Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Oracle and OpenAI have signed a deal worth $300B, the largest cloud computing contract in history as per the Wall Street Journal

Looks like we found the customer responsible for Oracle’s 350% increase in remaining performance obligations. Source: @amitinvesting on X

Robinhood Forays Into Social Media

Robinhood is expanding beyond trading with the launch of Robinhood Social, set to debut early next year with a limited invite-only rollout before going wider. Users will be able to: 1) Post trades and follow other traders, 2) Discuss market moves directly in the feed, 3) Trade from within the app at no extra cost, 4) View verified P&L histories and even track trades of public figures via disclosures. CEO Vlad Tenev: “Robinhood is no longer just where you trade – it’s your financial superapp.” At its annual Hood Summit, the company also unveiled futures trading (S&P 500, oil, Bitcoin, gold), short selling, and overnight index option trading coming in 2025. $HOOD has already tripled this year and joins the S&P 500 on Sept. 22.

Apple Launches New $1k Phone – You Buying?

Apple’s live product event delivered the usual fanfare with updates to iPhones, AirPods, and Watches. The spotlight, however, was on the iPhone Air, Apple’s thinnest phone yet, built with titanium and ceramic and powered by the new A19 chip. Despite the buzz, markets were unimpressed: $AAPL closed down 1.48%, the only Mag 7 stock in the red on Tuesday.

By FT >>> Donald Trump cannot fire Lisa Cook for now, according to a US judge, in a major win for the Federal Reserve governor fighting the president over efforts to remove her from the central bank

Jia Cobb, the federal judge presiding over the case in Washington, late on Tuesday held that Cook may not be fired while litigation is pending. “Cook has made a strong showing that her purported removal was done in violation of the Federal Reserve Act,” Cobb wrote. A provision of that act allows a president to remove a Fed governor only “for cause”, which according to Cobb would involve failing to fulfil statutory duties. The ruling will allow Cook to attend the Fed’s policy-setting committee meeting next week, when it is widely expected to cut interest rates for the first time this year. It marks a setback for Trump, who last month announced he was sacking Cook for alleged mortgage fraud, amid a campaign to pressure the US central bank into lowering borrowing costs. Source: FT https://lnkd.in/exQeKfwY

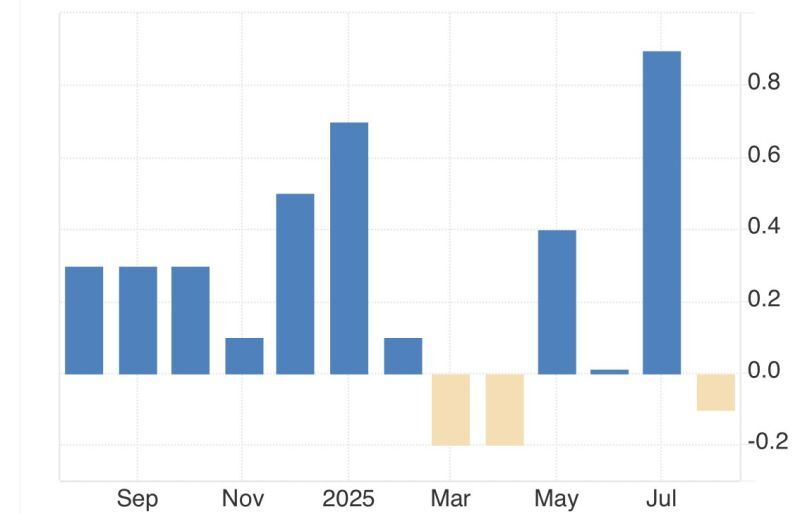

So now we have producer deflation?

US wholesale prices unexpectedly declined in August, a welcome development for investors clamoring for a Fed rate cut next week to boost the economy. Here are the details: PPI MoM: -0.1% vs 0.3% exp. PPI YoY: 2.6% vs 3.3% exp. PPI Core MoM: -0.1% vs 0.3% exp. PPI Core YoY: 2.8% vs 3.5% exp. We had producer deflation in August. Let see what the CPI report will look like tomorrow…

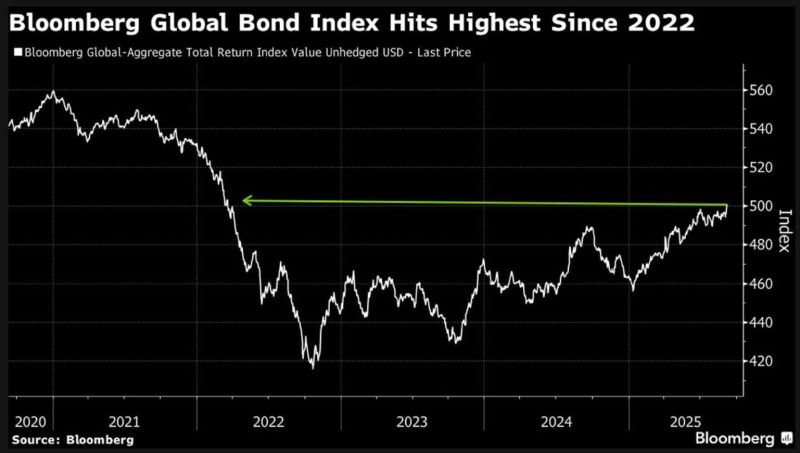

Bloomberg frames the latest bond rally (with yields falling) in a wider context:

“Three years after a surge in inflation pummeled fixed-income markets all around the world, global bonds have finally re-entered bull market territory. Bloomberg’s Global Aggregate Index, which tracks returns on sovereign and corporate debt across developed and emerging markets, has surged more than 20% from its 2022 trough to its highest level since March 2022 amid a broad fixed-income rally. The latest leg higher came as cooling US labor data fueled bets the Federal Reserve would step up policy easing.” Source: Bloomberg, Mo El Erian on X

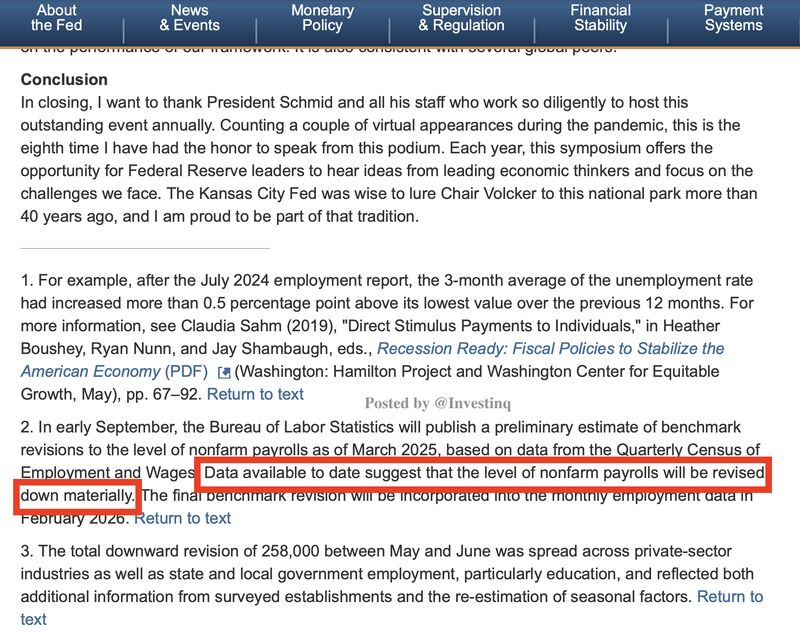

As highlighted by StockMarkets.news, the payroll downward revision was actually flagged by Powell weeks ago, sneaking it into a footnote in his Jackson Hole speech:

“Data available to date suggest that the level of non-farm payrolls will be revised down materially.” On Sept 9, that’s exactly what happened: -911,000 jobs erased. ➡️ The question now is was this worse than he expected, and does it warrant a 25 or 50 bps cut? Source: StockMarket.news

‼️ JUST IN : Taiwan Semiconductor $TSMC’S REVENUE JUMPED OVER 33.8% YoY TO $11.09B IN AUGUST

👉 TSMC (TAIWAN SEMICONDUCTOR) MAKES ALL THE CHIPS FOR NVIDIA , APPLE , AMD AMONG OTHERS 👉So far in 2025 (Through August) TSMC has brought in total revenue of $80.33B up 37.1% YoY. Source: GURGAVIN

Investing with intelligence

Our latest research, commentary and market outlooks