Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: US February NFP lower than expected!

➡️ Nonfarm Payrolls 151K (est. 160K, prev. 125K) ➡️ Private Nonfarm Payrolls 140K (est. 142K, prev. 81K) ➡️ Unemployment rate 4.1% (est. 4.0%, prev. 4.0%) ➡️ Average hourly earnings YoY 4.0% (est. 4.1%, prev. 3.9%) ➡️ Labor force participation 62.4% (est. 62.6%, prev. 62.6%) Source: Jayanth Ukwaththa on X, US Bureau of Statistics

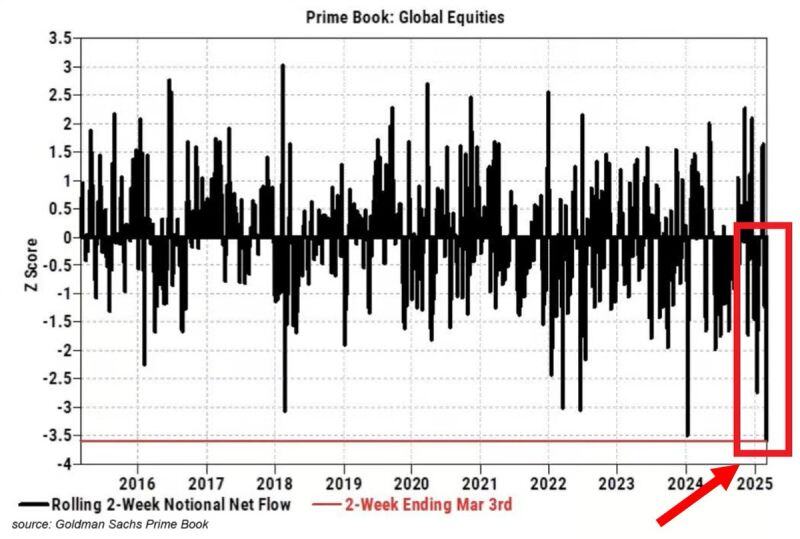

🚨HOLY COW: Hedge funds dumped global stocks at the fastest pace on RECORD over the last 2 weeks.

The majority of sales were in US equities and were even larger than during the 2022 BEAR MARKET. Meanwhile, sp500 and Nasdaq 100 are down 'just' 6% and 9% since their peaks. Source: Global Markets Investor

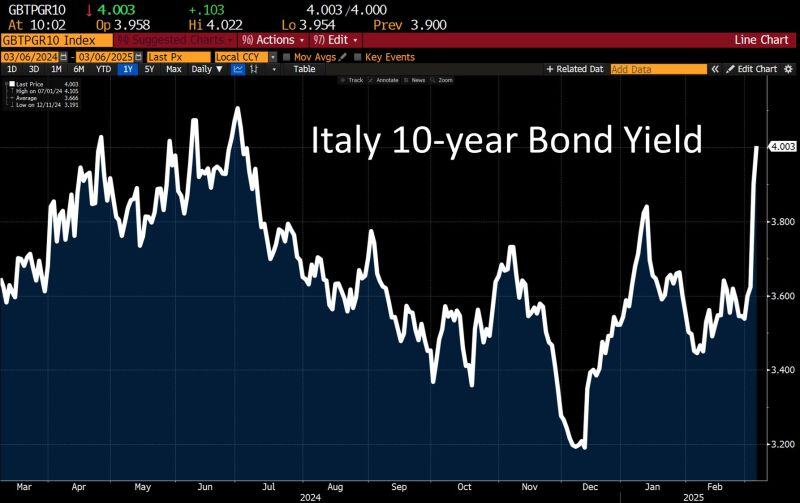

Italy's bond yield just crossed 4%! Thanks to Germany's embracement of debt to invest in defense and infrastructure.

Who remember what happened in 2011/2012? At the time the debt to GDP ratio was 108%. Today it is 140%... Source: Jeroen Blokland, Bloomberg

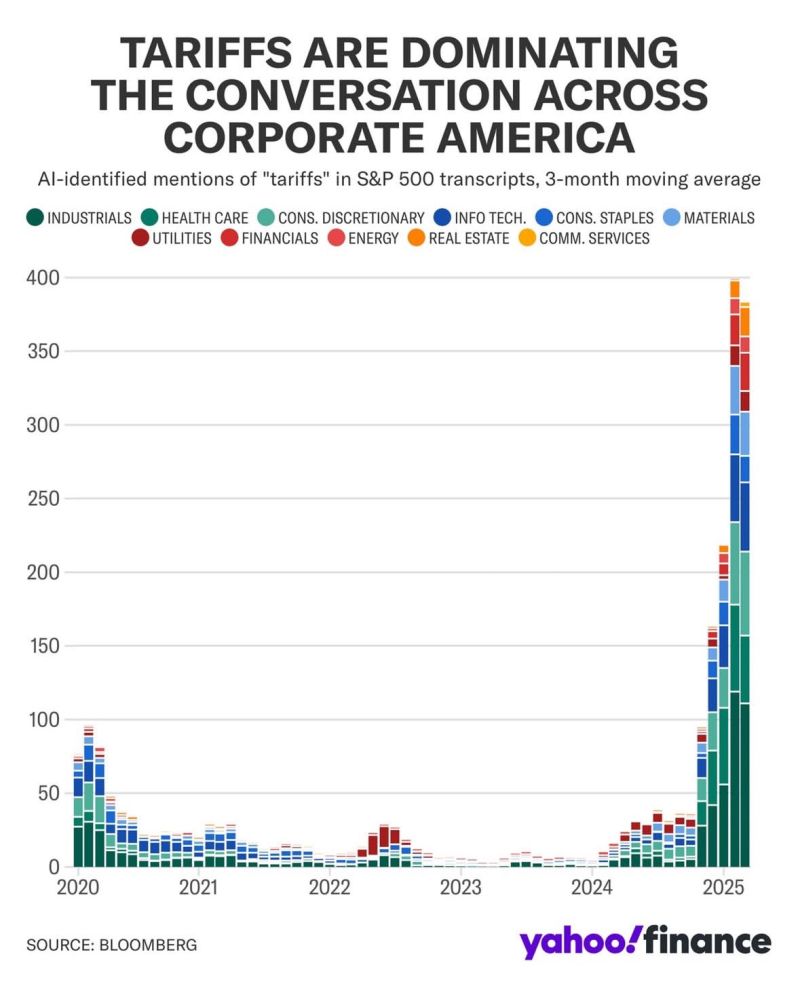

Roughly 80% of the stocks in the SP500 said the word tariffs on their last earnings call

Source: Evan on X

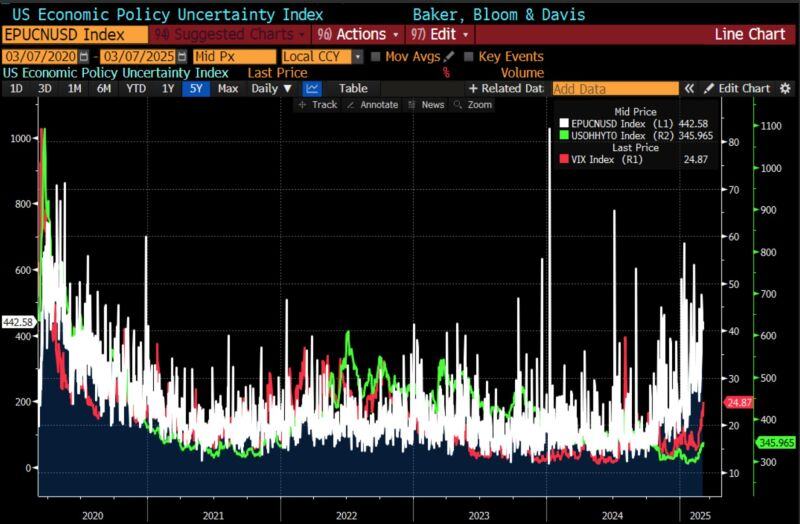

WATCH CREDIT SPREADS‼️

US high yield spreads (in green) are starting to tick up, but not to the extent of the Economic Uncertainty Index nor the Vix (in red). If credit weakens, then we know we are in trouble... Source: Bloomberg, RBC

➡️ 🚨 BREAKING: TRUMP SIGNS EXECUTIVE ORDER CREATING U.S. BITCOIN RESERVE. BITCOIN PRICE FALL

Trump has officially established the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, marking a major shift in U.S. crypto policy. The reserve will be funded using Bitcoin seized in criminal and civil forfeitures—no taxpayer money involved. The U.S. is estimated to hold around 200,000 BTC, but there’s never been a full audit. Unlike past sales that lost taxpayers $17 billion, this Bitcoin won’t be dumped—it’s being stored as a digital Fort Knox. The executive order also directs a full accounting of U.S. digital asset holdings, aiming to maximize value and solidify America as the crypto capital of the world. Bitcoin plunged approximately 6% after US President Donald Trump signed an executive order to establish a Strategic Bitcoin Reserve. Market participants had hoped the government would announce a plan to buy more Bitcoin, but Trump’s crypto tsar David Sacks said on X it would only use the Bitcoin it already holds from criminal cases — though it will look to develop “budget-neutral” strategies to acquire additional Bitcoin. The White House is also set to host a Crypto Summit today, led by @DavidSacks, with industry leaders including Coinbase's Brian Armstrong. ockpile, making Bitcoin an official part of U.S. financial strategy. Source: Mario Nawfal on X, www.cointelegraph.com

Investing with intelligence

Our latest research, commentary and market outlooks