Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

German long-term bond yields keep rising.

The yield on 30y Bunds has reached 3.23% — nearing its highest level in 14 years. Source: HolgerZ, Bloomberg

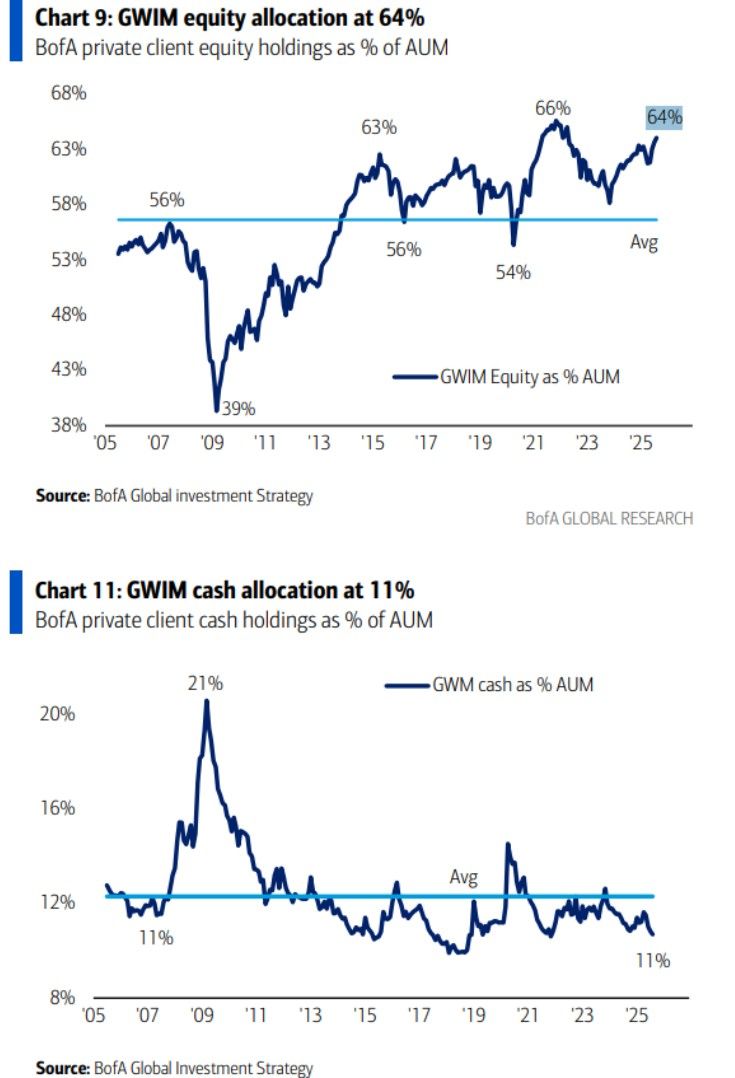

BofA private clients: 64% stocks, highest since March 2022

10.7% cash, lowest since October 2021 (Hartnett) Source: Mike Zaccardi, CFA, CMT, MBA

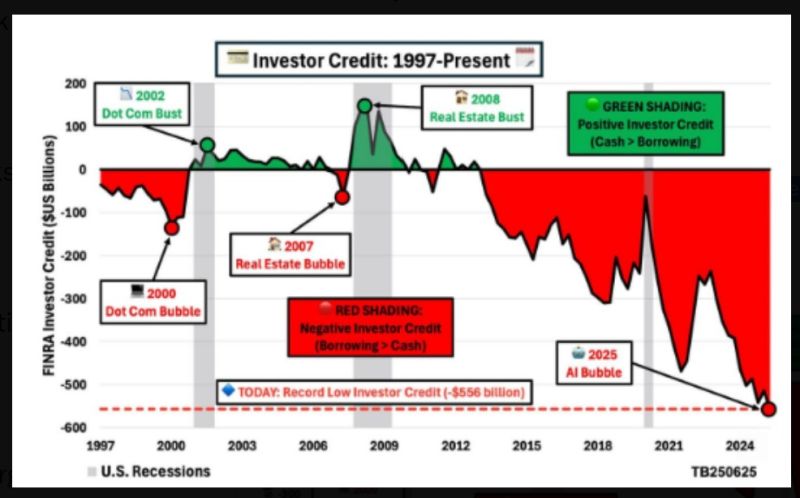

Investors are now buying stocks on margin at levels never seen before in history

Source: Barchart

If Canada raises their tariffs, it will be whatever that rate is PLUS 35%. "Thank you for your attention to this matter." Source: Eric Daugherty on X

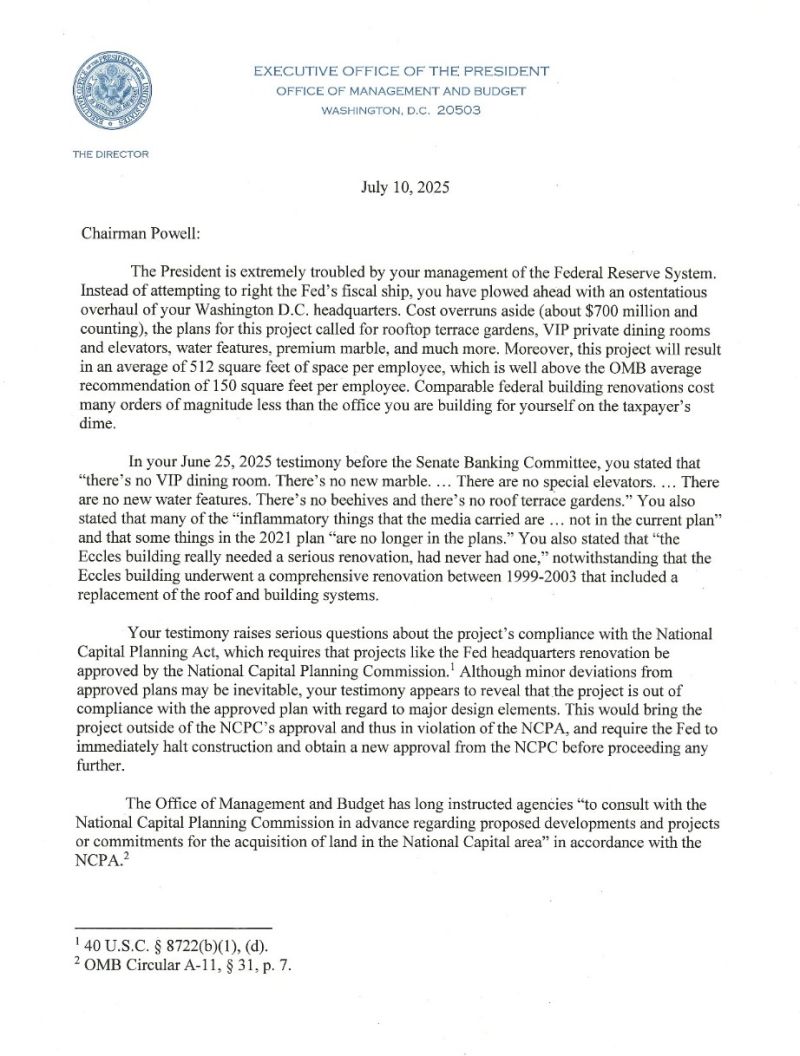

⚠️ Office of Management and Budget Director Russell Vought also suggested Powell had misled Congress about a pricey renovation of the central bank’s headquarters. ‼️ Vought’s broadside opens up a new front in the Trump administration’s war on the Fed chief. ➡️ Russ Vought: "Chairman Jerome Powell has grossly mismanaged the Fed. "While continuing to run a deficit since FY23 (the first time in the Fed's history), the Fed is way over budget on the renovation of its headquarters. Now up to $2.5 billion, roughly $700 million over its initial cost. These renovations include terrace rooftop gardens, water features, VIP elevators, and premium marble. The cost per square foot is $1,923--double the cost for renovating an ordinary historic federal building. The Palace of Versailles would have cost $3 billion in today's dollars! Unfortunately, Powell's recent testimony to Congress has led to serious questions that now require additional oversight from OMB, in conjunction with the National Capital Planning Commission. Today, I sent the letter below to Chairman Powell to get to the bottom of this largesse".

Investing with intelligence

Our latest research, commentary and market outlooks