Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

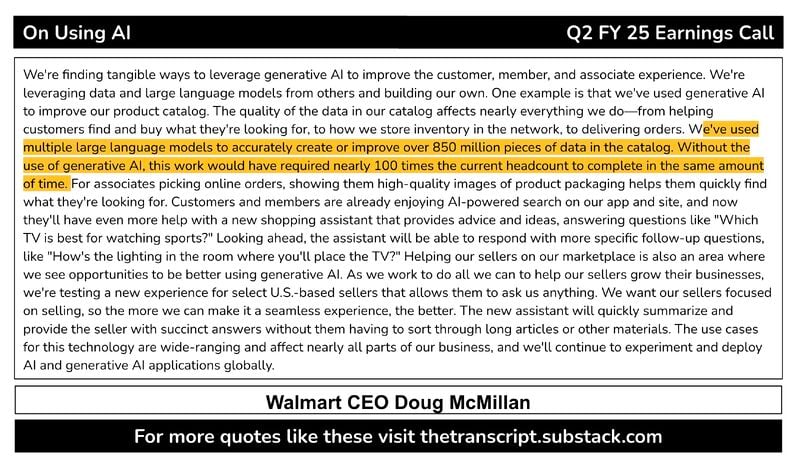

Walmart CEO on using AI

"We've used multiple LLMs to accurately create or improve over 850,000,000 pieces of data in the catalog. Without the use of hashtag#generativeAI, this work would have required nearly 100X the current headcount to complete in the same amount of time" $WMT Source: The Transcript

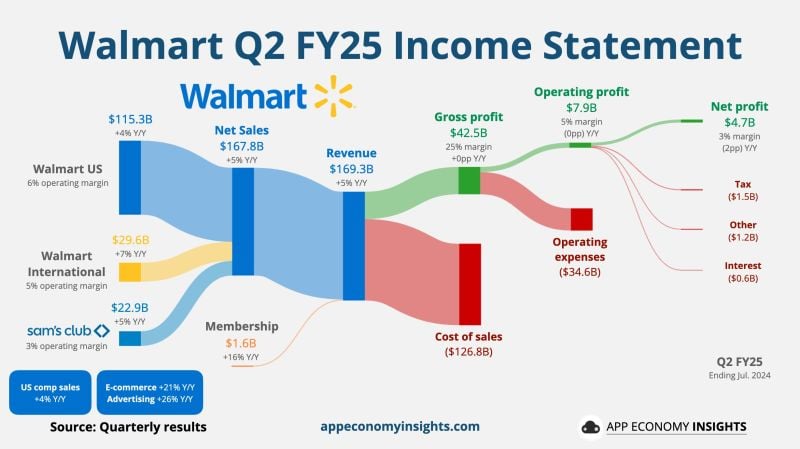

$WMT Walmart Q2 FY25 (ending in July):

• Revenue +5% Y/Y to $169.3B ($1.9B beat). • Non-GAAP EPS $0.67 ($0.02 beat). • Walmart US comp sales +4%. • E-commerce +21% Y/Y. • Advertising +26% Y/Y. FY25 Guidance: • Net sales +3.75% to 4.75% Y/Y (0.75% raise). Source: App Economy Insights

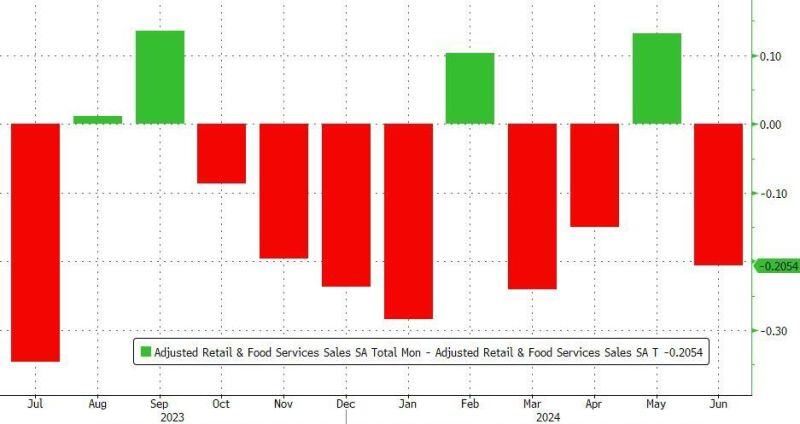

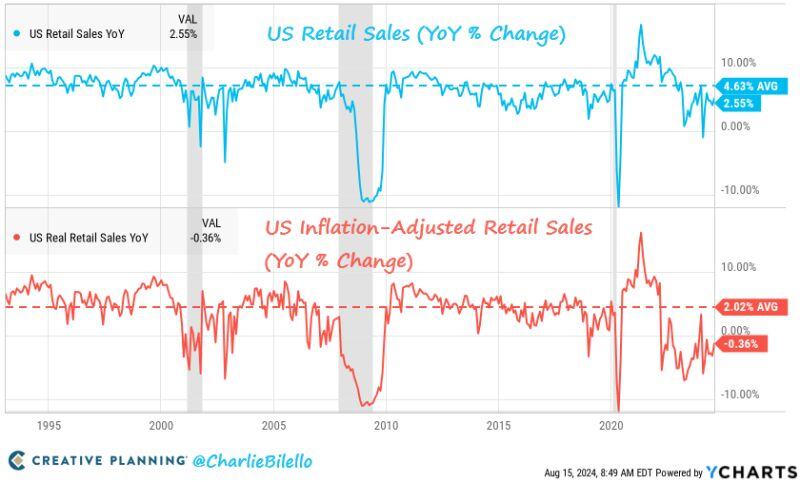

US Retail Sales increased 2.6% over the last year and this number is taken positively by markets

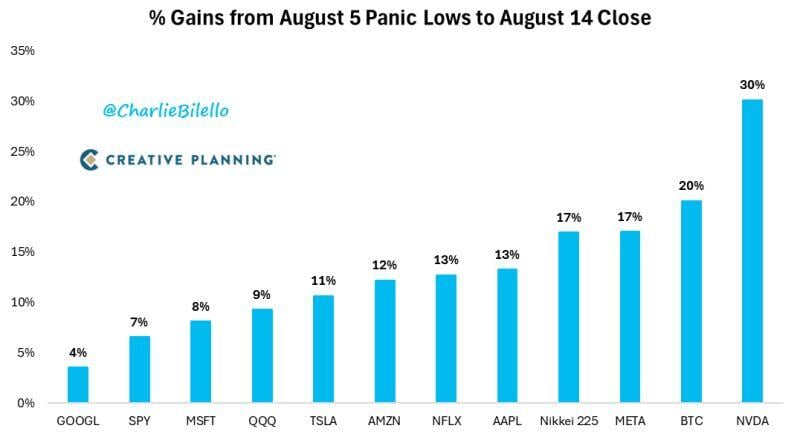

Retail sales came in better than expecting indicating that hashtag#consumers are still strong. Retail Sales month-over-month is the best number since January 2023. There are few caveats though: 1) After adjusting for higher prices they were down 0.4%. 2) Both of these numbers are well below the historical averages of +4.6% nominal and +2.0% real. 3) Previous numbers were revised downward Source: Charlie Bilello

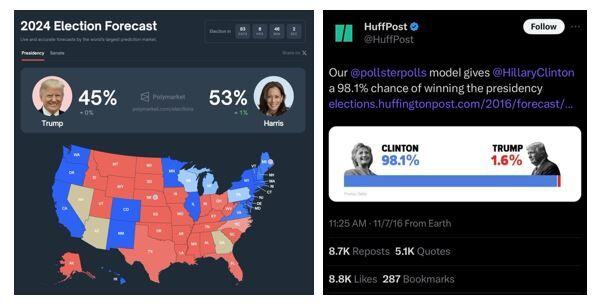

BREAKING: Prediction markets are now showing a 53% chance of Kamala Harris winning the 2024 election, according to Polymarket.

These markets are different than polls in that the probabilities are based on real money wagers. In 2016, polls put odds of Hillary Clinton beating Trump at 70%, with some as high as 98%. Trump's victory in 2016 ended up resulting in one of the largest polling and election forecaster failures in history. Will prediction markets prove to be more or less accurate? Source: The Kobeissi Letter

BREAKING >>> Hackers have reportedly stolen Social Security numbers of EVERY American from National Public Data, according to the Los Angeles Times

2.9 billion people's data was reportedly stolen Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks