Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

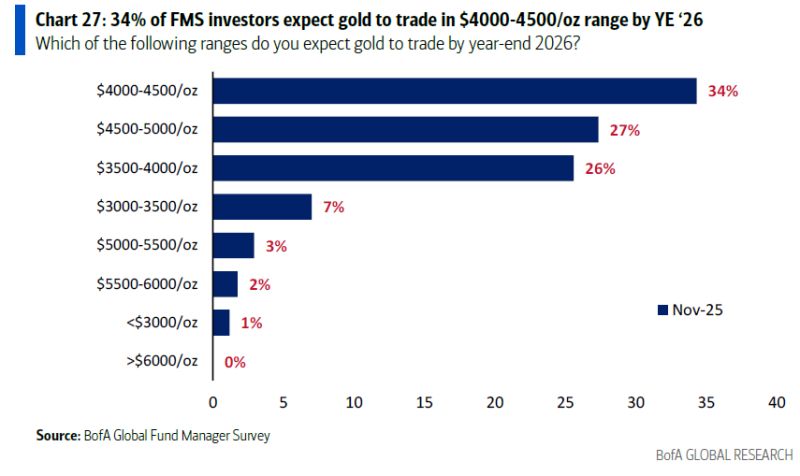

Only 5% of Fund Managers expect gold to trade above $5,000 by the end of 2026, none over $6,000

Source: BofA

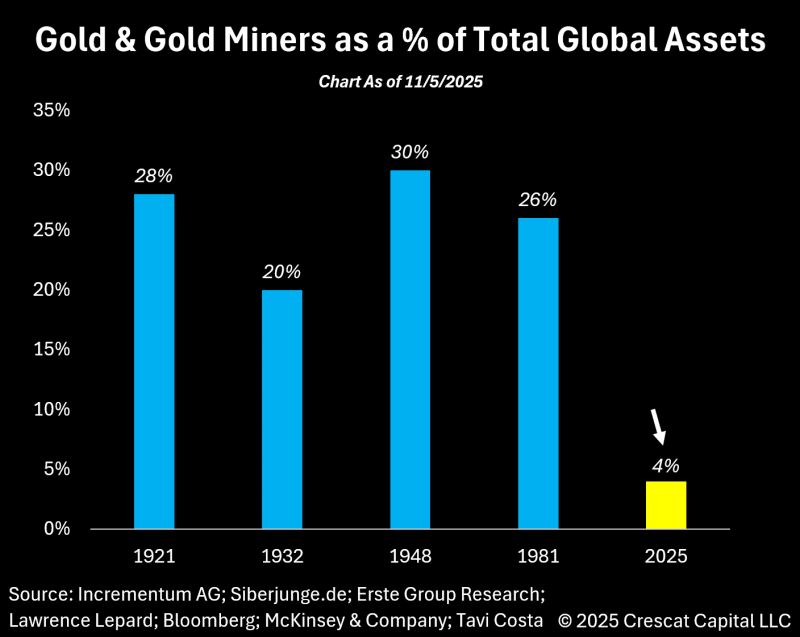

Gold and gold miners together represent about 5% of total global assets.

That is approximately 7–5 times below the highs reached in prior cycles. Source: Tavi Costa, Bloomberg

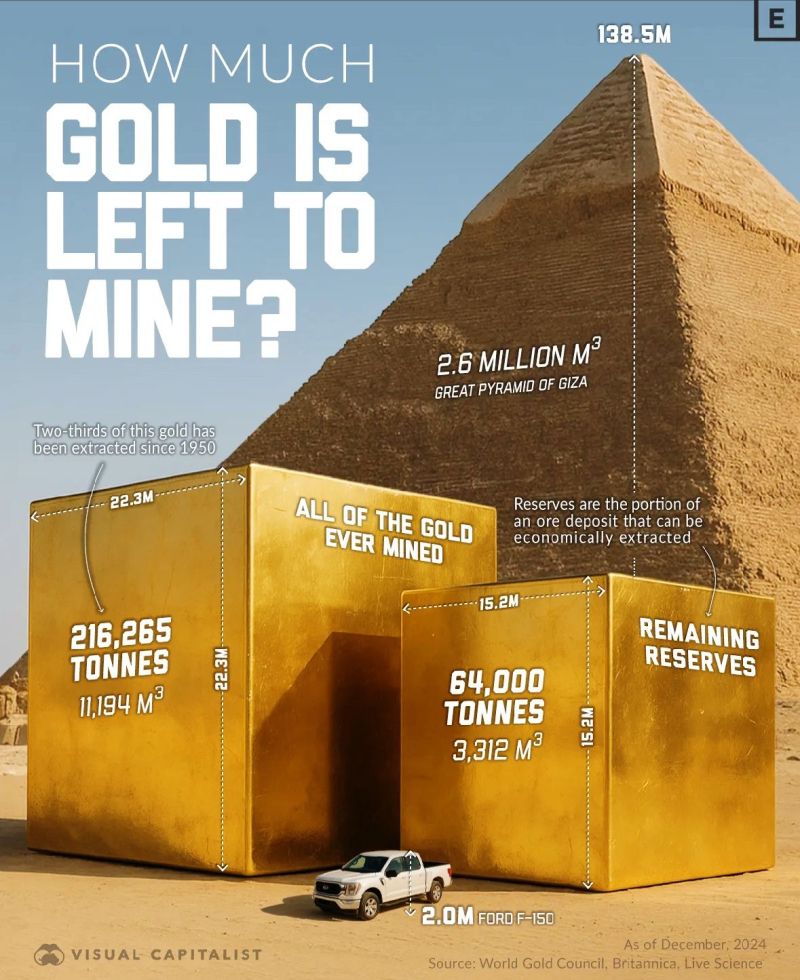

💰 How Much Gold Is Left to Mine?

To visualize: • 🟨 All the gold ever mined would fit inside a cube just 22.3 meters wide — smaller than the Great Pyramid of Giza. • 🟨 Remaining reserves would form a cube of 15.2 meters per side. • ⛏️ Two-thirds of all gold in human history has been extracted since 1950, a period of accelerated mining and financialization. 📊 Source: World Gold Council, Britannica, Live Science Source: INVEST

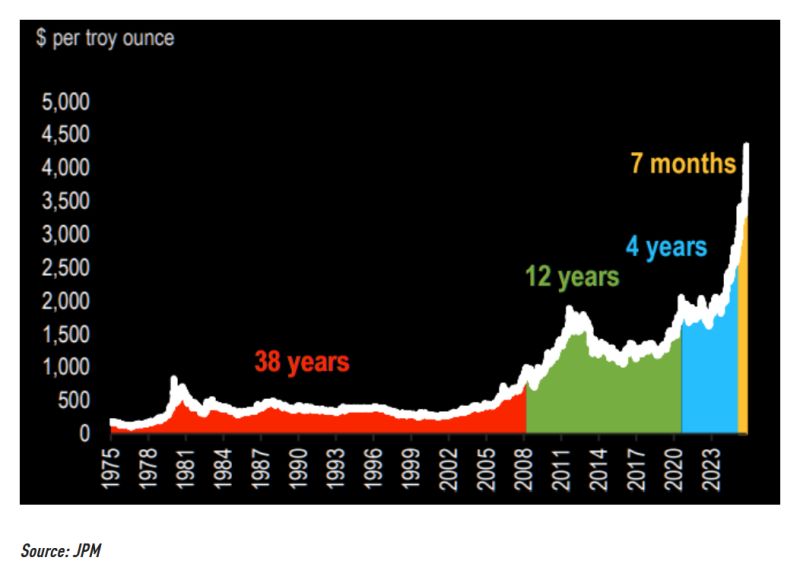

JP Morgan: “After taking 12 years to double from $1,000 to $2,000 (2008–2020), gold doubled again in just 5 years, crossing $4,000 this month.

The move from $3,000 to $4,000 took ~200 days — and from $3,300 to $4,300 only ~60.” Source: The Market Ear, JPM

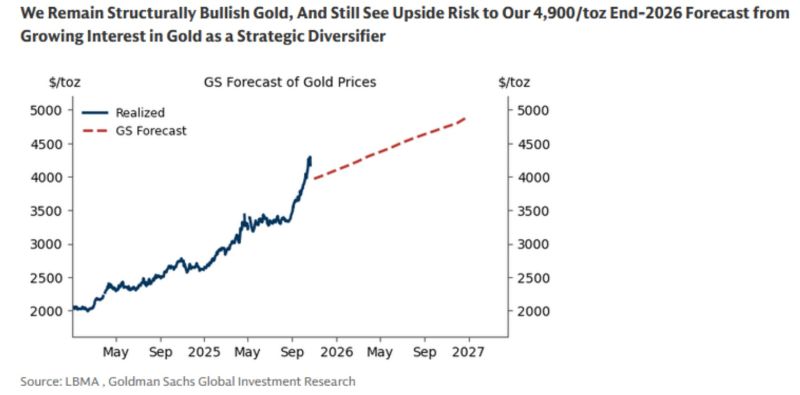

Goldman's gold forecast

"We remains structurally bullish on gold, and still see upside risk to our 4,900/toz End-2026 forecast" Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks