Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

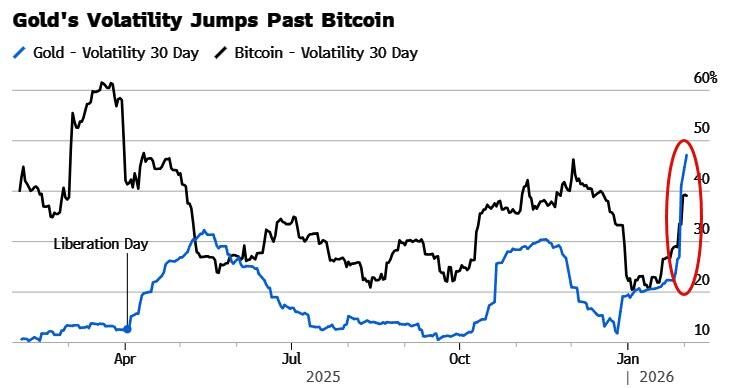

30-day realized vol in gold has climbed above 44%, the highest level since the 2008 financial crisis, according to data compiled by Bloomberg.

That surpasses the roughly 39% for Bitcoin, the original cryptocurrency often dubbed “digital gold.” Since Bitcoin’s creation 17 years ago, gold has only been more volatile on two occasions, most recently last May during a flare-up in trade tensions sparked by President Trump's tariff threats. Source: Bloomberg, www.zerohedge.com

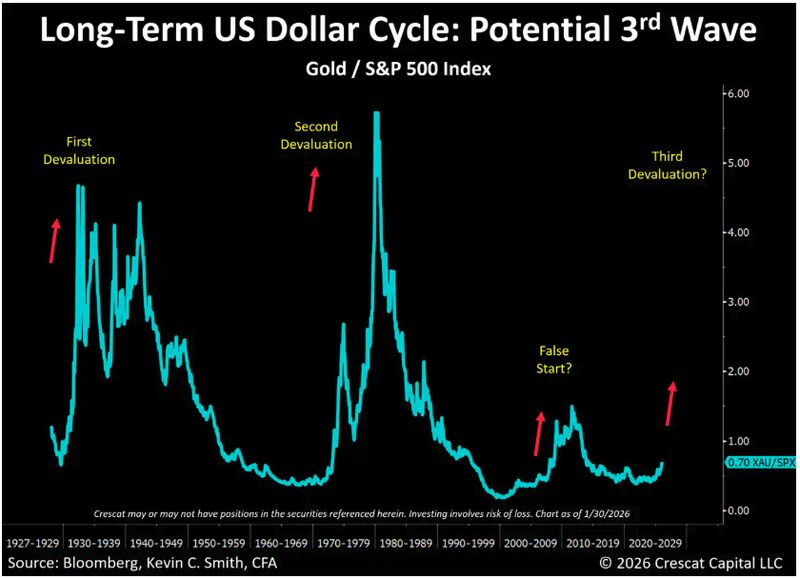

THIRD WAVE OF THE US DOLLAR CYCLE

Interesting comment by Crescat Capital: ‘We think the gold panic on Friday on the announcement of Kevin Warsh as the new Fed Chair caused a healthy pullback from short-term overbought conditions in the precious metals markets. While Warsh may appear the least dovish among President Trump’s candidates, we believe he is indeed in favor of lowering interest rates in 2026, as the President has also affirmed. Investors in Crescat’s portfolio of undervalued precious and critical metals miners should not be too concerned. Our activist mining portfolio outperformed gold, silver, and the gold equity benchmarks, both on Friday and cumulatively for the month of January. Still, the gold correction was no small matter. We think it presents a buying opportunity. In fact, now, as much as ever, is the time for gold investors not to panic but to step back and look at the big picture’. Source: Crescat Capital

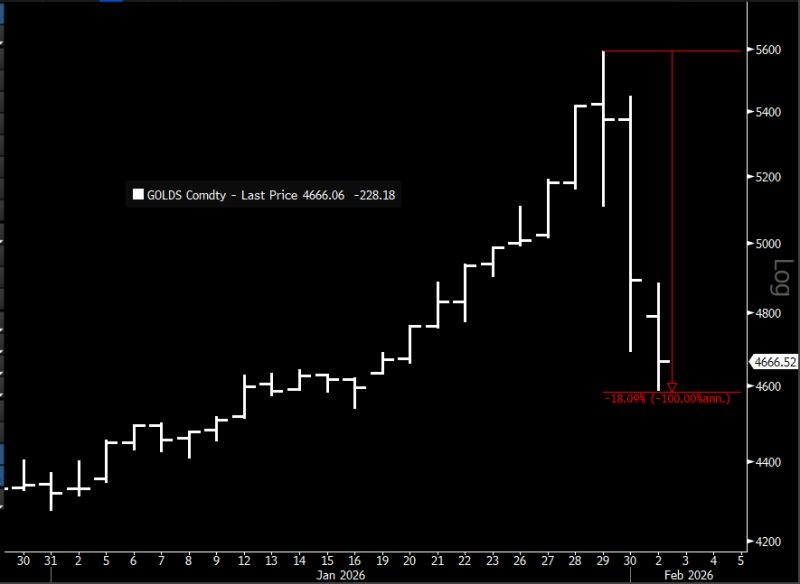

No bounce... pickup up where we left off on Friday.

*SPOT GOLD FALLS 5%, ADDING TO BIGGEST PLUNGE IN OVER A DECADE (Down 18% from Thursday's high) Source: Jim Bianco

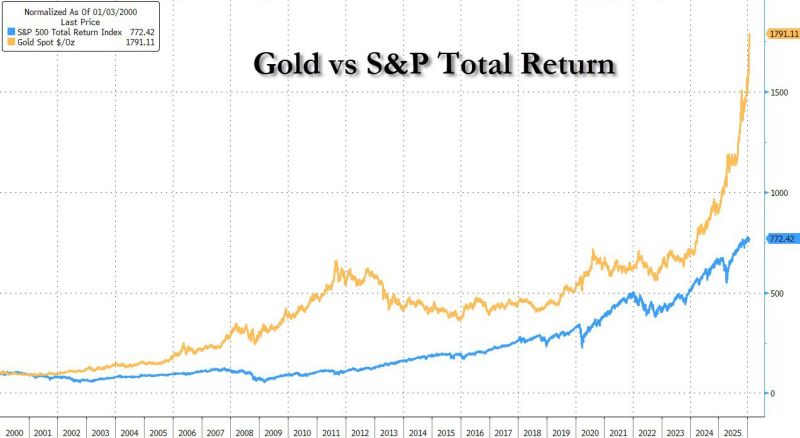

Gold vs S&P total return.

A rock has outperformed the collective genius of the US capital markets by more than 100% Source: zerohedge

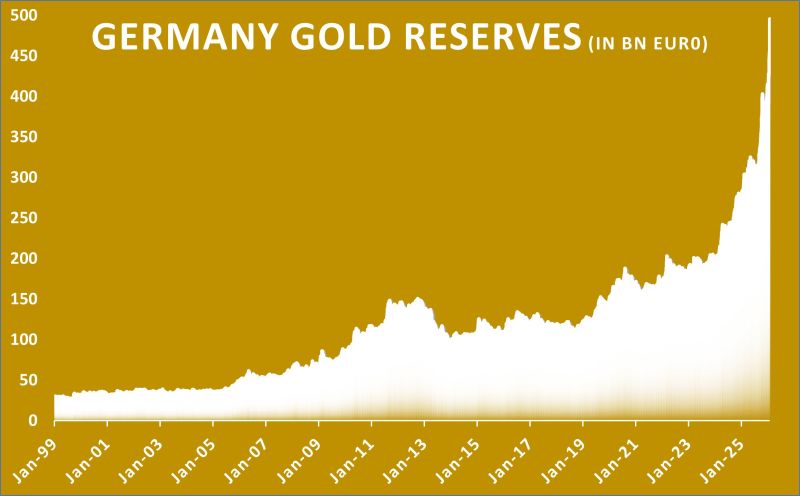

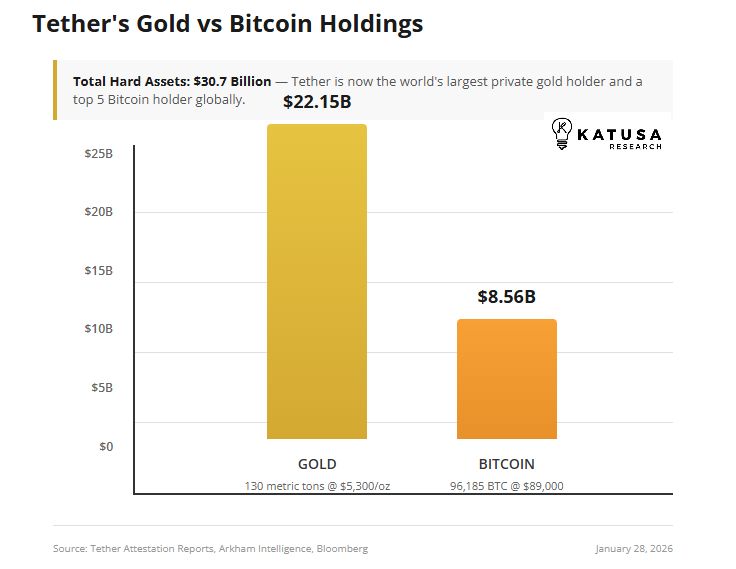

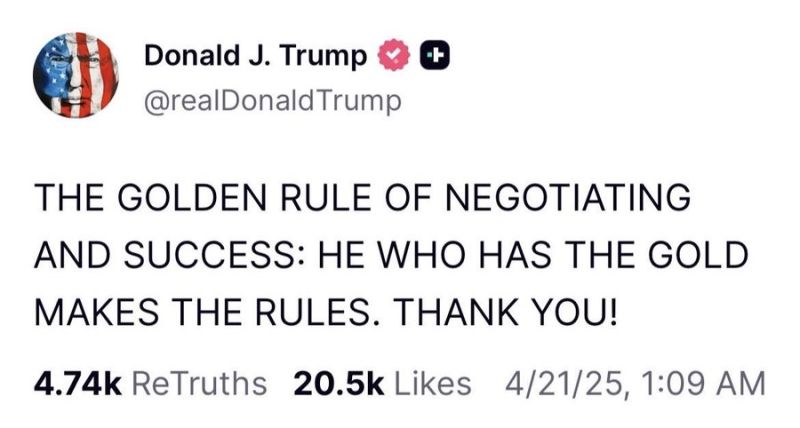

Trump: He who has the gold makes the rules

European gold in US custody: - Germany: ~40% of gold holdings - Italy: ~50% - Netherlands: ~30% Not your vault, not your gold ??? Source: Lukas Ekwueme @ekwufinance

Investing with intelligence

Our latest research, commentary and market outlooks