Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

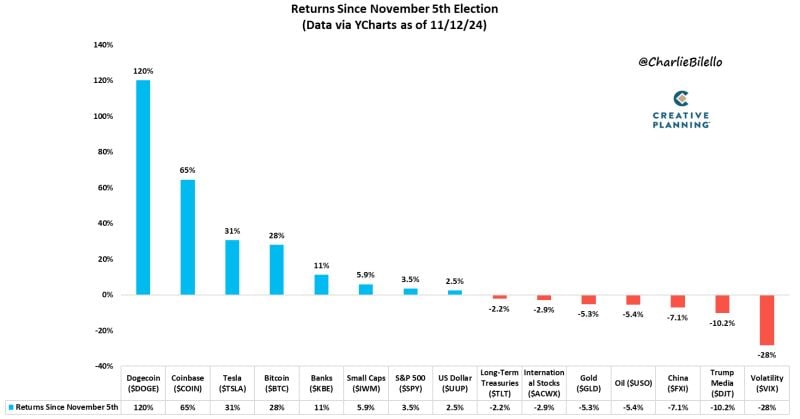

Returns since election...

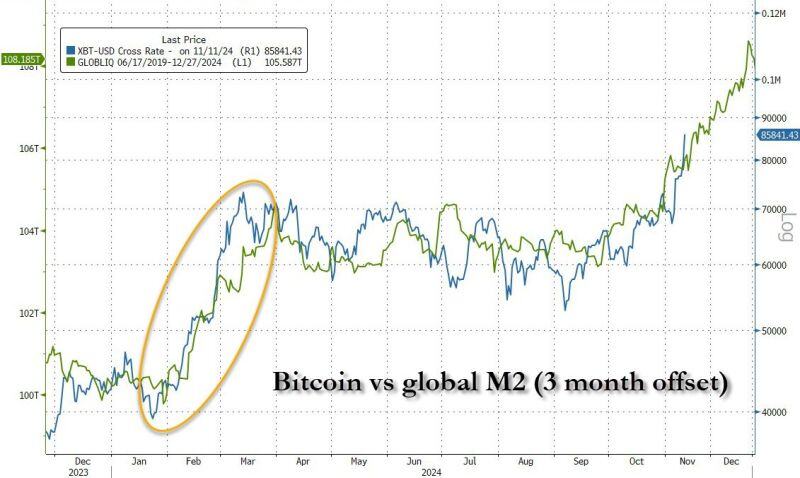

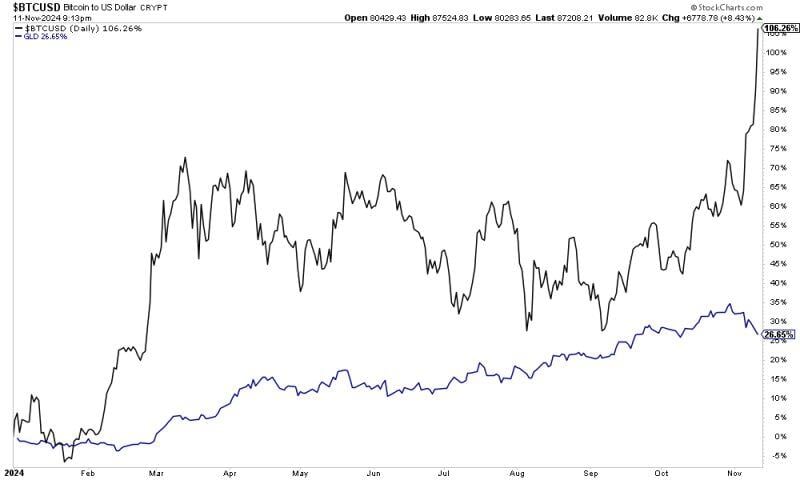

Dogecoin: +120% Coinbase: +65% Tesla: +31% Bitcoin: +28% Banks: +11% Small Caps: +5.9% S&P 500: +3.5% US Dollar: +2.5% --- Long-Term Treasuries: -2.2% International Stocks: -2.9% Gold: -5.3% Oil: -5.4% China: -7.1% Trump Media: -10% Volatility: -28%

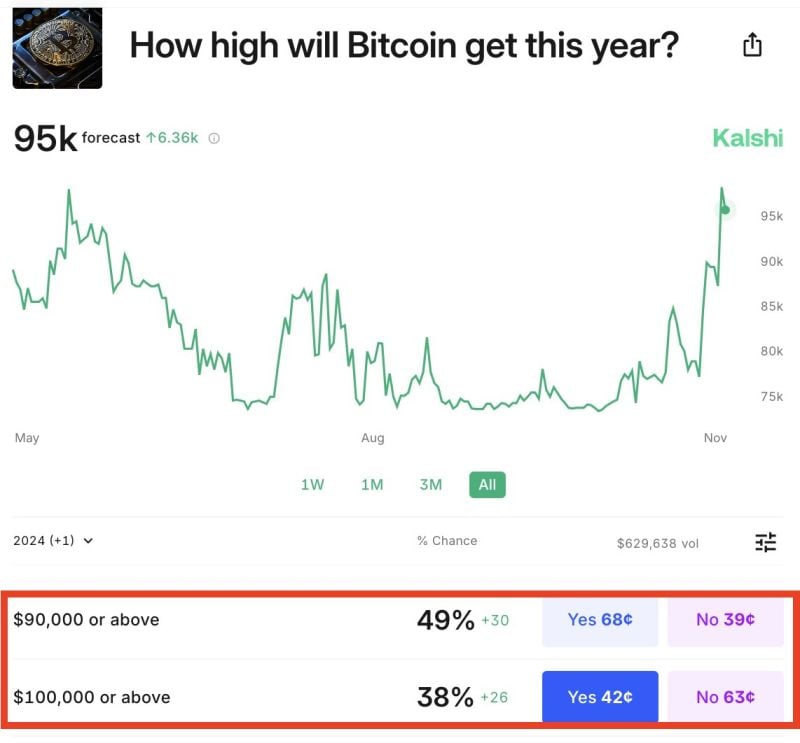

BREAKING: Prediction markets are now pricing in a 38% chance that we will see Bitcoin to $100,000+ THIS YEAR.

Since the election, the odds of Bitcoin hitting $100,000 in 2024 have skyrocketed from 8% to 38%, according to Kalshi. .There is also a 49% chance of Bitcoin hitting $90,000+ by the end of this year. Source: The Kobeissi Letter

FLOWMAGEDON... This is absolutely insane:

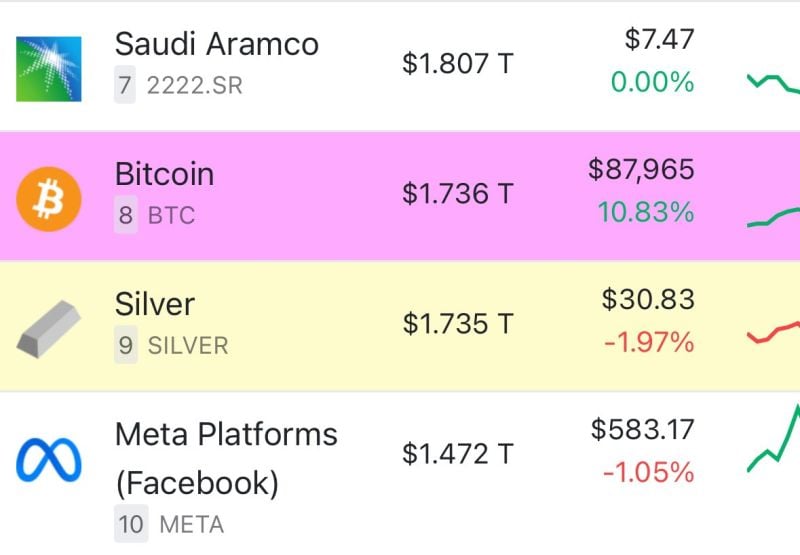

1. Tesla, $TSLA, has added $450 billion in 1 month 2. Bitcoin has added $1 trillion over the last 12 months 3. The S&P 500 has added $15 trillion over the last 13 months 4. Gold has added $4.5 trillion over the last 12 months 5. Nvidia, $NVDA, has added $2.4 trillion over the last 12 months 6. The Magnificent 7 have added $9 trillion over the last 4 years We are witnessing one of the greatest runs in stock market history.

Investing with intelligence

Our latest research, commentary and market outlooks