Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

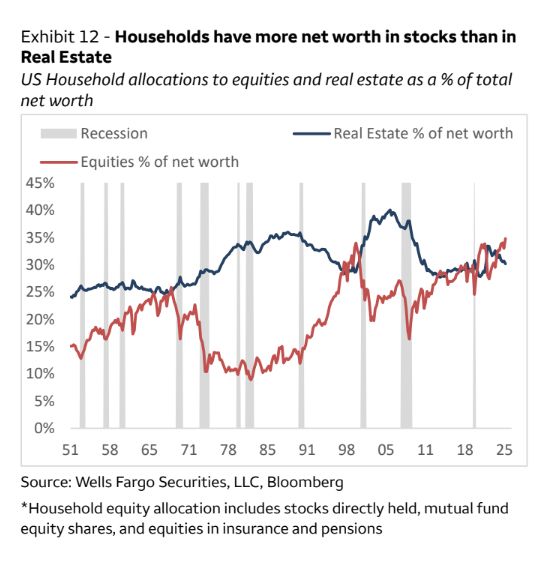

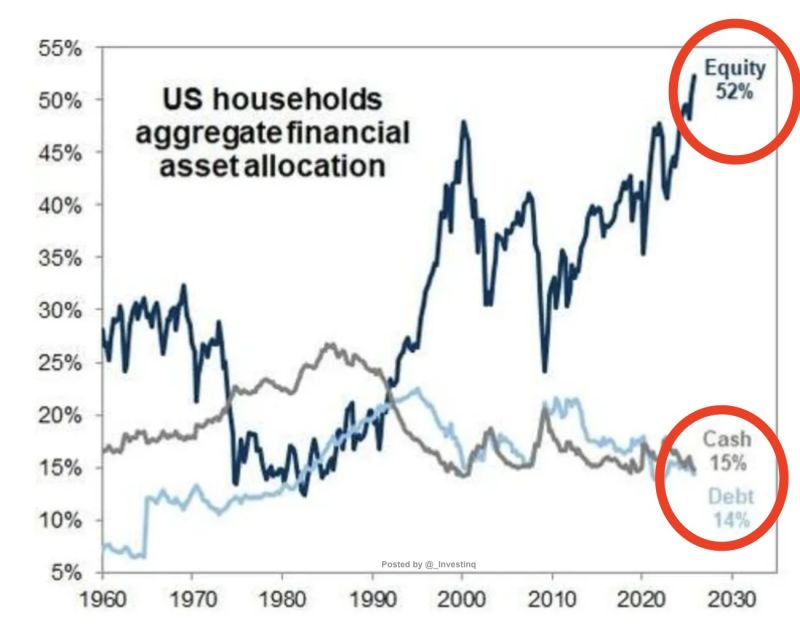

A very interesting chart: we're currently in a relatively rare situation where households have more wealth invested in the stock market than in physical property!

This crossover has only happened a couple of times in modern history, most notably in the late 1960s and again in the late 1990s. What's particularly striking is that both of those periods preceded major bear markets that lasted for years. What this means practically is that households have become increasingly concentrated in equity investments, making them more vulnerable to stock market volatility. When your wealth is primarily in stocks and the market drops, you lose wealth quickly. Real estate tends to be more stable and less prone to sudden crashes, though it can still decline. The US Government can not afford a bear market... Should we prepare ourselves for a "Trump put" in 2026? Source: Wells Fargo, StockMarket.news

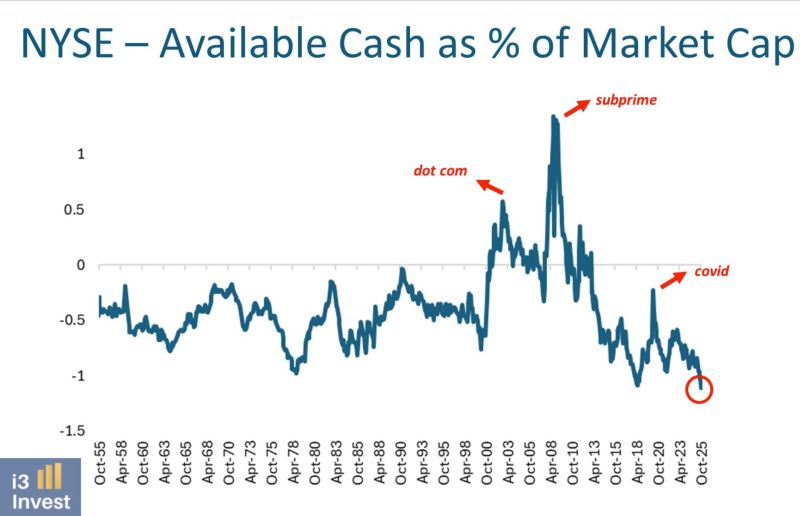

How far can this go?

Investors are in "all-in mode", as NYSE available cash as a percentage of market cap has just reached its lowest level ever. Source: Guilherme Tavares i3 invest

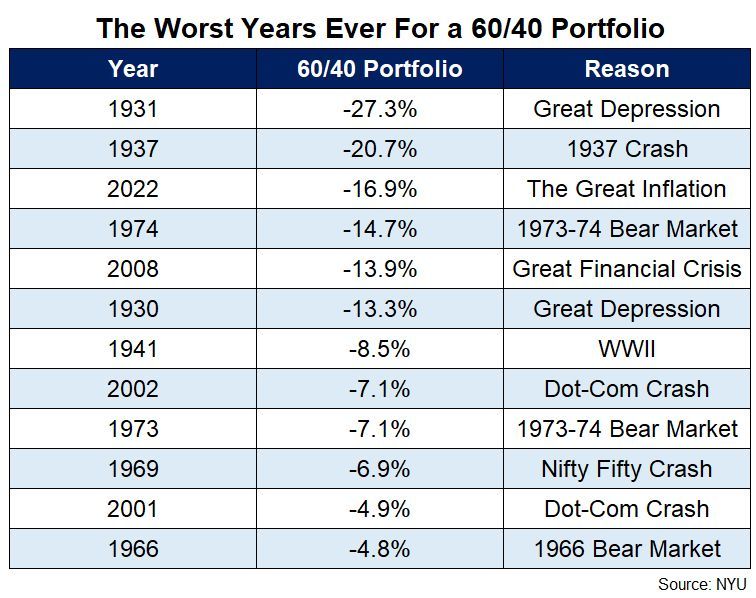

Boring Investing Still Works

"Introducing more complexity into your portfolio can make it much harder to manage. The fees are higher, they’re more illiquid, it’s harder to rebalance, and there isn’t nearly as much transparency." Source: Ritholtz @RitholtzWealth NYU

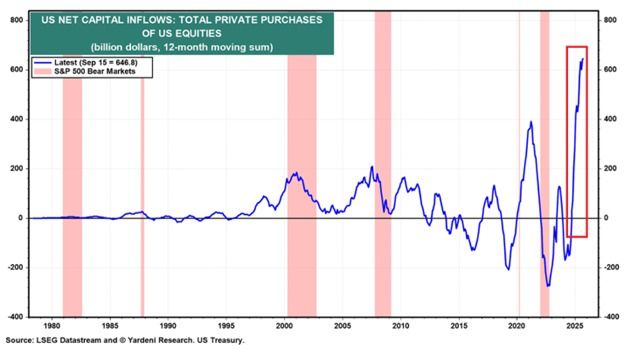

Foreign investors are buying US equities at a record pace:

Private investors outside the US purchased a record +$646.8 billion of US equities in the 12 months ending in September 2025. Purchases have doubled since the start of the year. This is now 66% ABOVE the+$390.0 billion high seen in 2021. Meanwhile, foreign private-investor purchases of US Treasuries were +$492.7 billion during the same period. Rolling 12-month non-US buying of Treasuries has remained above +$400 billion for 4 straight years. Source: The Kobeissi Letter

Retail investors and Quants dominate US stocks trading

Source: Empirical research, RBC

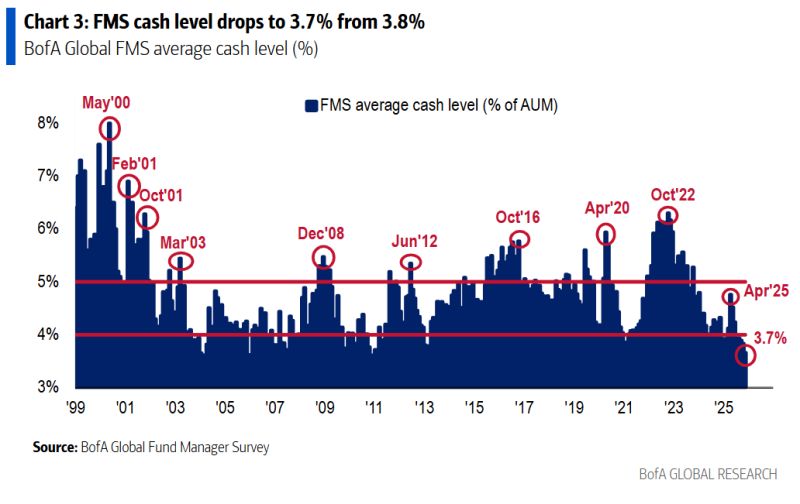

Investors are holding one of the lowest proportions of cash in modern history:

November BofA global fund manager survey. "Cash levels of 3.7% or lower has occurred 20 times since 2002, & on every occasion stocks fell and Treasuries outperformed in the following 1-3 months:" BofA

This is Historic: Retail investors own the risk.

Households are holding a record 52% in equities, up from 25% after 2008. That’s above every cycle before it. Source: Goldman Sachs, zerohedge

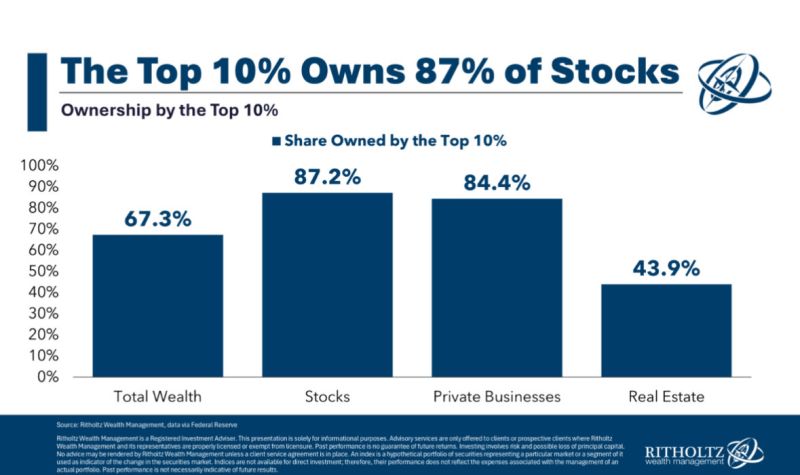

The "K-shaped" economy in one chart...

The top 10% of American households own 87% of all stocks, nearly 85% of all private businesses and 44% of Real Estate Another way of looking at this: The bottom 90% increasingly don’t matter in official economic data Source: Amy Nixon @texasrunnerDFW

Investing with intelligence

Our latest research, commentary and market outlooks