Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

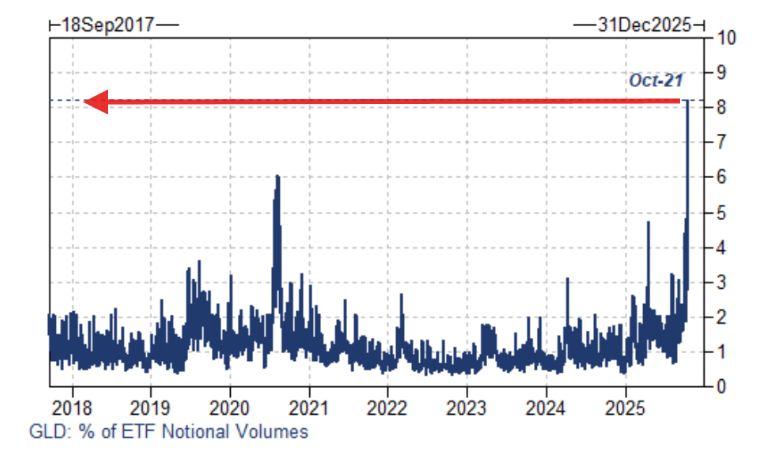

Goldman on gold's Tuesday flush:

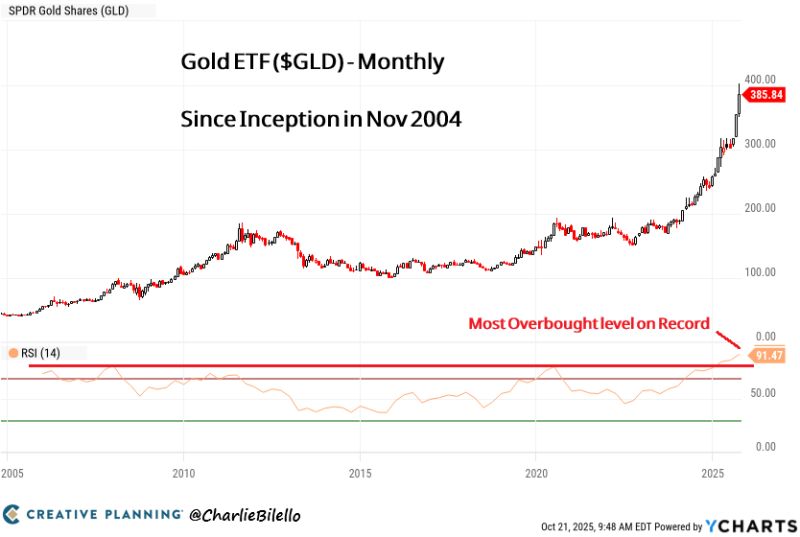

"The best answer we have for the largest % move in 10 years is (simply) positioning, and that we’ve rallied for 9 consecutive weeks. The ease of trading an ETF for quick exposure has been on full display; as of [Tuesday's] close $GLD accounted for 8% of all notional US-listed ETF volumes, its largest share of activity in our dataset. Flows on the ETF desks skewed (unsurprisingly) strongly better for sale today". Source: Neil Sethi

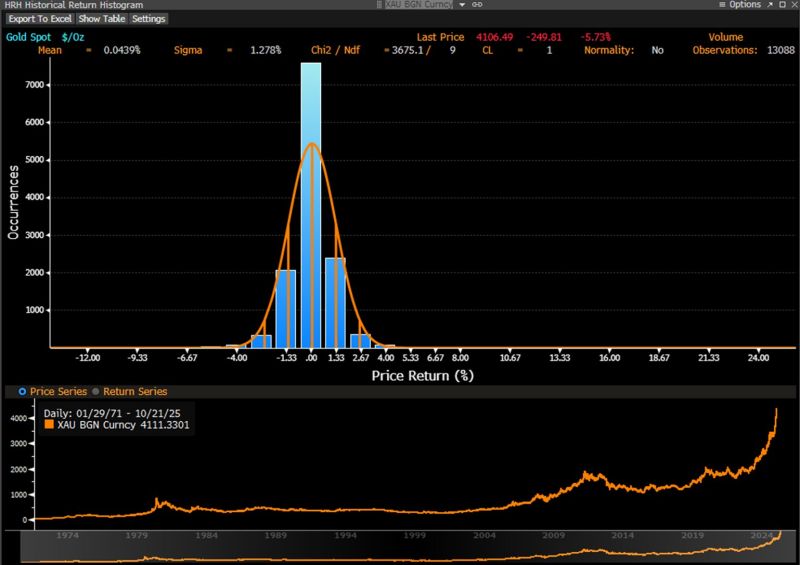

Gold is giving us a lesson in statistics. Yesterday's −5.7% move is a rare 4.46-sigma move.

In a “normal” world, that’s once every 240,000 trading days. In reality −4.67% to −6.00% occurred 34 times since 1971, i.e. in 13,088 trading days (0.26% = 1 in 385 days). Even bigger drawdowns happened 21 times since 1971. Message: Gold is NOT low-vol. FOMO caused the latest leg up. Now, profit taking and weak hands got shaken out. Means? Statistically speaking, chances are that calmer days are ahead. Source: Alexander Stahel 🌻@BurggrabenH on X

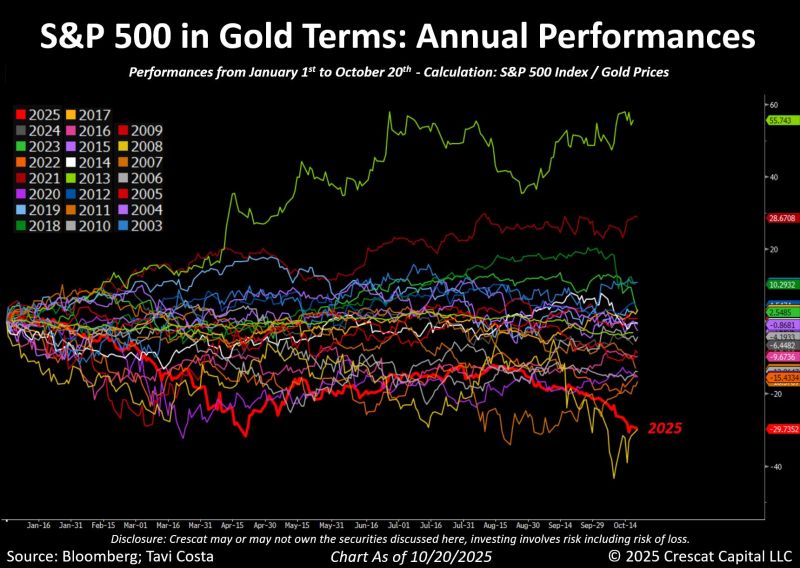

In gold terms, the S&P 500 is down nearly 30% so far this year.

The decline is about to surpass 2008 as the worst year for the index in gold terms in over two decades. Source: Tavi Costa, Bloomberg

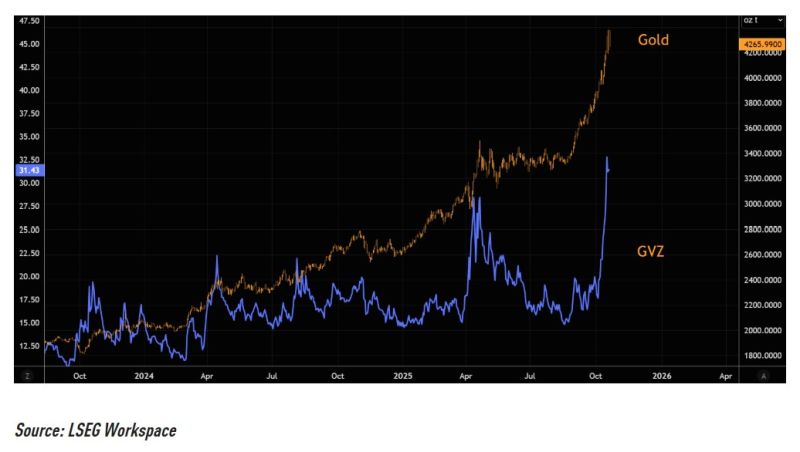

The Short Term Risk For Gold

Gold volatility, GVZ, has exploded to the upside. Everybody underexposed to gold has grabbed calls with both hands, pushing volatilities to extremes. Theta is painfully expensive up here. Once gold pauses or reverses, this could turn into a major headwind. Source: The Market Ear

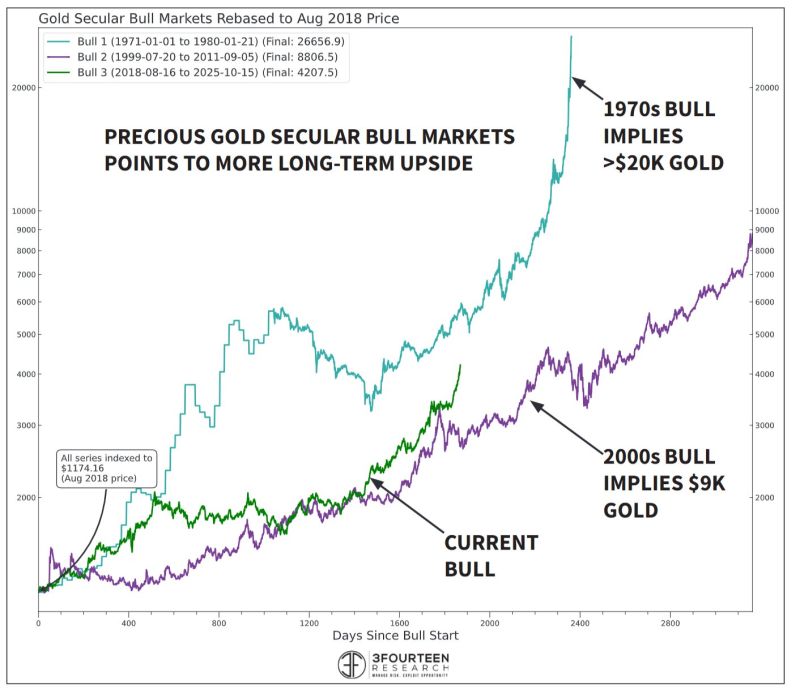

The long-term potential for GOLD

The current gold secular bull market tracking higher than the early-2000s move and lower than the 1970s bull. Source: @3F_Research, Warren Pies This is not an investment

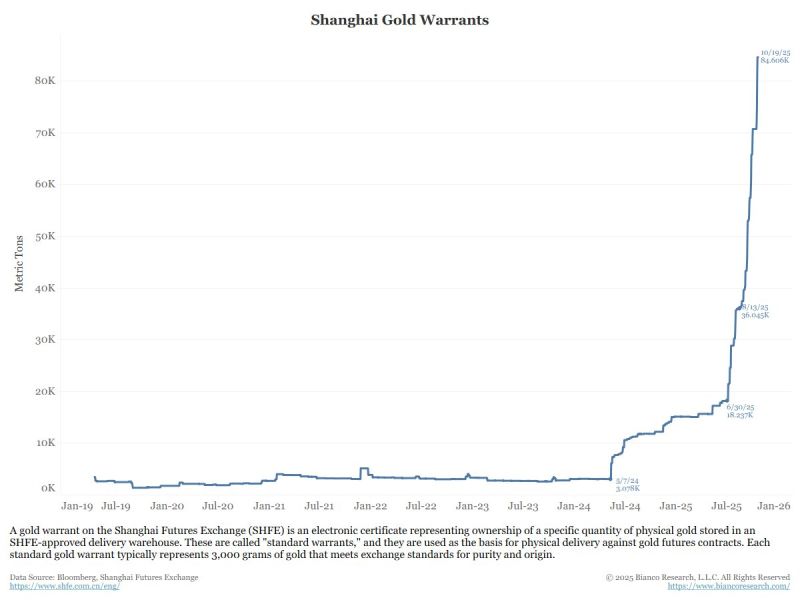

China is remonetizing gold

Gold Warrants on the Shanghai futures exchange are UP 25x since the beginning if the year. What is a Gold Warrant? A gold warrant on the Shanghai Futures Exchange (SHFE) is an electronic certificate representing ownership of a specific quantity of physical gold stored in an SHFE-approved delivery warehouse. They are used as the basis for physical delivery against gold futures contracts. Each standard gold warrant typically represents 3,000 grams of gold that meets exchange standards for purity and origin. Why are they surging? Shanghai gold warrants are surging due to a combination of record-breaking safe-haven demand, robust central bank gold purchases (notably by the People’s Bank of China), and intense price volatility driving investor and arbitrage activity. Source: Jim Bianco, @AndreasSteno

Investing with intelligence

Our latest research, commentary and market outlooks