Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

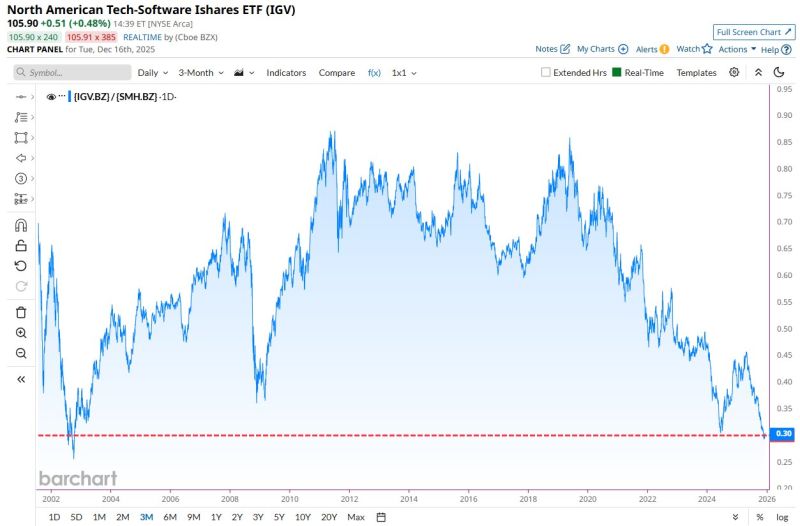

Software Stocks are now underperforming Semiconductors by the largest margin in more than 23 years

Source: Barchart

In case you missed it...Tech may finish the year with a lower Forward P/E than it began the year...

Tech bubble? Are you sure? Source: Seth Golden @SethCL Factset

$IBM CEO says that at today’s costs it takes about $80B to build & fill a 1 GW AI data center

So the ~100 GW of announced capacity implies roughly $8T of capex & “no way you’re going to get a return on that,” since you’d need “about $800B of profit just to pay for the interest” Source: Wall St Engine

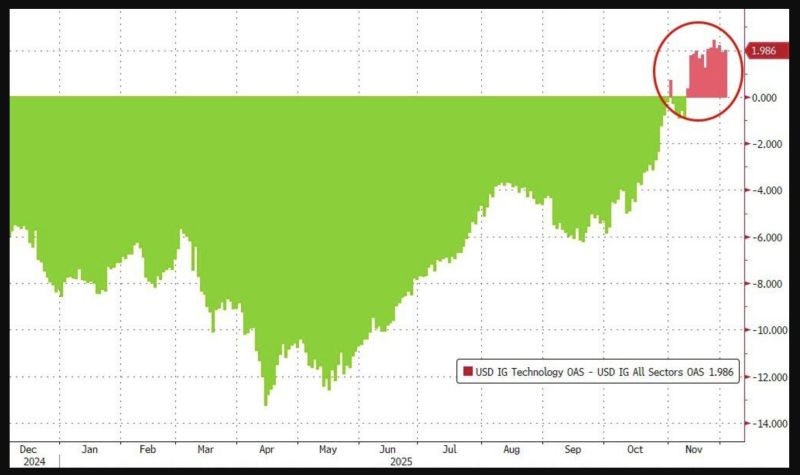

Overall Tech credit Spreads continue to trade wide to the overall IG credit market...

Source: zerohedge

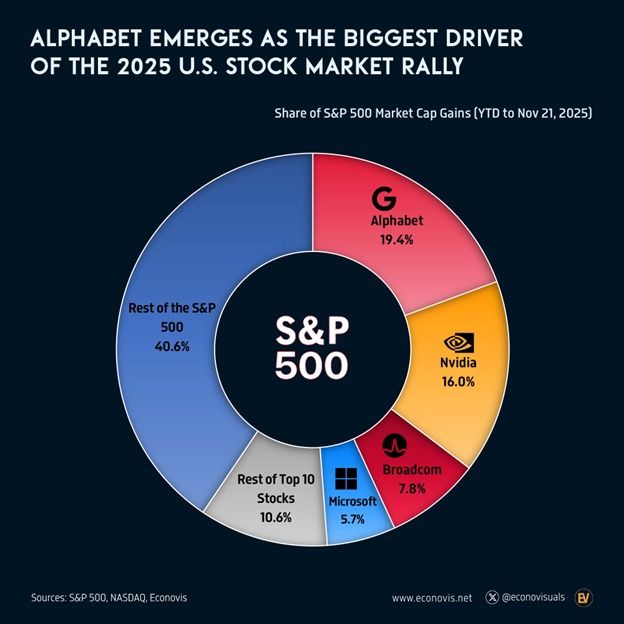

🚀 Big Tech Is Carrying the Entire Stock Market — Literally

Alphabet ($GOOGL) has been the single biggest driver of the S&P 500 this year… accounting for 19.4% of the index’s entire YTD gain. That’s what happens when you add $1.3 trillion in market cap in 11 months. Right behind it? Nvidia ($NVDA): +16.0% contribution (+$1.05T) Broadcom ($AVGO): +$520B Microsoft ($MSFT): +$380B Together with the rest of the mega-cap giants, the top 10 stocks now make up 59.4% of the S&P 500’s total gain this year. Which means the other 490 companies combined contributed just 40.6%. Source: The Kobeissi Letter, econovisuals

Samsung bets big on AI 🇰🇷 Korean tech giant

Samsung just announced plans to buy and deploy 50,000 Nvidia GPUs — a massive move aimed at supercharging its chip manufacturing for mobile devices and robotics. 💡 The partnership is another win for Nvidia, whose GPUs remain the gold standard for building and deploying advanced AI systems. 🔧 Samsung also confirmed it’s working with Nvidia to optimize its 4th-gen HBM (High Bandwidth Memory) for next-generation AI chips — a move that could reshape the global AI hardware landscape. 👉 The AI arms race just got another heavyweight upgrade.

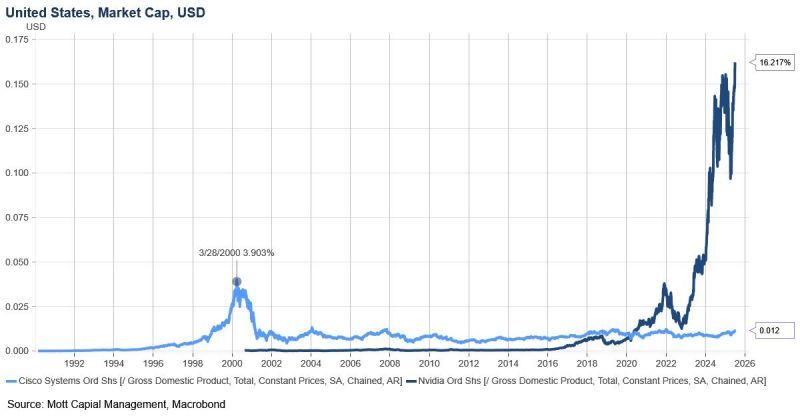

Cisco peaked at 4% of U.S. GDP.

Nvidia is currently 16% of U.S. GDP. Source: Spencer Hakimian @SpencerHakimian

Very important read-through of yesterday's mega cap tech earnings ➡️

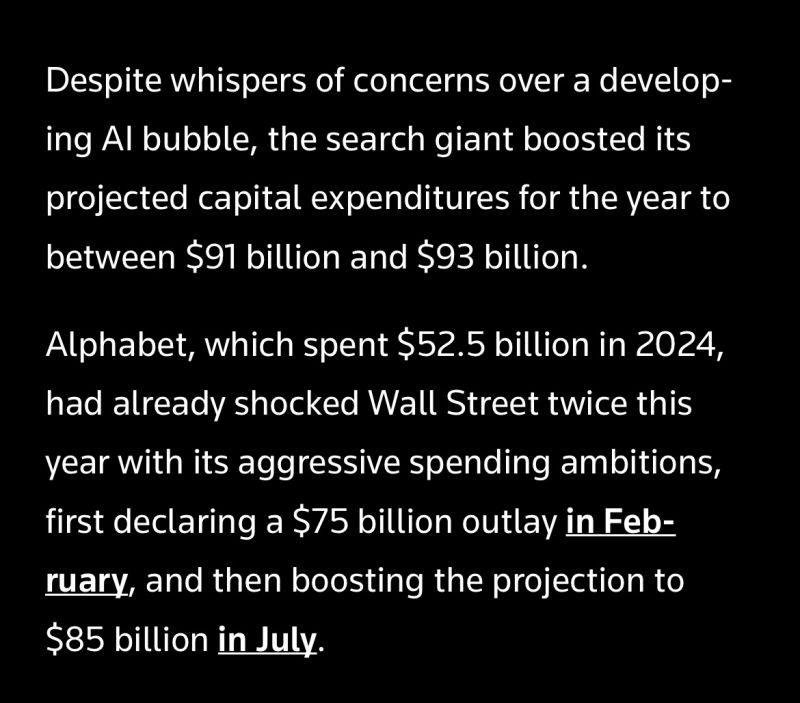

Hyperscaler CapEx remains sky-high: • $GOOGL: FY $91–93B (vs $85B est) • $MSFT: Q1 $34.9B (vs $30B est) • $META: Expects higher CapEx in 2026 Note that Google raises 2025 Capex for the second time this year: “With the growth across our business and demand from Cloud customers, we now expect 2025 capital expenditures to be in a range of $91 billion to $93 billion." BULLISH 🚀 Source: Investing visuals @InvestingVisual Michael Horner @michaelbhorner

Investing with intelligence

Our latest research, commentary and market outlooks