Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold reaches most overbought level in history after hitting 91.8 on the monthly RSI

Source: Barchart

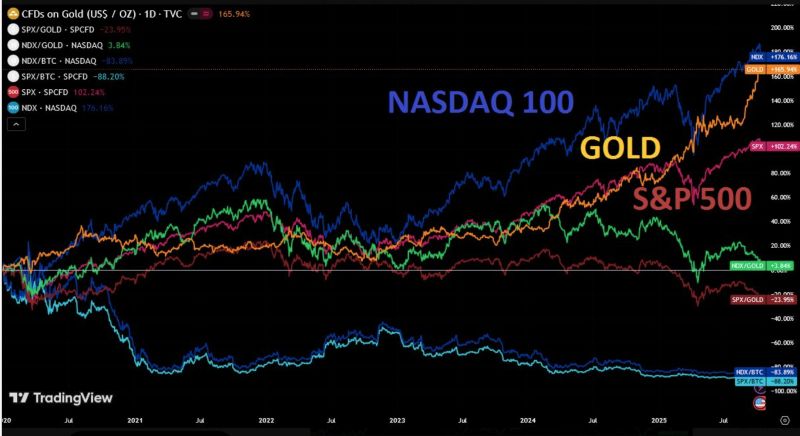

The "debasement trade", the decline in the purchasing power of USD, in one chart since 2020:

Bitcoin: +1400% Silver: +182% Nasdaq 100: +176% Gold: +166% S&P 500: +102% In gold: NDX +4%, SPX -24% In Bitcoin: NDX -84%, SPX -89% Source: Global Markets Investor @GlobalMktObserv

Mighty Dollar...

The dollar index $DXY is taking out range highs, closing well above the 50 and the 100 day moving averages. We haven't seen the DXY close "properly" above the 100 day since the dollar bear started earlier this year. Not good short term news for the gold and precious metals space. Source: The Market Ear

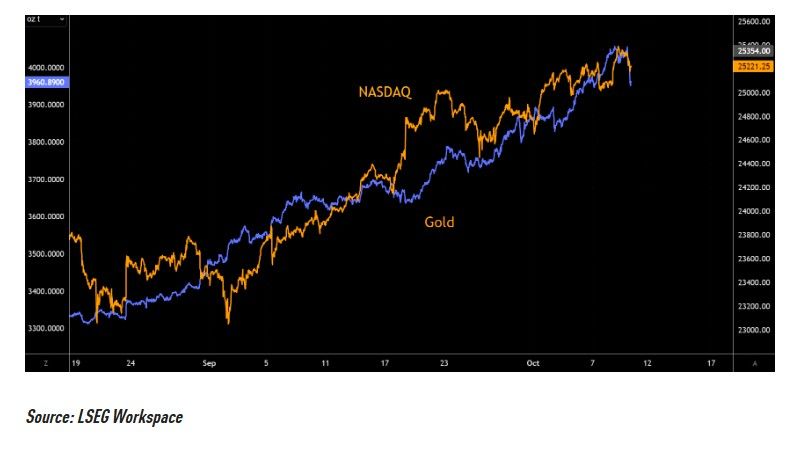

Same same... Below is a 30 min chart of the Nasdaq index and gold since September....

Stocks and gold have moved in close tandem over the past weeks when the last squeeze started. Slightly illogical given the fact gold is, at least partly, a fear hedge. It could be that the same short term money is just chasing momentum, irrespective of "logic". Source: The Market Ear

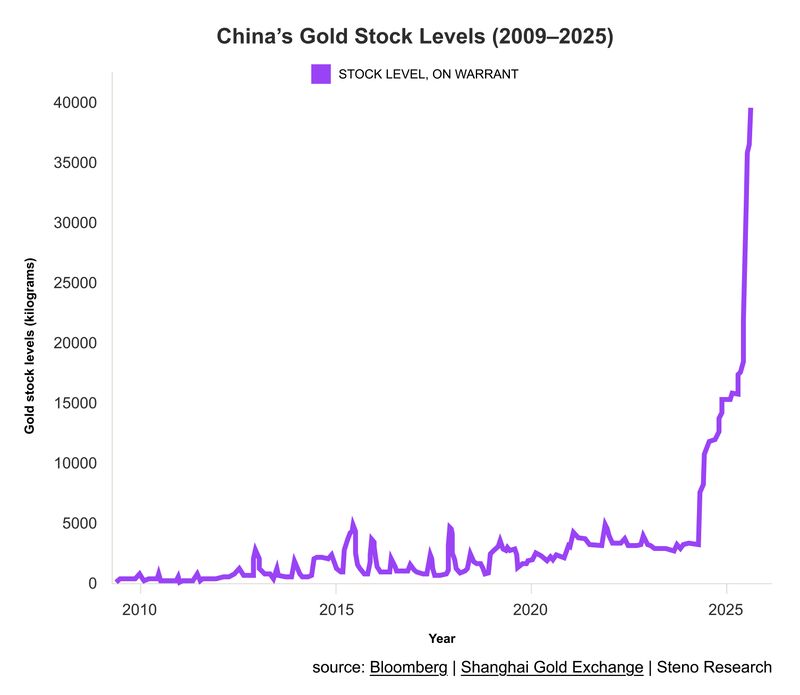

When geopolitical & socio-economic tensions rise, both people & nations turn to hard assets.

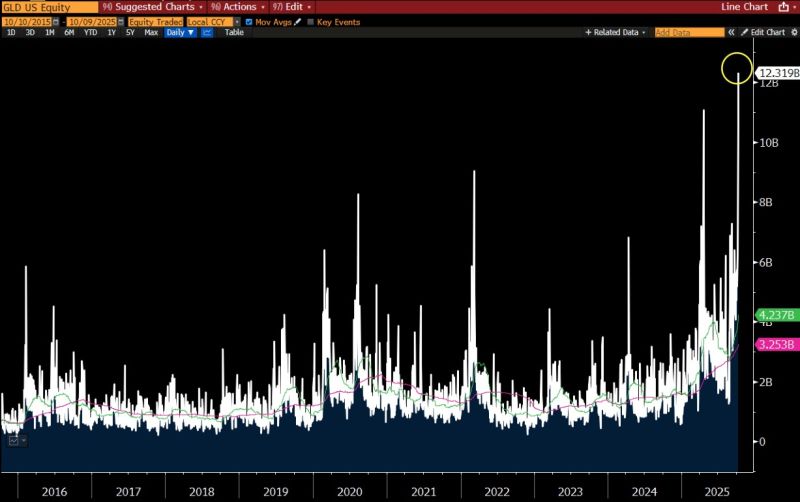

One big buyer in particular has been Beijing. China has been swapping Treasuries for gold for years, lifting reserves to over 74m ounces. 👉 This is a reflection of both state policy and popular sentiment: hedging against dollar risk, sanctions, and China’s own shaky property and stock markets. Source: Chamath Palihapitiya @chamath, Steno Research, Bloomberg

Gold is now above $4,000/oz, and who would’ve thought silver would remain this cheap relative to gold?

Source: Tavi Costa, Macro Trends

Investing with intelligence

Our latest research, commentary and market outlooks