Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The next 24 hours could be extremely volatile! supreme court tariff ruling is expected today at 10:00 am et

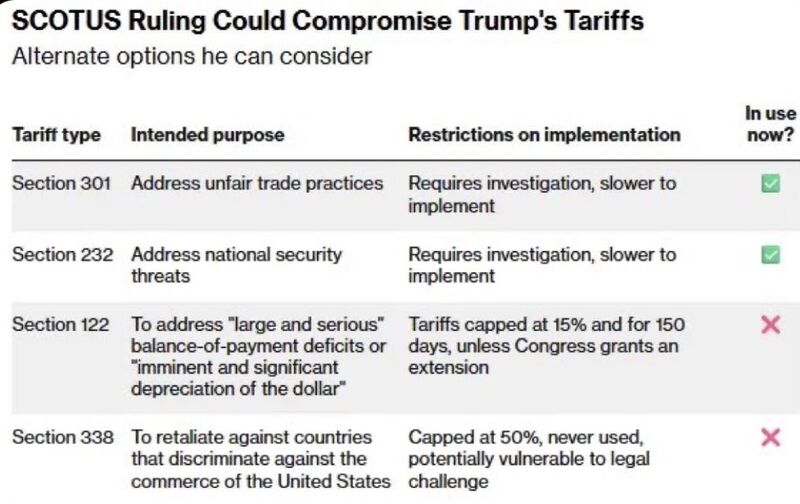

Markets price a 71% chance that courts rule Trump’s tariffs illegal, raising the prospect of $600B+ in refunds and significant market uncertainty. A non-consensus view argues the opposite outcome is more likely: keeping the tariffs may be less disruptive than reversing them. U.S. businesses have already adapted by restructuring supply chains, repricing goods, and adjusting investment plans, so a sudden rollback could punish those who adjusted and reward those who didn’t. Early fears of runaway inflation, collapsing earnings, and stalled growth have not materialized. Striking down the tariffs would also create legal and fiscal uncertainty around refunds and replacement measures, increasing volatility. Once embedded, tariffs function as a fiscal revenue tool, not just trade policy. Bottom line: The court may prioritize the least disruptive outcome—maintaining or modifying tariffs rather than eliminating them outright. Source: Cassian @ConvexDispatch, @BobEUnlimited

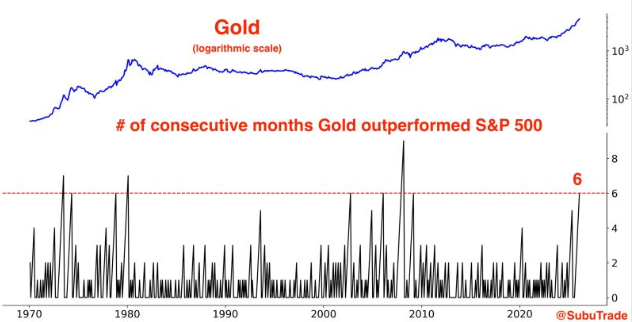

Gold has now outperformed the S&P 500 for 6 consecutive months, the longest streak since the Global Financial Crisis

Source: Barchart

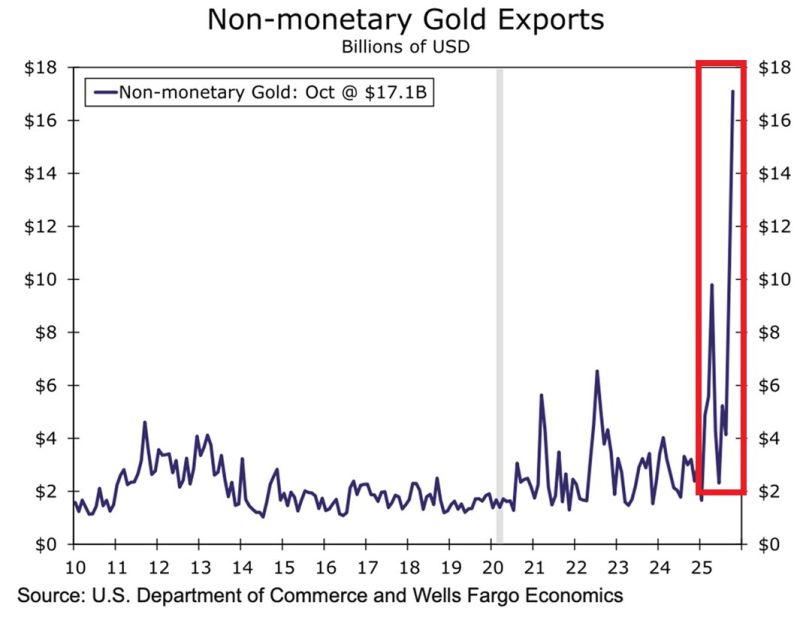

Gold is flooding out of the US at a record pace

US non-monetary gold exports surged to a record $17.1 BILLION in October. This refers to physical bullion shipped for investment, jewelry, and industrial use, not central bank reserves. This marks an unprecedented spike compared with the typical ~$1–3B monthly range over the last 15 years. The surge reflects soaring demand for hard assets as investors hedge against currency weakness, geopolitical tensions, and trade-policy uncertainty. Truly unprecedented. Source: Global Markets Investor

Gold and Silver just hit a new all-time high as the US dollar weakened after Powell accused Trump of targeting the Fed.

Now the Fed’s independence is at risk, so investors are dumping dollar and buying metals for safety hedge. The precious metal bull run still shows no signs of stopping in 2026. Source: Bull Theory @BullTheoryio

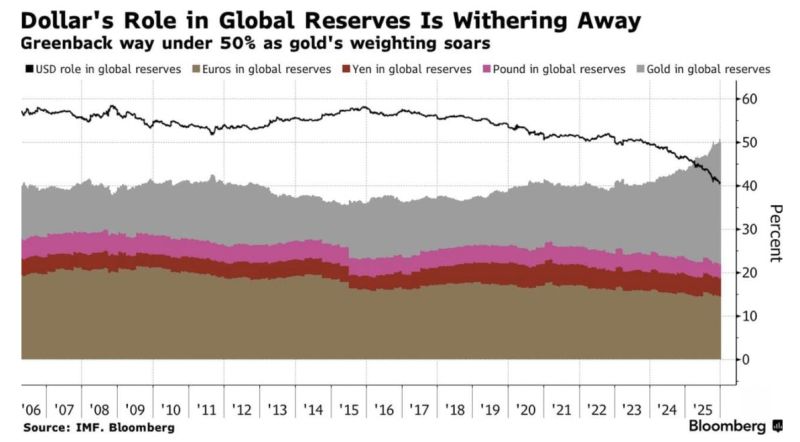

Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset 🚨🚨🚨

(of course performance helped) Source: Barchart, Bloomberg

Time to be contrarian on bitcoin?

Interesting comment by Gert van Lagen @GertvanLagen on X: $BTC / GOLD is hitting the purple downtrend on RSI for 5th time in history. 🟠Occurrences: + Bear market bottom 2011 + Bear market bottom 2015 + Bear market bottom 2018 + Bear market bottom 2022 + Bear market bottom 2025 ? Each time a higher low on BTC/GOLD was printed 🟠

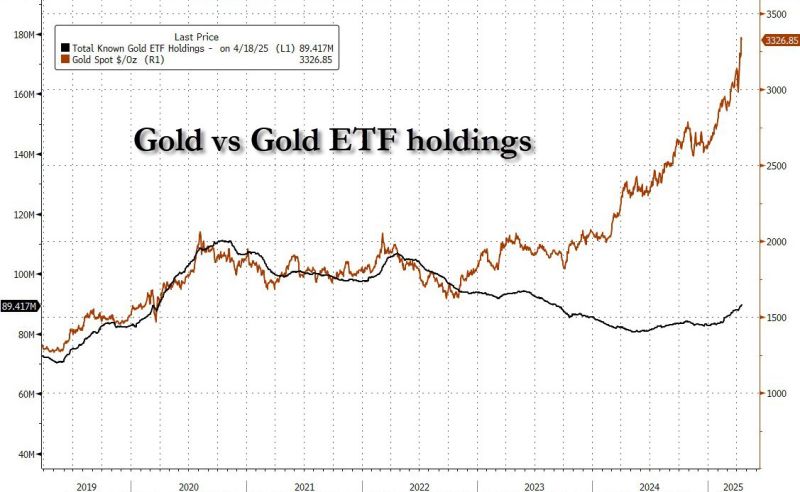

Gold just had its biggest ever ETF inflow at $8.0bn in the past week. There is just a "little" more to go for ETFs to catch up...

Source: zerohedge

BREAKING: Gold trades above $4,500 for the first time in history.

Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks