Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

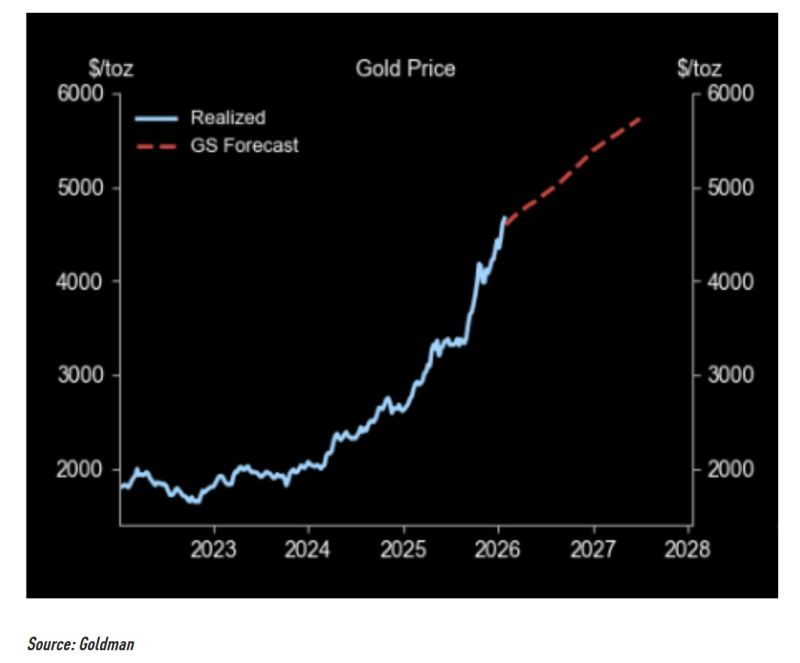

Goldman is raising Gold price target to $5,400

"We raise our Dec2026 gold price forecast to $5,400/toz (vs. $4,900 prior) because the key upside risk we have flagged--private sector diversification into gold--has started to realize. We assume private sector diversification buyers, whose purchases hedge global policy risks and have driven the upside surprise to our price forecast, don't liquidate their gold holdings in 2026, effectively lifting the starting point of our price forecast." Source: TME

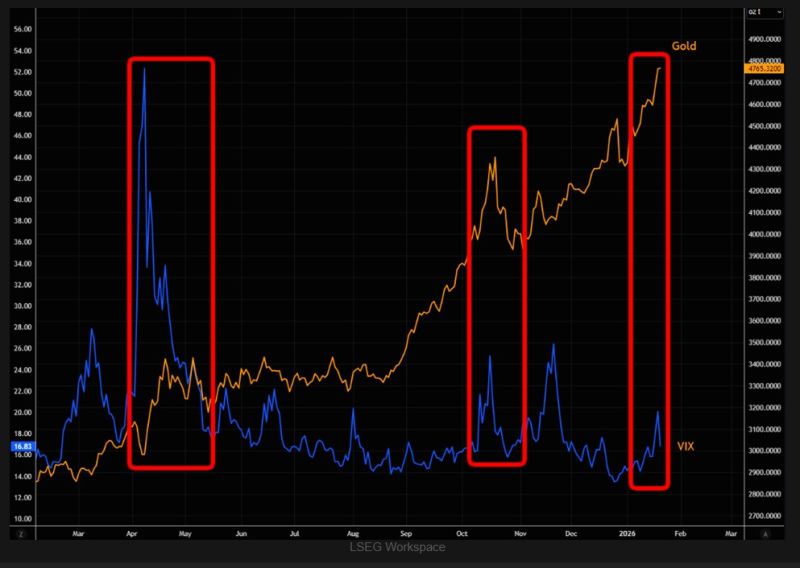

Is Gold Still the Go-To Fear Hedge

Better hashtag#hedge alternatives? hashtag#Gold as the global fear hedge looks expensive relative to the VIX. Volatility remains somewhat elevated despite the recent pullback tied to the Greenland/Trump headlines, but chasing gold here as protection looks late. Source: TME

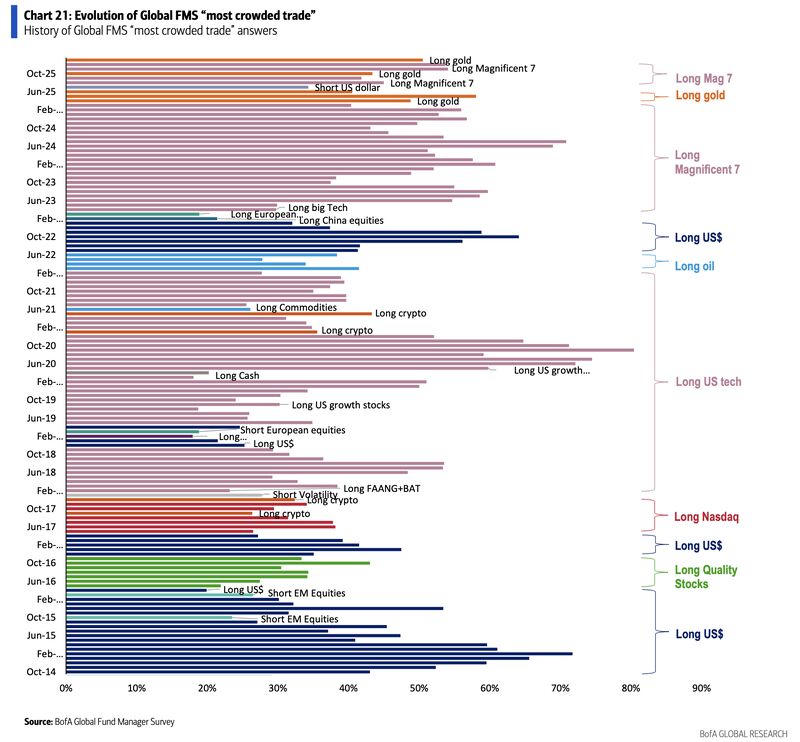

Gold is now the most “crowded trade”, acc to BofA’s monthly Global Fund Manager Survey.

Source: Holger Zschaepitz @Schuldensuehner BofA

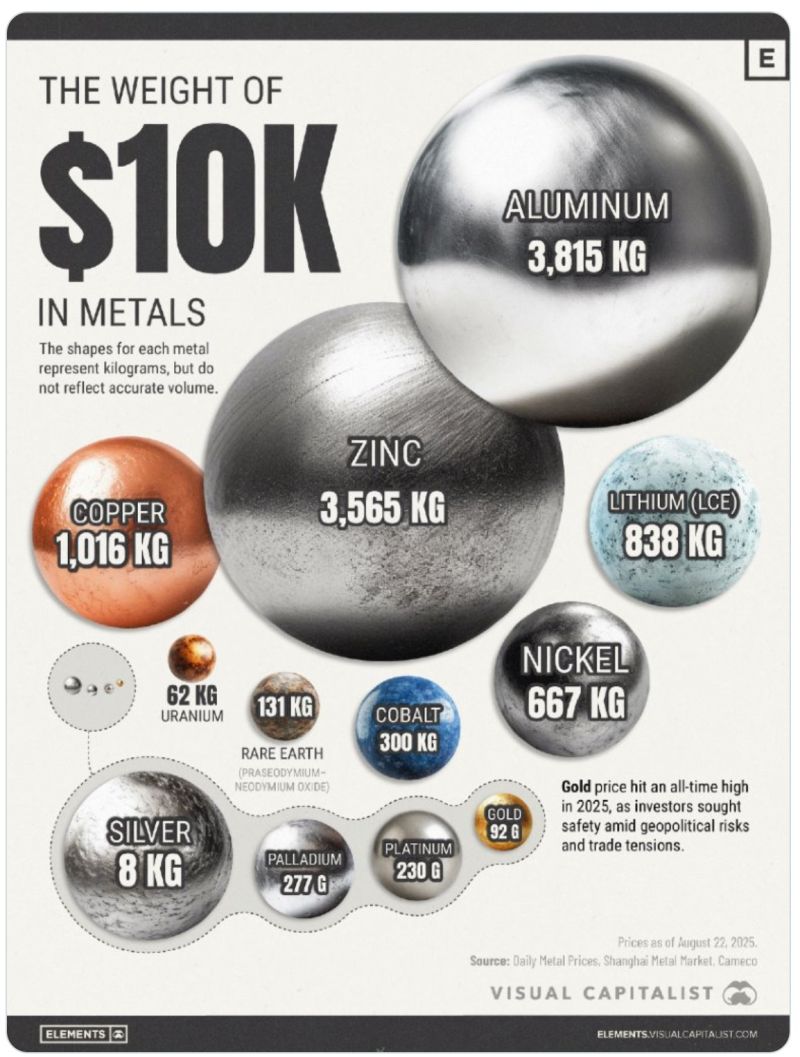

This is HISTORIC: The gold-to-silver ratio plunged to 50, the lowest in 14 YEARS.

This means it now takes just 50 ounces of silver to buy 1 ounce of gold, down from ~105 in April 2025. Since then, gold prices have rallied +43% while silver prices have SKYROCKETED an unbelievable +186%. Silver is outperforming gold at the fastest pace in decades. Source: Global Markets Investor Global Markets Investor

The Correlation Between Gold Prices and Japanese Bond Yields (2013–2025)

Gold (in organe) and 10-year JGB yields (in blue). Japan was always the endgame Source: www.zerohedge.com

The Gold/Silver pair down to 52x - the lowest since Dec 2012

Since: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks