Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Some thoughts by Ray Dalio on the Big Beautiful Bill

"Now that the budget bill has passed Congress, we can see what the projections look like for deficits, government debt, and debt service expenses. In brief, the bill is expected to lead to spending of about $7 trillion a year with inflows of about $5 trillion a year, so the debt, which is now about 6x of the money taken in, 100 percent of GDP, and about $230,000 per American family, will rise over ten years to about 7.5x the money taken in, 130 percent of GDP, and $425,000 per family. That will increase interest and principal payments on the debt from about $10 trillion ($1 trillion in interest, $9 trillion in principal) to about $18 trillion (of which $2 trillion is interest payments), which will lead to either a big squeezing out (and cutting off) of spending and/or unimaginable tax increases, or a lot of printing and devaluing of money and pushing interest rates to unattractively low levels. This printing and devaluing is not good for those holding bonds as a storehold of wealth, and what’s bad for bonds and US credit markets is bad for everyone because the US Treasury market is the backbone of all capital markets, which are the backbones of our economic and social conditions. Unless this path is soon rectified to bring the budget deficit from roughly 7% of GDP to about 3% by making adjustments to spending, taxes, and interest rates, big, painful disruptions will likely occur".

BREAKING

🔴 Donald Trump has secured passage of his flagship tax and spending legislation after the House of Representatives approved the bill, handing the US president a political triumph six months into his second term ✅ ▶️ The 218 to 214 vote by the House on Thursday came after Democratic minority leader Hakeem Jeffries spoke against what he called the “ugly” legislation for a record eight hours and 44 minutes, in a symbolic act of defiance. ▶️The House’s approval came hours after the president quashed a rebellion among House Republicans who threatened to hold up what Trump calls his “big, beautiful bill”. ▶️ The president would sign the bill into law at 5pm on Friday in Washington, according to White House press secretary Karoline Leavitt, meeting his self-imposed deadline of July 4. ▶️ The legislation extends vast tax cuts from Trump’s first administration, paid for in part by steep cuts to Medicaid, the public health insurance scheme for low-income and disabled Americans, and other social welfare programmes. ▶️ The bill will also roll back Biden-era tax credits for clean energy, while scaling up investment in the military and funds for Trump’s crackdown on immigration. Source: FT (link to the article ▶️ https://lnkd.in/errs6gtu)

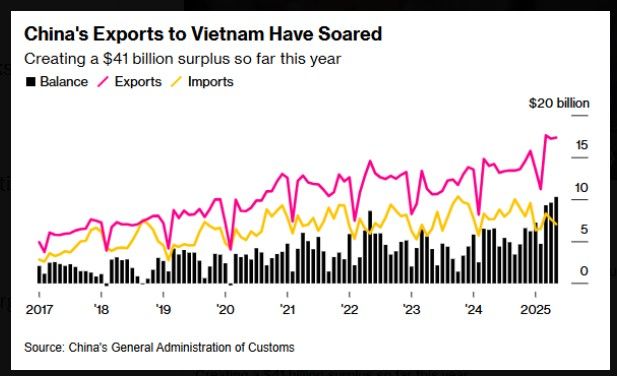

Beijing Braces for US Trade Deals That Aim to Shut Out China - Bloomberg

The US-Vietnam trade deal is aimed at isolating China primarily by targeting the use of Chinese components in goods exported from Vietnam to the US. The deal imposes a tiered tariff system where Vietnamese exports containing Chinese inputs face higher tariffs—20% generally, and up to 40% on goods suspected of being transshipped from China through Vietnam with minimal processing. This is designed to prevent Chinese products from bypassing US tariffs by routing them through Vietnam, a practice that increased after earlier US-China trade tensions led companies to relocate production to Vietnam. The US strategy behind this deal is part of a broader effort to reshape global supply chains into "trusted" networks that exclude Chinese firms and reduce China's role in international trade. The Trump administration has pushed trading partners like Vietnam to cut back on imports from China and control their supply chains more tightly to avoid facilitating Chinese goods entering the US market indirectly.

Vietnam is to pay 20% tariffs on all goods sent to the US. Meanwhile, the US will get total access to the Vietnamese markets - they can sell US products there for 0% tariffs.

Moreover, the US will charge Vietnam a 40% tariff on 'any transhipping', a steep levy that could rattle countries still hoping to secure significant relief from Trump’s 'liberation day' tariffs. Source: FT

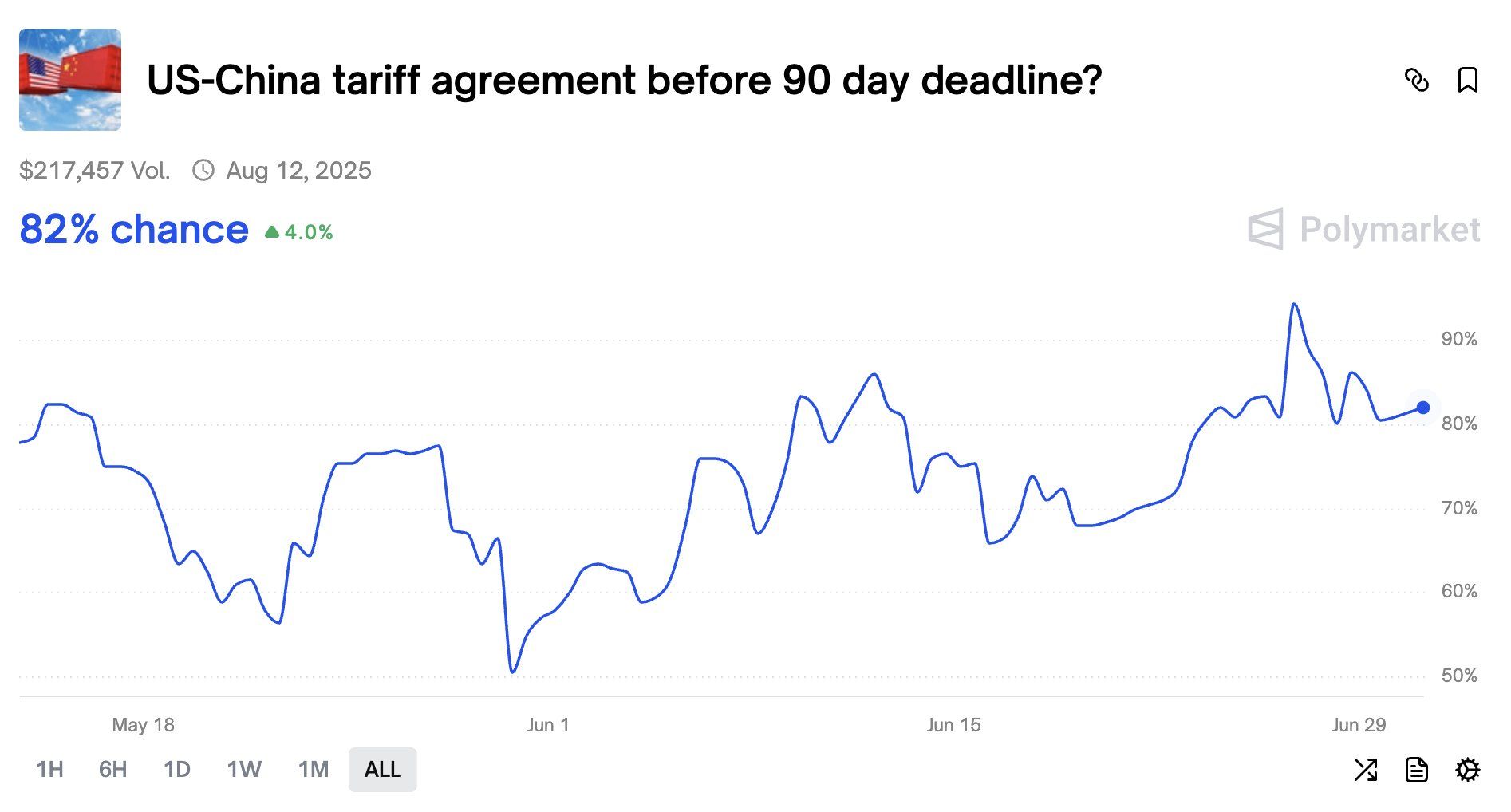

ALERT: There’s only 8 days remaining until the tariff negotiation deadline

Betting markets are placing an 82% chance of US-China reaching an agreement before that deadline. Source: Bravos Research

President Donald Trump expressed frustration with U.S.-Japan trade negotiations

This occurred on Monday as Treasury Secretary Scott Bessent warned that countries could be notified of sharply higher tariffs as a July 9 deadline approaches despite good-faith negotiations. Trump wrote in a social media post that Japan's reluctance to import American-grown rice was a sign that countries have become "spoiled with respect to the United States of America." "I have great respect for Japan, they won't take our RICE, and yet they have a massive rice shortage," Trump wrote on Truth Social. "We'll just be sending them a letter, and we love having them as a Trading Partner for many years to come." Trump said last week that his administration would send letters to a number of countries notifying them of their higher tariff rates before July 9, when tariff rates are scheduled to revert from a temporary 10% level to his suspended rates of 11% to 50% announced on April 2. Trump's Monday complaint about U.S.-Japan rice trade follows his comments broadcast on Sunday that Japan engages in "unfair" autos trade with the U.S. Source: Reuters, FT

Treasury Secretary Scott Bessent asked Republicans in Congress on Thursday to remove the so-called “revenge tax” from President Trump’s “big, beautiful” bill

The provision would grant Trump the authority to tax foreign holdings of US investments as a way to retaliate against countries imposing new taxes on US companies operating overseas. Bessent argued that the provision, known as Section 899, was no longer necessary after the Trump administration reached a deal with G7 nations at last week’s summit to exempt US companies from a 15% global corporate minimum tax championed by the Biden administration. “After months of productive dialogue with other countries on the OECD Global Tax Deal, we will announce a joint understanding among G7 countries that defends American interests,” the Treasury secretary wrote on X. “President Trump paved the way for this historic achievement.” Source: New York Post

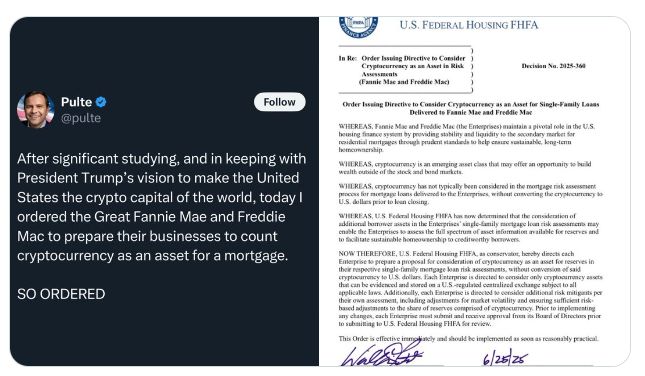

BREAKING: US Federal Housing Finance Agency orders Fannie Mae and Freddie Mac to count Bitcoin & crypto as an asset when assessing mortgage eligibility.

Source: Bitcoin Archive @BTC_Archive

Investing with intelligence

Our latest research, commentary and market outlooks