Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

This looks like a very strong trend

Japanese 10-year government bond yield hit 2.07%, the highest since the 1990s. Gold prices hit a record $4,440, rising +68% year-to-date. Finally, silver prices surpassed $66 per ounce for the first time in history, now up +134% year-to-date. When will it end? Source: Global Markets Investor

JUST IN 🚨: Gold hits $4,400 for the first time in history 📈📈

Source: Barchart

🔥Gold and silver are moving almost perfectly in line with Japanese government bond yields:

Japan's 10-year government bond yield has risen roughly 1.5 percentage points since the beginning of 2023, reaching 1.98%, the highest level since the 1990s. During this same period, gold and silver prices have skyrocketed by 135% and 175%, respectively. Are precious metals being used as a primary hedge against the rising cost of government debt? Source: Global Markets Investor

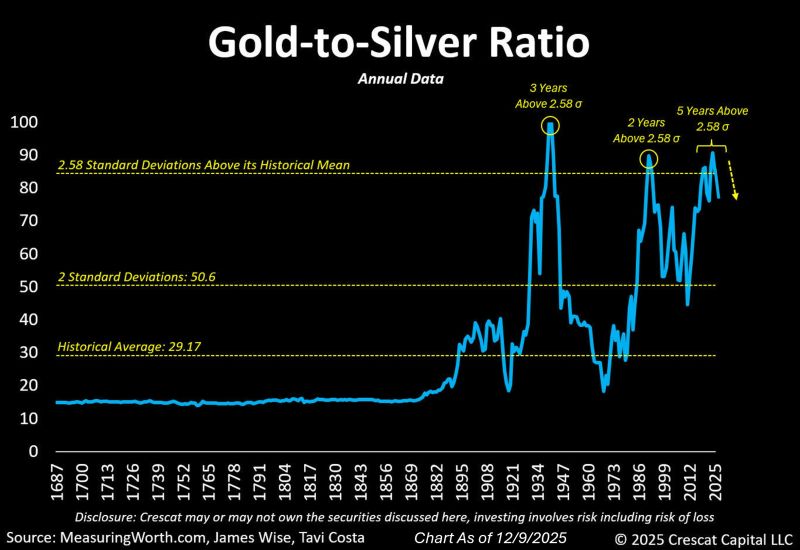

The gold-to-silver ratio is starting to move abruptly, as it often does after reaching extremely elevated levels.

Source: Tavi Costa

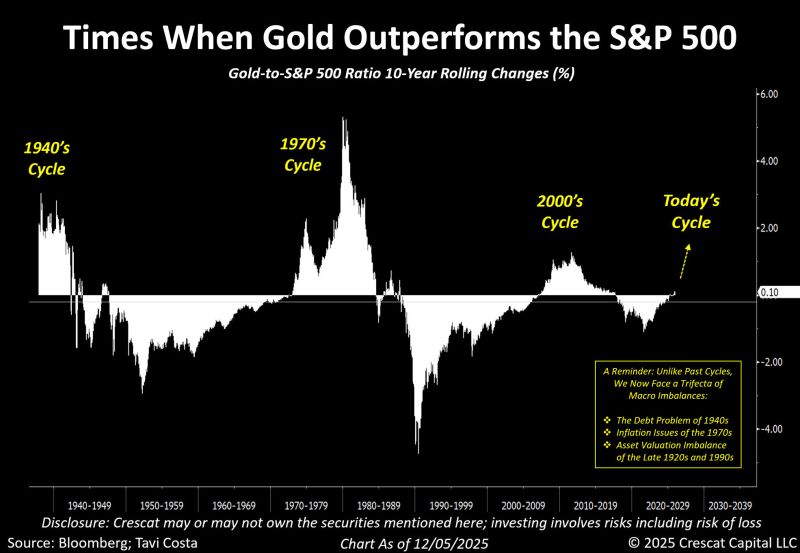

Gold relative to S&P 500: are we just at the start of the cycle?

A fascinating chart by Otavio (Tavi) Costa Gold relative performance dynamic follows very long-term cycles, and we’re likely only in the early stages of this one. As Tavi points out, we now face a trifecta of macro imbalances: ▪️The Debt Problem of the 1940s ▪️Inflation Issues of the 1970s ▪️Asset Valuation Imbalance of the Late 1920s and 1990s Source: Bloomberg, Crescat Capital

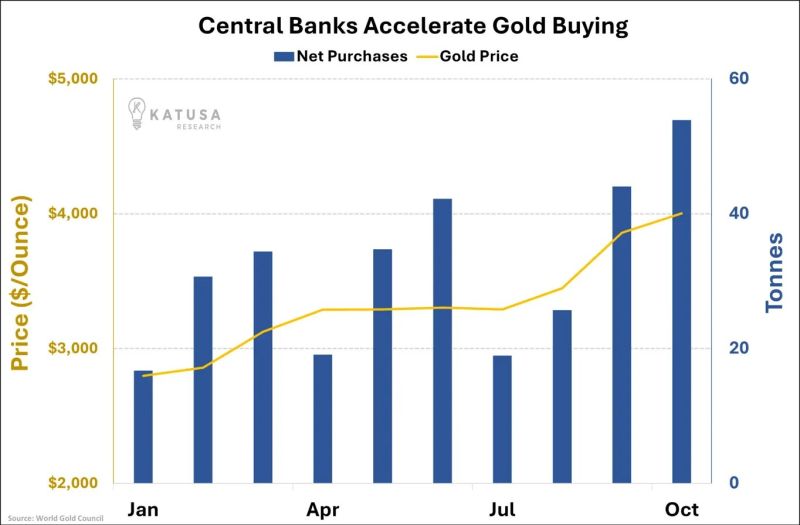

This chart destroys every "gold is too expensive" argument

They were buying 20 tonnes when gold was at $3,000. Now they're buying 55 tonnes at $4,000. Source: Katusa Research @KatusaResearch

Investing with intelligence

Our latest research, commentary and market outlooks