Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

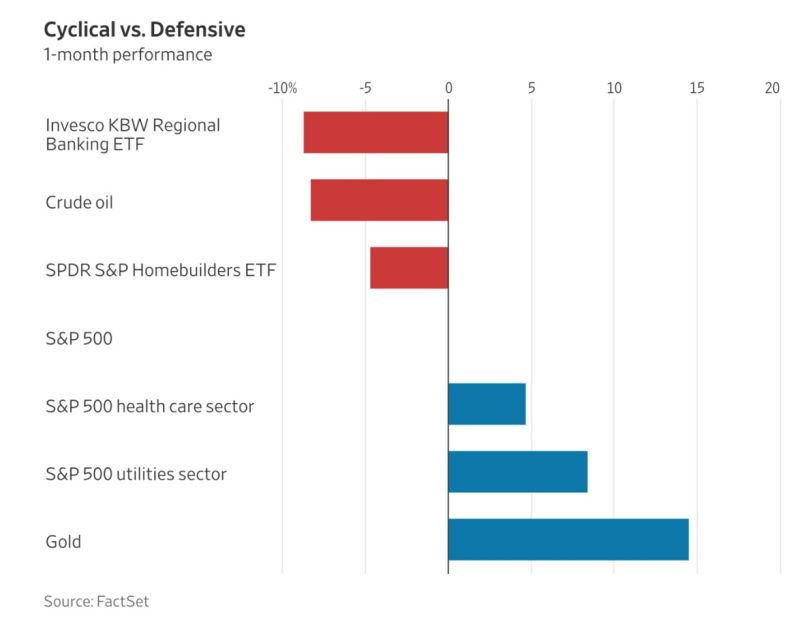

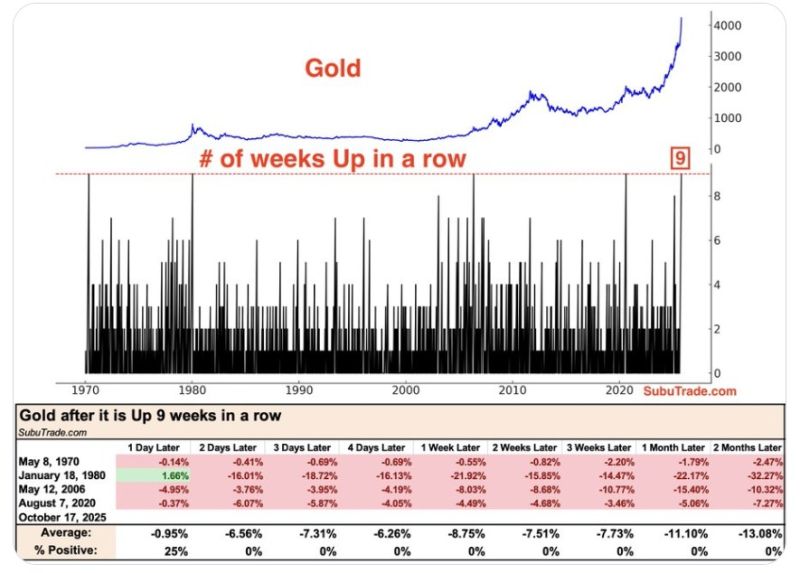

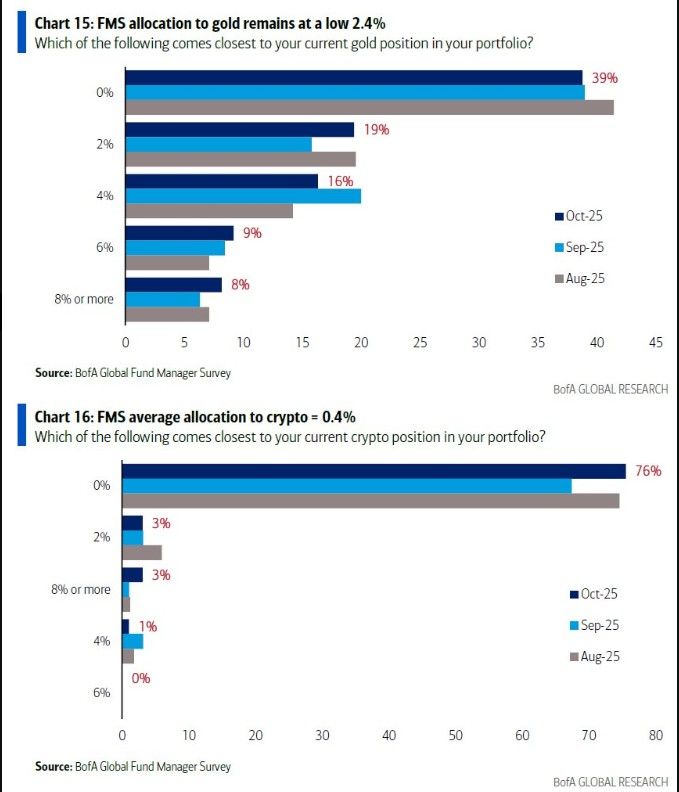

Gold is Up 9 weeks in a row.

Gold has never gone up 10 weeks in a row before. Source: Subu Trade on X

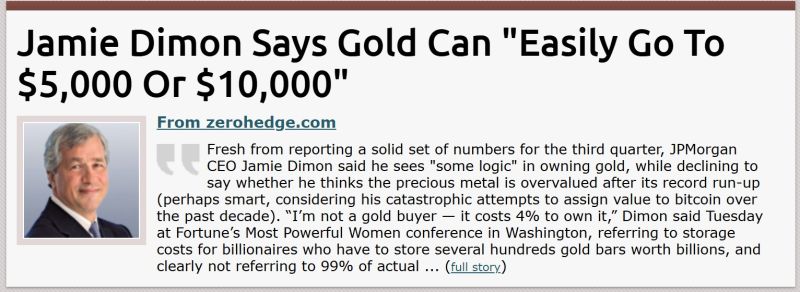

I’m not a gold buyer, it costs 4% to own it,”

Dimon said Tuesday at Fortune’s Most Powerful Women conference in Washington, referring to storage costs for billionaires who have to store several hundreds gold bars worth billions, and clearly not referring to 99% of actual gold buyers who own a little gold at home and which costs them 0% to own it. That said, Dimon admitted that gold “could easily go to $5,000, $10,000 in environments like this. This is one of the few times in my life it’s semi-rational to have some in your portfolio.” Source: zerohedge, metals mine

$GLD Gold Trust ETFD just broke out of a 5-year cup & handle vs $SPY S&P 500 index ETF.

COVID highs are now in sight. Source: Trend Spider

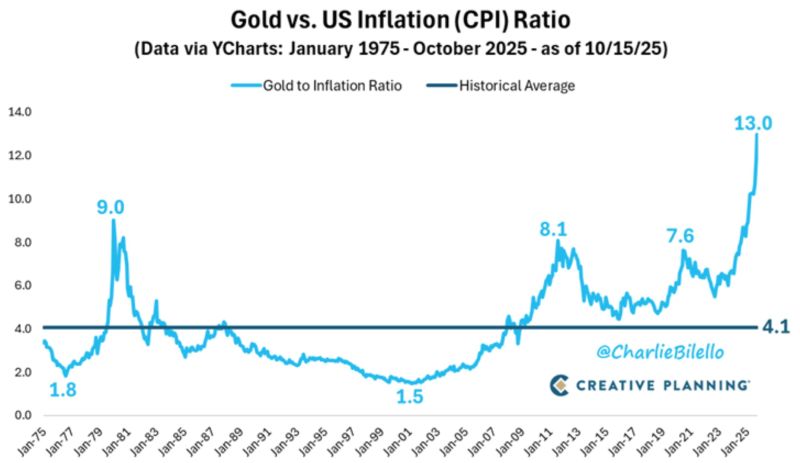

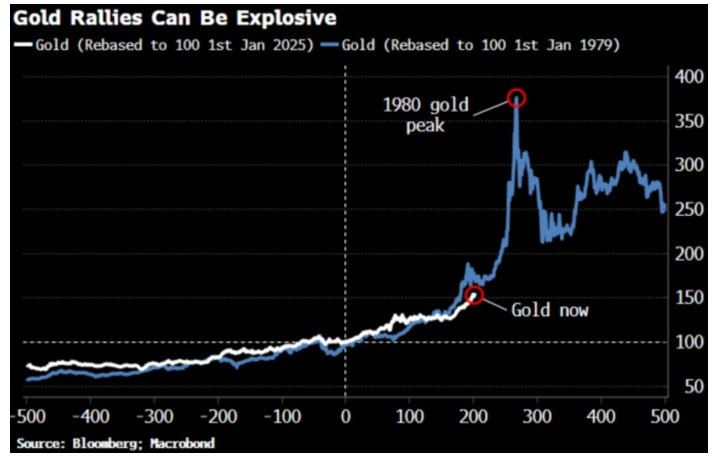

Relative to inflation, Gold has never been higher than it is today. 13x vs. 9x at the peak in 1980.

Source: Charlie Bilello

Will gold rally be as explosive as the one in the 80s ???

Source: Macrobond, Bloomberg, Incrementum AG

Investing with intelligence

Our latest research, commentary and market outlooks