Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

How many loans to negative cash flow start ups were made using Nvidia chips as collateral?

Source: Edward Dowd @DowdEdward

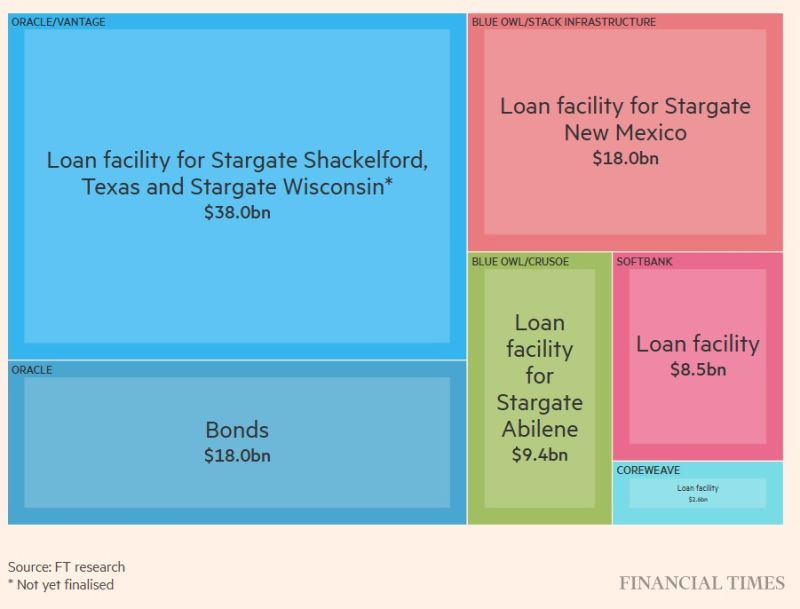

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions

A great FT article on how OpenAI partners amassed $100bn debt pile to fund its ambitions.

In case you missed it... US 10-Year Treasury Yield back near its lowest level in the last 14 months 📉📉

Source: Barchart

Apple $AAPL is set to ship more smartphones than Samsung in 2025

This would be the first time it will have done so in 14 years ... Apple will ship around 243M iPhone units this year vs 235M shipments from Samsung. Bloomberg reported that Counterpoint Research expects Apple to become the No. 1 brand by shipments this year with a 19.4% market share. The report says Samsung’s Galaxy line will grow only 4.6% this year, while iPhone sales are likely to increase by 10% compared to last year.

🚨 $GOOGL co-founders Larry Page and Sergey Brin are now the 2nd and 3rd richest people on the planet.

Yes, Google just leap-frogged nearly everyone. According to Bloomberg’s latest rankings, here’s the current Top 10 richest people in the world: 1️⃣ Elon Musk — $442B 2️⃣ Larry Page — $276B 3️⃣ Sergey Brin — $258B 4️⃣ Larry Ellison — $254B 5️⃣ Jeff Bezos — $251B 6️⃣ Mark Zuckerberg — $225B 7️⃣ Bernard Arnault — $196B 8️⃣ Steve Ballmer — $166B 9️⃣ Michael Dell — $155B 🔟 Jensen Huang — $155B The Google founders jumping to #2 and #3 is a reminder of one thing: AI isn’t just reshaping technology, it’s reshaping the leaderboard of global wealth in real time. Source: Evan

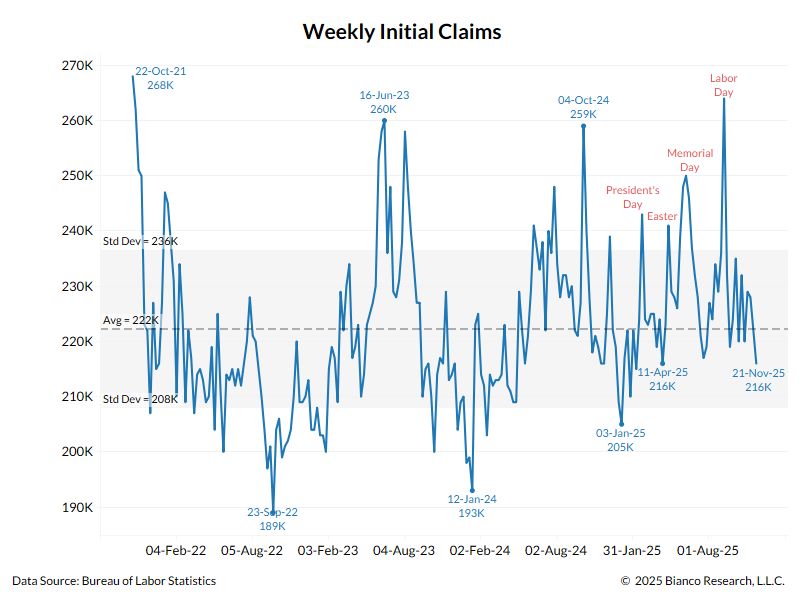

🚨 Fresh data just dropped and it’s sending mixed signals about the job market.

📉 Weekly jobless claims fell by 6,000 to 216,000, beating expectations of 225,000. 👉 Translation: fewer people filed for unemployment last week. Layoffs remain relatively low. But here’s the twist: 📈 Continuing unemployment claims rose by 7,000 to 1.96 million. 👉 That means more people are staying on unemployment longer. What does this combo really signal? While companies may not be cutting large numbers of workers, the economy doesn’t seem to be creating enough new jobs to absorb people who are already unemployed. In short: 🔹 Layoffs are low. 🔹 Hiring isn’t high enough. 🔹 Workers are getting stuck in unemployment longer. A cooling job market… or the calm before a bigger shift? Source: Truflation, Bianco Research

Alphabet Google's forward PE looks like a meme stock. Nearly doubled off the low. 👇

Source: Matt Cerminaro @mattcerminaro

Investing with intelligence

Our latest research, commentary and market outlooks