Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US CPI report is out - and it is a rather MIXED one

1) Core CPI comes in cooler than expected (2.9% vs. 3.0% expected). Note however that this is the highest level since February. On a sequential basis, U.S. core CPI rose 0.2% M/M, below estimates for a 0.3% increase. 2) Headline CPI inflation increased 2.7% Y/Y, ABOVE forecasts for a 2.6% reading. This is also the highest level since February. On a sequential basis, US CPI rose 0.3% on the month, in line with estimates. 3) Looking at the various CPI components, it seems that tariffs are beginning to drive up prices for core goods like clothing, furniture, appliances, shoes & toys. However, falling car prices are helping to mask full impact. ▶️ All in all, today’s inflation report effectively eliminates any chance of a Fed rate cut at the July 30 FOMC meeting. And if subsequent inflation readings reiterate the rise in inflation, it could jeopardize future rate cuts as well. ✅ The CME Group’s FedWatch tool showed only a 2.6% probability of a fed rate cut at the meeting. 👉 Yes, indeed. The us inflation outlook remains highly uncertain. And so is the US tariff policy. On our side, we believe that the Fed might cut rates only once in 2025. Source: Bloomberg

UK ministers are to bring back consumer subsidies for some electric vehicles through a new scheme worth £650mn, as they try to boost sales of battery models that still lag government targets.

Households will receive a discount of up to £3,750 per vehicle when they buy a new electric car that is priced below £37,000, under a programme to be announced on Tuesday that will include £63mn of funding for charger installations. The former Conservative government scrapped direct purchase incentives for battery-driven models in 2022, arguing that the market had sufficiently matured. But the industry has repeatedly called for more financial assistance to encourage EV purchases. Source: FT

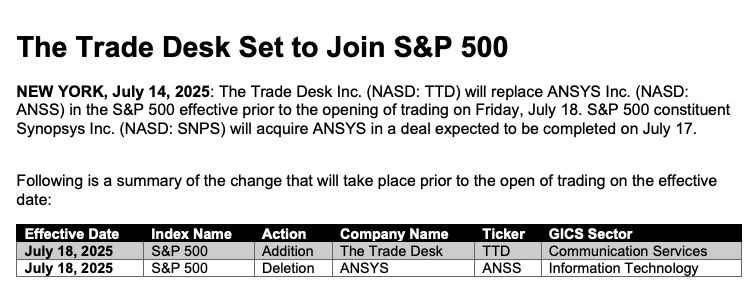

TRADE DESK IS JOINING THE S&P 500

Trade Desk $TTD will replace ANSYS in the S&P 500 before the markets open on July 18th.

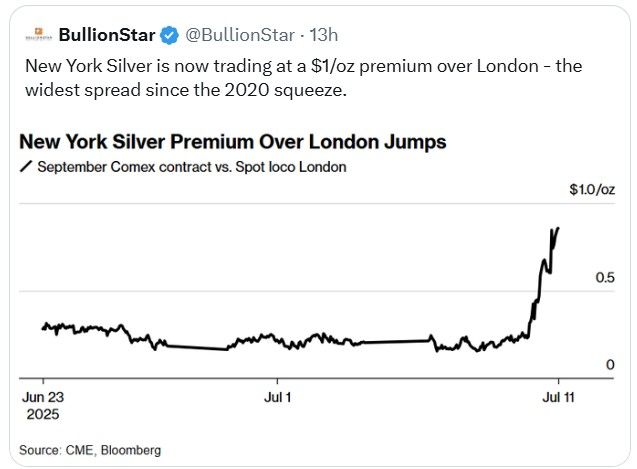

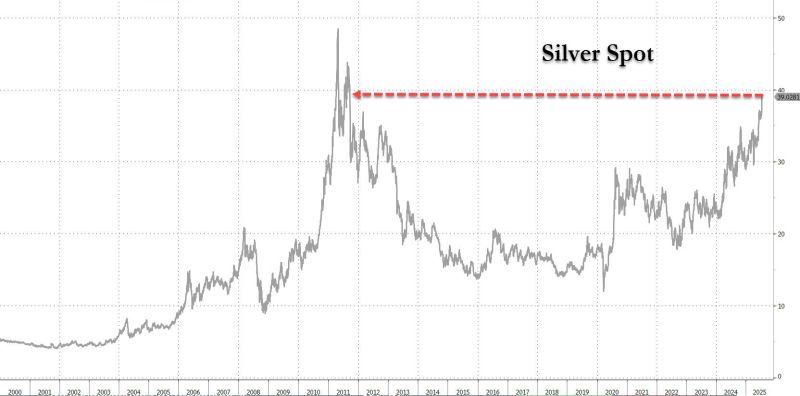

🚨 NEW YORK BEGGING FOR SILVER. LONDON CAN’T DELIVER.

Source: @MakeGoldGreat on X

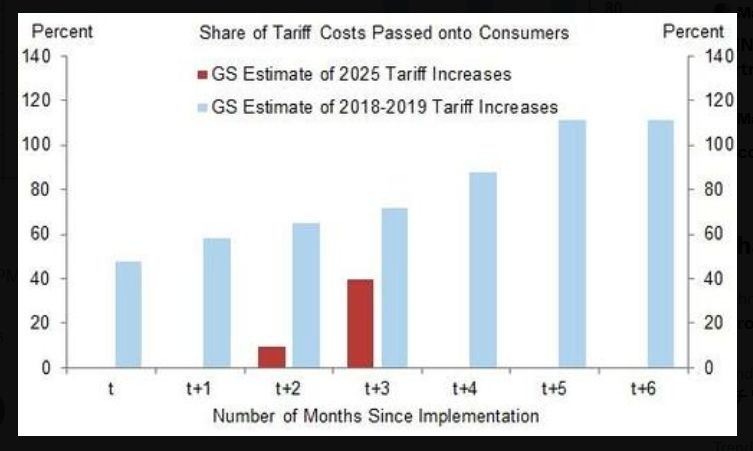

Goldman Sachs analysis suggests that the share of tariff costs that fell on consumers rose from 0% in the first month of implementation to 10% after two months.

It then rose to 40% after three months, it is still too early to see the full pass-through of tariffs on inflation. Source: Markets & Mayhem

The electrification theme in 4 charts

Platinum, palladium, copper, uranium. Four key metals in the electrification of everything. As highlighted by @DimitryFarberov on X, their quarterly charts are starting to come alive. • Copper just broke out of a 15+ year base • Platinum finally cleared its downtrend • Palladium trying to bottom at major support • Uranium still in its handle, consolidating after a huge move Different charts, same theme.

Silver surges above $39 for the first time since the first US downgrade in Aug 2011

Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks