Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Culture Eats Strategy for Breakfast

Source: Wolf of Harcourt Street Quote from Peter Drucker

France’s National Rally continued to cement its lead in opinion polls a week before the country’s snap parliamentary election, largely at the expense of President Emmanuel Macron’s centrist bloc.

Support for Marine Le Pen’s far-right party was pegged at 36% in a survey by Elabe published Sunday in La Tribune Dimanche. That’s ahead of 27% for the left-wing New Popular Front alliance, and just 20% for Macron’s movement. Source: Bloomberg

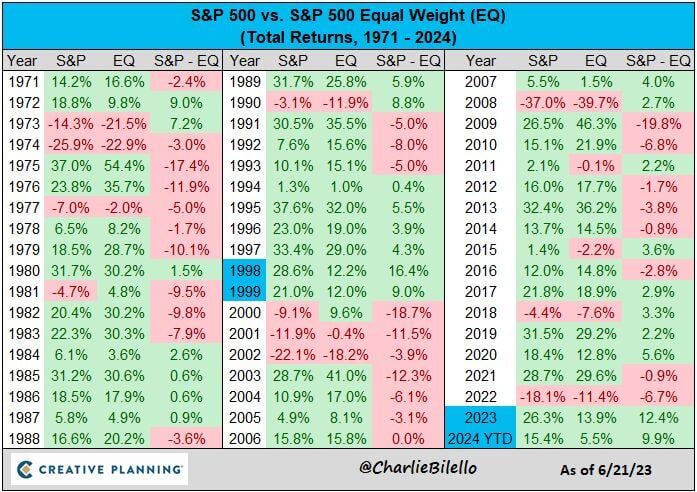

The market cap-weighted S&P 500 is outperforming the equal weight index by nearly 10% this year, following 12% outperformance in 2023.

Since 1971, the only back-to-back years with a higher combined outperformance: 1998-1999. Source: Charlie Bilello

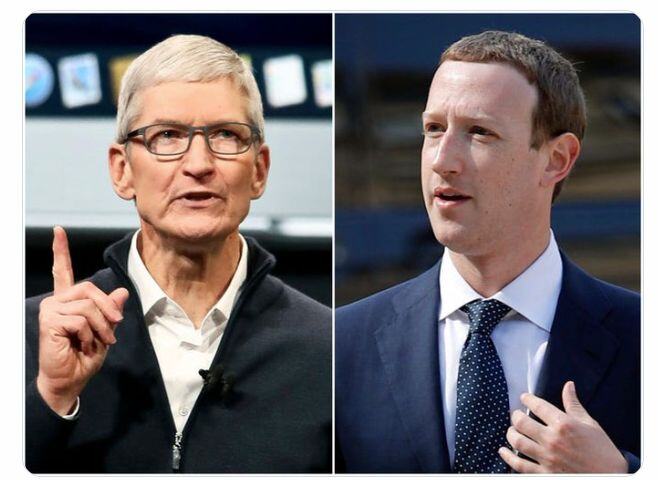

JUST IN: *META, APPLE REPORTEDLY DISCUSSED AI COOPERATION - WSJ

The Wall Street Journal is reporting that Apple and Meta have discussed a partnership that would see Meta AI models integrated into iOS 18 for Apple Intelligence. This integration would likely be similar to the deal Apple has struck with ChatGPT, which is currently the only third-party partner for Apple Intelligence.

The Nasdaq 100 and Bitcoin have moved in tandem for the past 4+ years.

With the recent Tech rally, the Nasdaq is showing its largest divergence versus Bitcoin during this time frame. Will we see bitcoin catch up or Tech catch down? Source: David Marlin

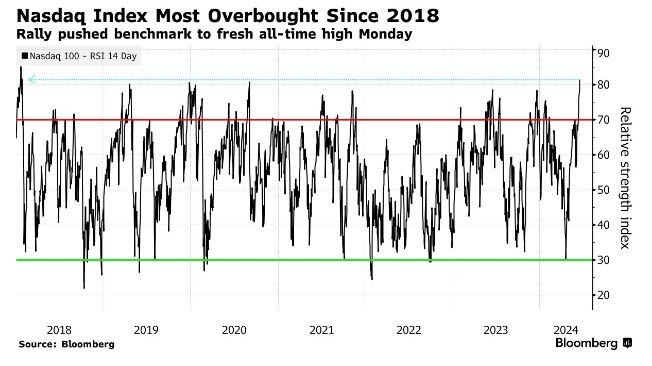

Mega Cap Tech Stocks hit their most overbought level in more than 6 years last week

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks