Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

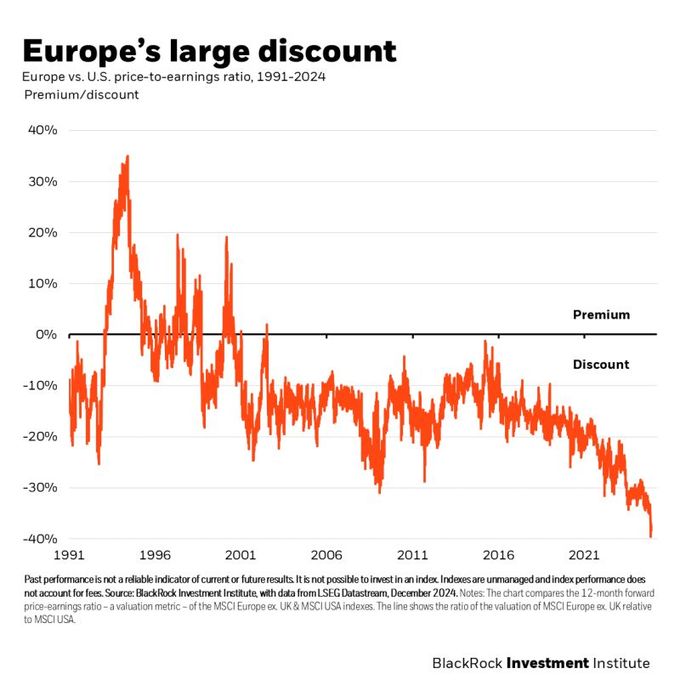

European Stocks trading at an all-time record discount relative to US Stocks

Source: Barchart, Blackrock

JUST IN: MICHAEL SAYLOR AND MICROSTRATEGY $MSTR BOUGHT 15,350 MORE BITCOIN $BTC

MicroStrategy spent ~$1.5 billion to buy the 15,350 at an average price of ~$100,386 per Bitcoin, boosting total holdings to 439,000. $MSTR 📈 +3.50% in pre-market. Source: Michael Saylor Tracker

It seems that Trump invitation wasn't that well received...

Source: BRICS News

🚨BREAKING: SAUDI ARABIA TO HOST THE 2034 WORLD CUP

FIFA has officially confirmed Saudi Arabia as the host of the 2034 World Cup, marking a bold step for football’s future in the Middle East. This is a chance to showcase Saudi Arabia’s transformation and its commitment to global sports. With its growing investment in infrastructure, culture, and innovation, the kingdom is set to deliver a world-class tournament like never before. Source: The Guardian, Mario Nawfal on X

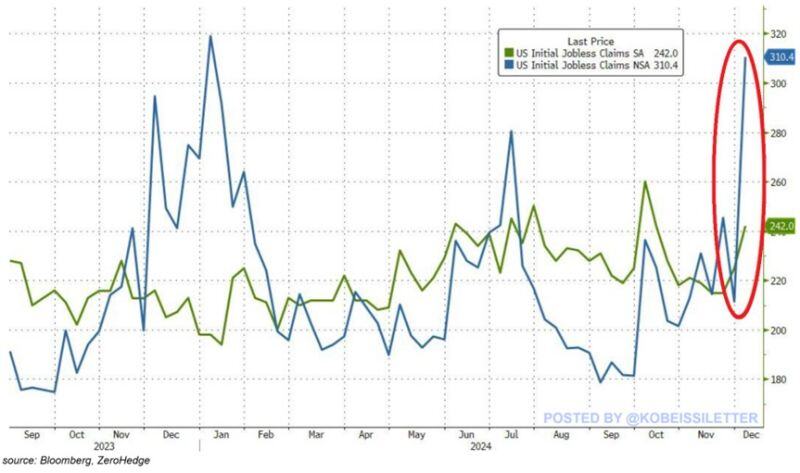

Has the era o stagflation begun?

Initial jobless claims spiked by 17,000 to 242,000 last week, the highest since the first week of October. Non-seasonally adjusted claims skyrocketed by 99,140 to 310,366, the highest since January. This marks a whopping 30% year-over-year increase. At the same time, the number of people receiving jobless benefits surged to 1.89 million, near the 3-year high. To put this into perspective, continuing jobless claims are now 14% above the 2018-2019 pre-pandemic levels. All while CPI, PCE, and PPI inflation are all back on the rise. We have a weakening labour market with rising inflation. Source: The Kobeissi Letter

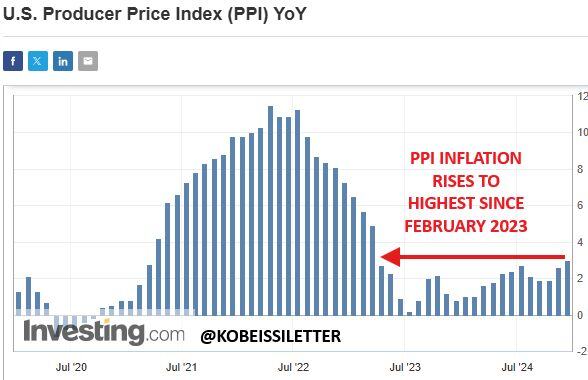

BREAKING: November PPI inflation RISES to 3.0%, above expectations of 2.6%. Core PPI inflation RISES to 3.4%, above expectations of 3.2%.

Moreover, the US Bureau of Labor Statistics has revised October PPI inflation HIGHER, from 2.4% to 2.6%. Also, Core PPI inflation for October has been revised HIGHER from 3.1% to 3.4%. This means that 6 out of the last 7 PPI inflation reports have now been revised higher. With today's 3.0% PPI inflation print, PPI inflation is now at its highest level since February 2023. CPI, PPI, and PCE inflation are all officially back on the rise in the United States... Source: The Kobeissi Letter

TEXAS GOES ALL IN ON BITCOIN WITH STATE RESERVE PLAN!

Texas just made a bold crypto power move! State Rep. Giovanni Capriglione has filed a bill to create a Strategic Bitcoin Reserve, setting the stage for Texas to lead the Bitcoin revolution. This is a visionary step toward making Texas the ultimate Bitcoin hub. Source: Watcher Guru, @VoteGiovanni thru Mario Nawfal

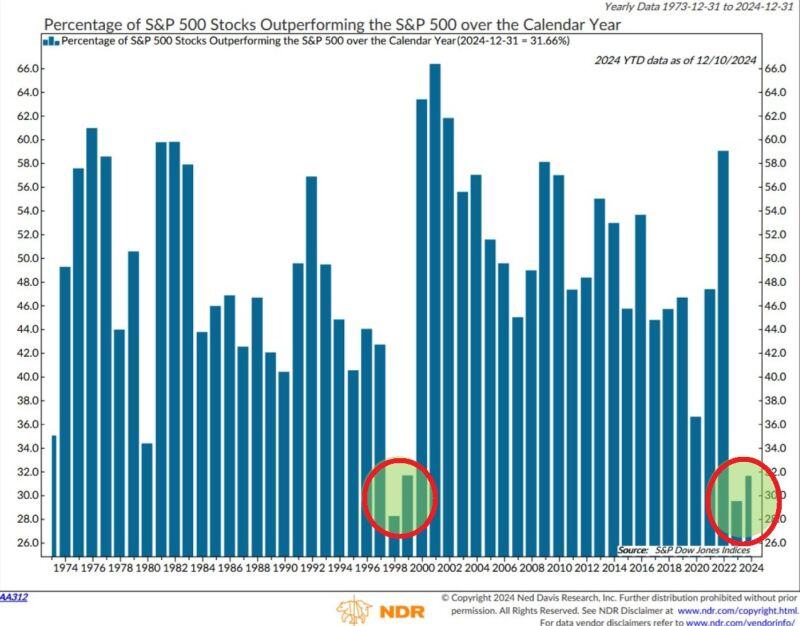

🚨Only 32% of the S&P 500 firms have outperformed the index year-to-date after 29% in 2023, one of the lowest readings on record.

In other words, 32% of companies gained more than 27% this year. In the past, this happened only once, in the 1998-1999 Dot-Com Bubble. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks