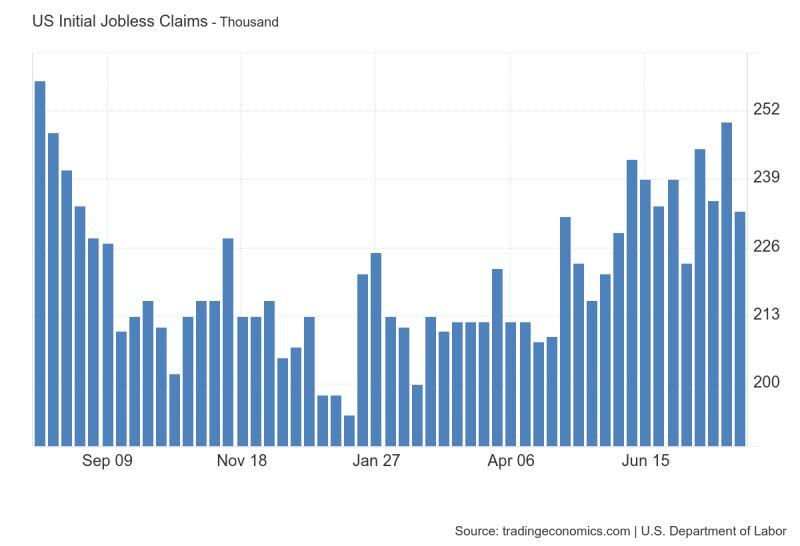

Interesting to see how the psychology of the market has been changing lately.

A few weeks ago, strong job reports had a negative effect on stocks. Now it is the other way round. Initial jobless claims reversed their uptrend and stocks seem quite happy with this. Why? Because there is actually a "growth" fear (instead of an "inflation" fear) which means that any decent economic report will be welcome by the market (and any bad one could push stocks lower).

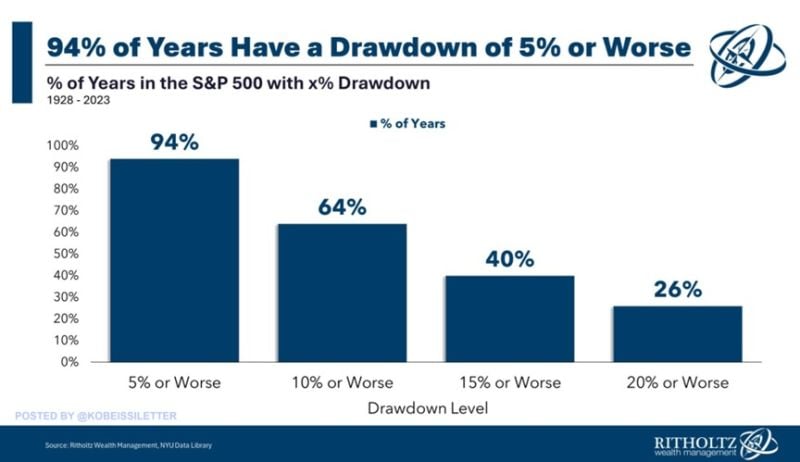

Stock market corrections are a common occurrence: Since 1928, the S&P 500 has experienced a decline of 5% or more in 94% of years.

A correction of 10% or more happened in 61 out of the last 96 years. A larger drawdown of 15%+ was seen in 40% of the years in the 1928-2023 timeframe. Finally, a bear market with a 20% drop or more took place in 25 out of the last 96 years. Stock market pullbacks are normal. Source: Ritholtz Financial, The Kobeissi Letter

US bond vigilantes managed to turn the stockmarket around.

Investors shunned a $42bn auction of benchmark 10-year US securities, which drew a yield that was well above the pre-sale indicative level. That horrible bond auction pushed stocks lower. Source: Bloomberg, @johnauthers, HolgerZ

Super Micro Computer stock, $SMCI, just swung from UP +20% to DOWN -20% in 24 hours.

The stock rose to an after hours high of $729.00 yesterday and is trading at $486.00 in after hours today. $SMCI is now down 60% from its high seen just 5 months ago. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks