Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Gold's long-term correlation with the S&P 500 has just reached an extremely high level, only seen in...August 2007.

Source: Guilherme Tavares i3 invest

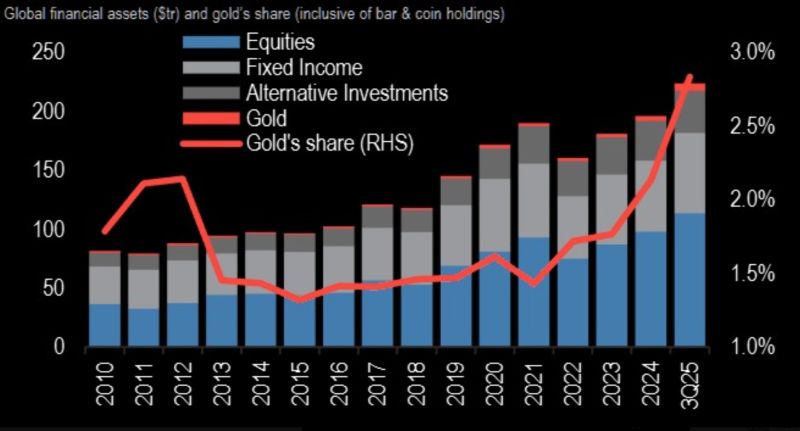

Gold is only 2.8% of investor AUM... imagine 4–5%.

Source: The Market Ear

Gold is on pace for its best year since 1979, up over 60% in 2025.

Source: Charlie Bilello

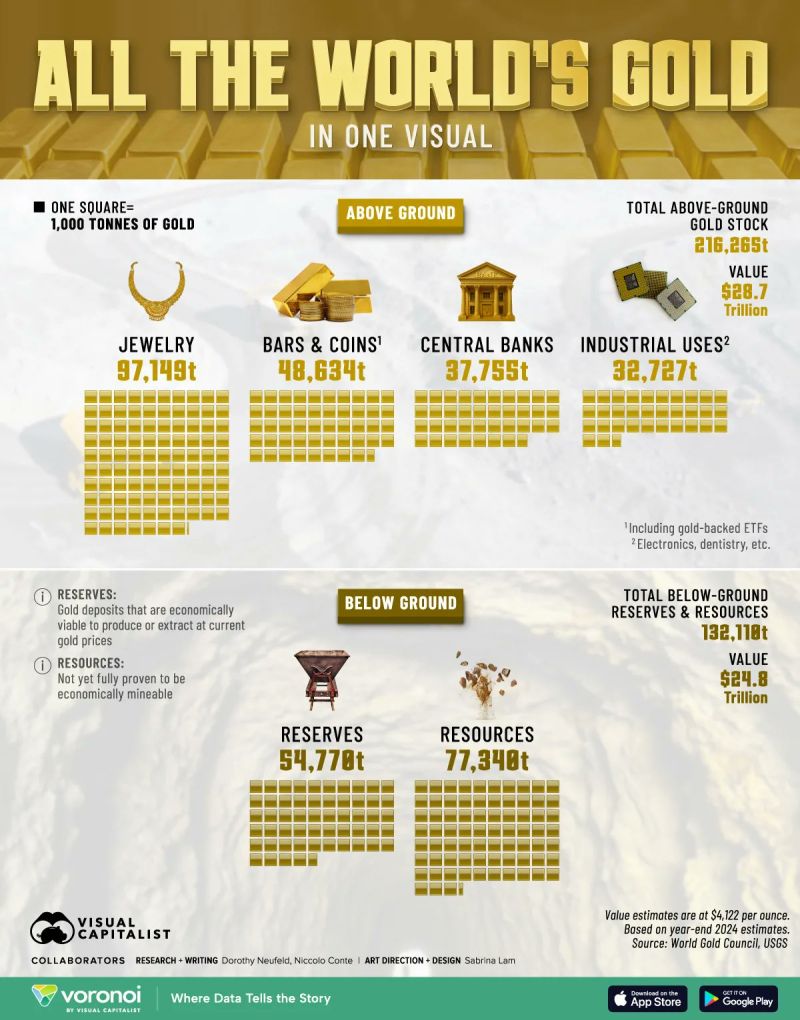

All the world's gold, in one visual

There are 216,265 tonnes of gold above ground… and another 132,118 tonnes still waiting below Where is it all? Jewelry: 97,149t Central Banks: 37,755t Industry & Tech: 32,727t Bars & Coins: 48,634t Source: ⚡️AIGOLD⚡️ @AIGOLDOfficial

Gold loves rising Japanese rates.

This remains a massive driver of the shiny metal, despite few talking about it on a daily basis. Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks