Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Did someone front run Trump's dollar announcement by going all-in gold?

At exactly 3pm, a large block of gold‑linked call (GLD) trading went through, coinciding with the sharp move higher in spot gold. In over‑the‑counter equivalent terms, a trader rolled 250k deltas out of an in‑the‑money 4,950/5,050 call spread, and into a Feb. 20 5,250/5,400 call spread, representing 1.1 mm ounces of gold exposure ($5.1BN). The client paid $30MM in net premium to implement the new structure. Source: zerohedge

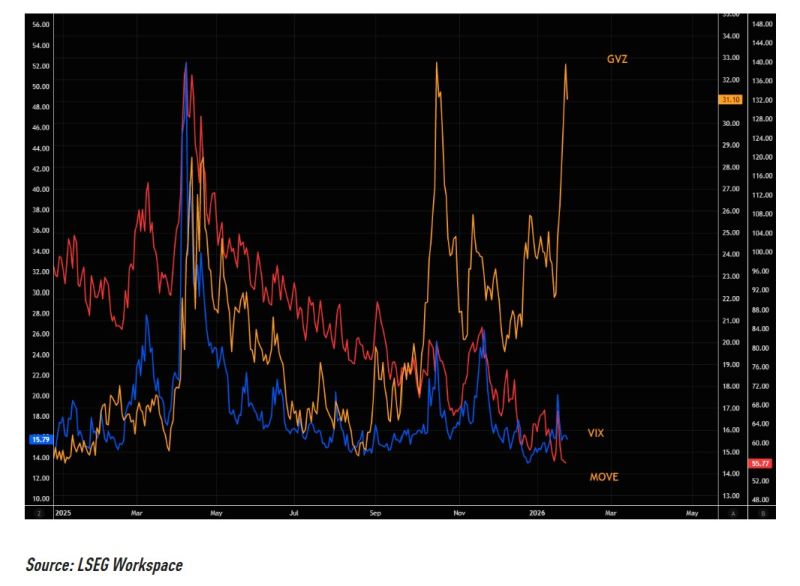

Gold volatility is now the global cross-asset volatility outlier (silver too, though that market is essentially broken for now).

Hedging “global” risk via gold volatility at these levels is very unattractive. Source: The Market Ear

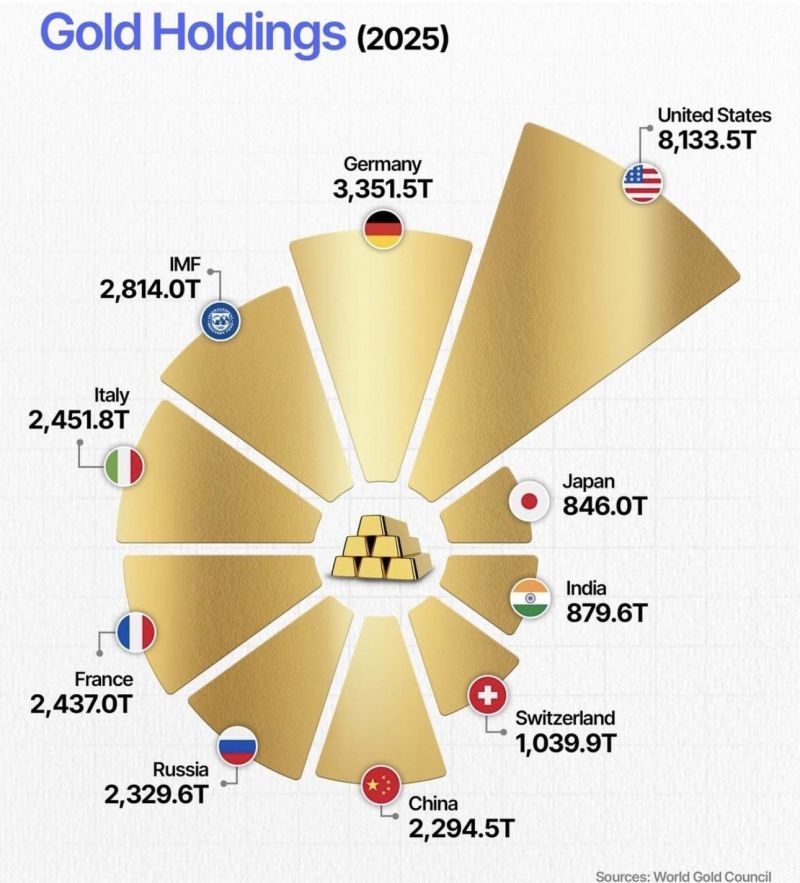

Who really holds the world’s gold?

• 🇺🇸 United States still dominates with 8,100+ tonnes • 🇩🇪 Germany remains Europe’s anchor • 🇮🇹 🇫🇷 🇷🇺 all sit around 2,300–2,450 tonnes • 🇨🇳 China keeps climbing, quietly • 🇨🇭 Switzerland punches far above its size • 🇯🇵 🇮🇳 hold far less than their economic weight

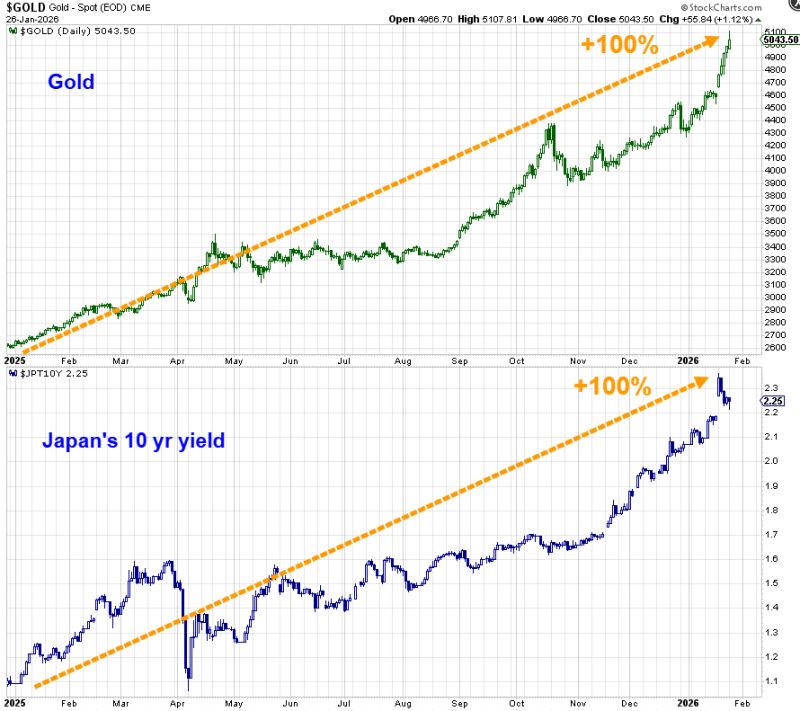

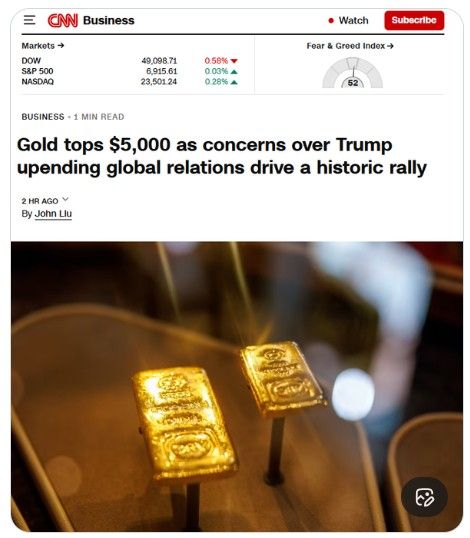

And there you have it Gold is officially trading above $5,000.

Source : Mohamed El-Erian

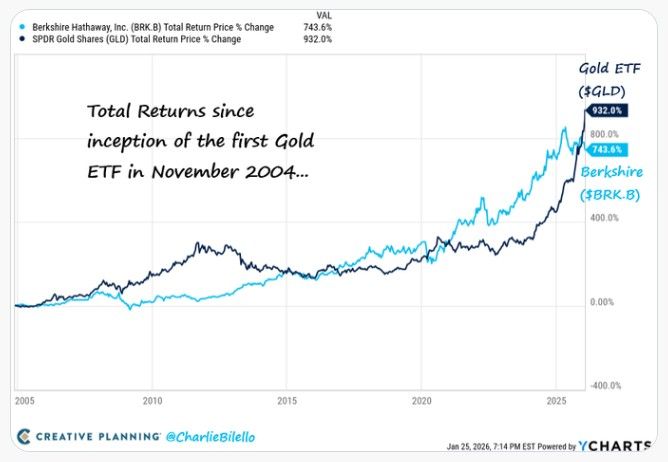

Total Returns since inception of the first Gold ETF in November 2004

Berkshire Hathaway $BRK.B: +744% Gold ETF $GLD: +932% Source: Charlie Bilello

I disagree with this headline from CNN

Gold is not rising because of Trump. It is rising because the US has $39 trillion in debt, $2 trillion in annual deficits, 25% of tax revenue goes to interest payments and Congress refuses to stop. They thus need to go through monetary debasement. This is not a bug. It is a feature of the system. And store of values are one of the way to protect purchasing power. By the way, Europe and Japan have similar debt and spending problems. Gold is at record highs against every currency, not just the dollar. Source: Wall Street Mav

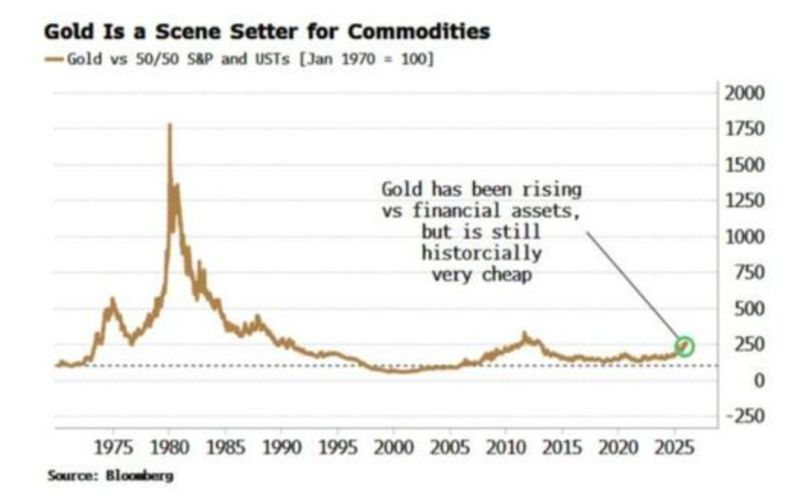

A shocking chart while Gold is flirting with $5,000/oz, it remains historically undervalued versus a 50/50 (S&P 500 / US Treasuries) portfolio

Source: Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks