Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

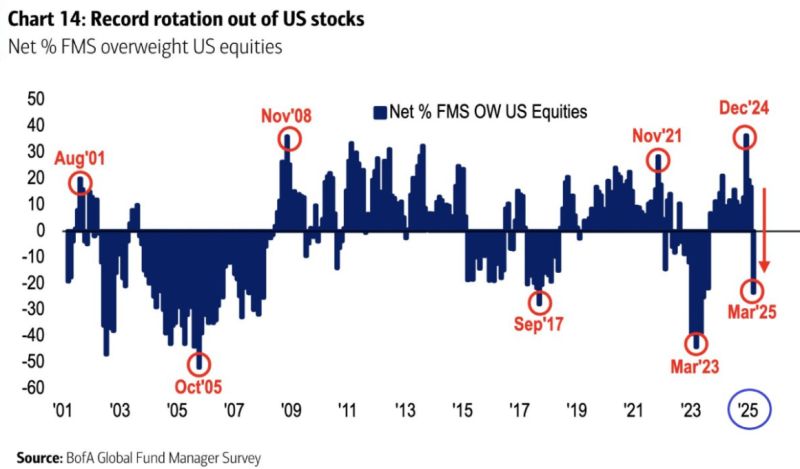

Fund Managers just rotated OUT OF U.S. Stocks at the fastest pace in history

source :BofA

Fitch Lowers World Growth Forecast Amid Tariffs Chaos

The ratings agency cut its U.S. 2025 growth forecast to 1.7% from 2.1%, a level well below the growth rates of close to 3.0% in both 2023 and 2024. It also lowered its U.S. GDP forecast for 2026 to 1.5% from 1.7%. Fiscal easing in China and Germany will cushion the impact of higher U.S. import tariffs, but growth in the eurozone this year will still be slower, while Mexico and Canada will experience technical recessions due to the scale of their U.S. trade exposures, it added. World growth is set to slow to 2.3% in 2025, well below trend and down from 2.9% in 2024, Fitch said. It will remain weak at 2.2% in 2026. The downgrades by Fitch follow similar moves by the Paris-based Organization for Economic Cooperation and Development this week, with a number of private-sector forecasts also moving in the same direction. source : wsj

👑 Berkshire Hathaway: The King Stays King 👑

While markets remain volatile, Warren Buffett’s Berkshire Hathaway just hit all-time highs: Berkshire’s Class A stock rose 1.8% to close at $784,957 on March 17, while its more affordable Class B shares ended the trading day at $523.01. Both were all-time highs for the shares. Berkshire’s Class B stock is up 16% this year versus a 3% decline in the benchmark S&P 500 index. source : tipranks

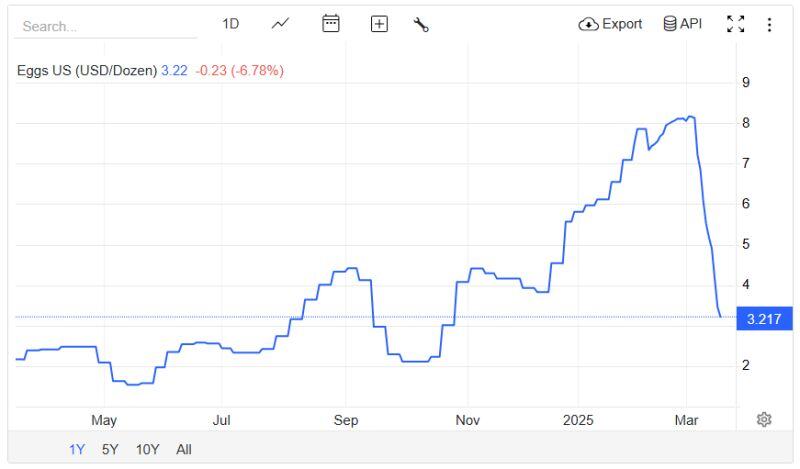

BREAKING 🚨: Eggs

The Great Egg Collapse of 2025 continues with prices plunging more than 60% this month. Source: Barchart @Barchart

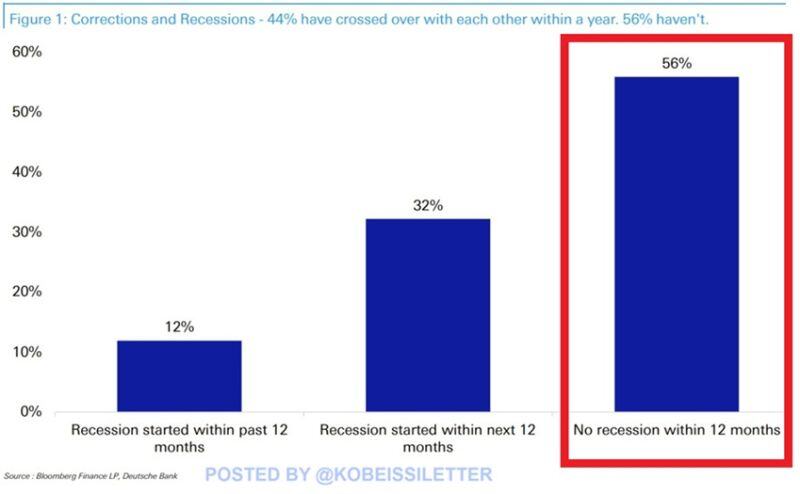

How often do market corrections lead to a recession in the US?

There have been 60 S&P 500 corrections including the most recent one, according to Deutsche Bank analysis. Historically, in 12% of corrections, a recession had already begun in the previous 12 months. 32% of the time a recession took place within the next 12 months. In 56% of corrections, the US avoided an economic downturn within the next 12 months. In other words, market corrections are only accompanied by a recession ~44% of the time. Can we avoid a recession this time? Source: The Kobeissi Letter

👉 The Bank of Japan held interest rates on Wednesday as the rising risk of a global trade war and potential downturn in the US weighed on Japan’s hope for a sustained economic revival.

👉The unanimous decision, which came at the conclusion of a two-day meeting of the Japanese central bank’s policy board, left the short term policy rate at about 0.5 per cent. 👉The result was widely forecast by economists and had been priced in by markets, according to traders. 👉In a statement accompanying the decision, the BoJ warned that “high uncertainties” remained around Japan’s economic activity and prices. The central bank made particular reference to the “evolving situation regarding trade and other policies in each jurisdiction”. Source: FT

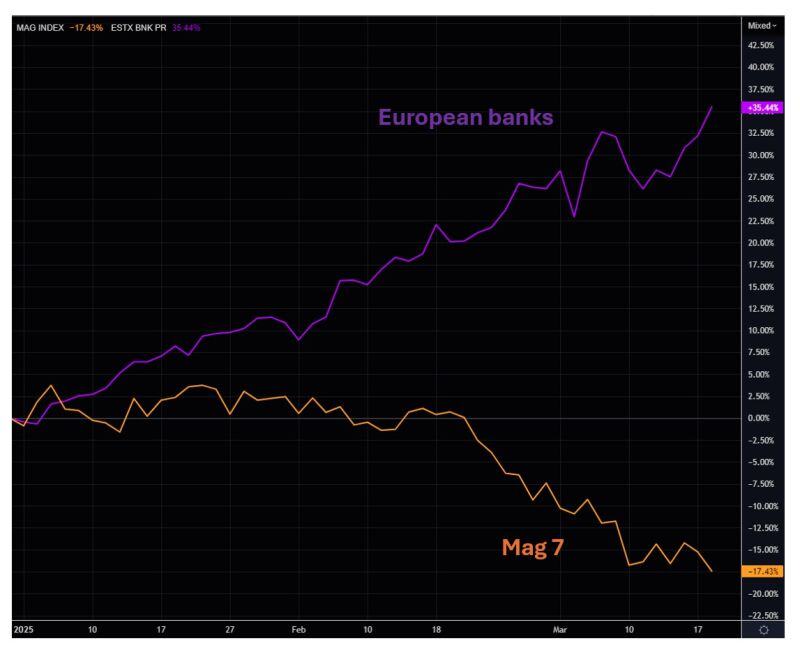

Who needs hot tech...

...when you can have European banks? Chart shows MAG vs SX7E YTD in %. Source: The Market Ear

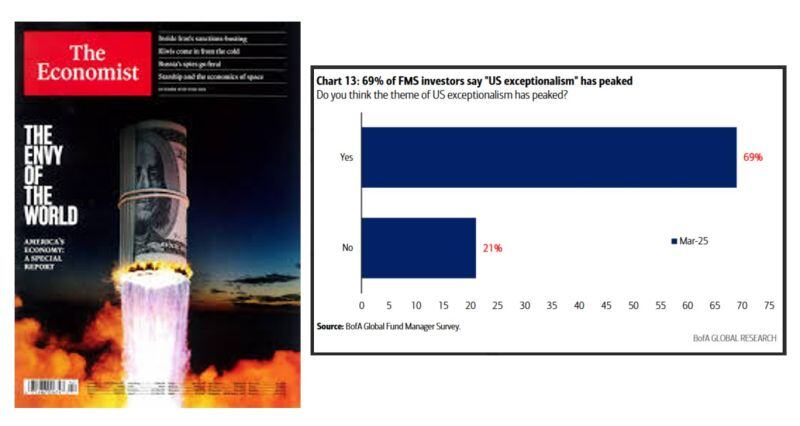

Lots of things have happened since this cover page by The Economist (October 2024)...

According to the BofA Fund Manager Survey, 69% of investors believe that US exceptionalism has peaked... Have we moved from one extreme to another ????

Investing with intelligence

Our latest research, commentary and market outlooks