Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Foreign investors withdrew ~$6 BILLION from US equity funds last week.

This is the the 3rd largest amount on record and in-line with levels seen during March 2020. source : BofA, kobeissiletter

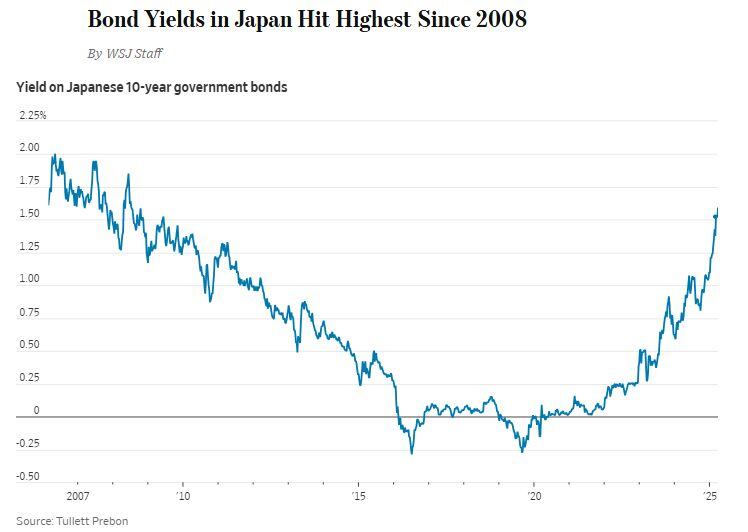

Japanese 10-Year Bond Yield jumps to highest level since the Global Financial Crisis 🚨

Source: Barchart

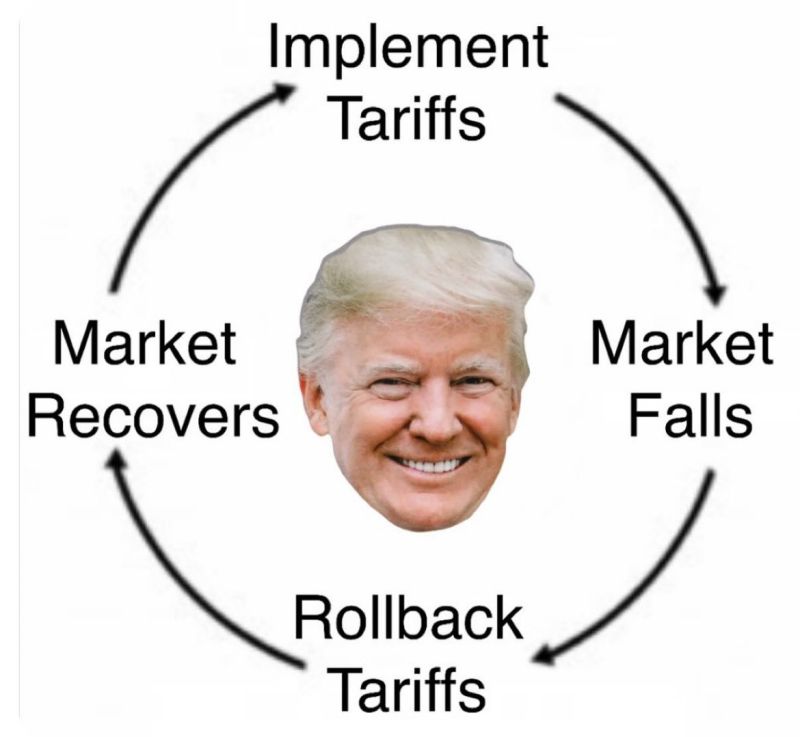

Trump’s economic cycle for the next 4 years?

Source: Not Jerome Powell on X

"Nothing good happens below the 200-day moving average."

— Paul Tudor Jones Source: Tavi Costa on X

🚨 GOOGLE SAYS QUANTUM TECH IS JUST 5 YEARS AWAY FROM REAL-WORLD IMPACT

Julian Kelly, Director of Hardware at Google Quantum AI: "We think we're about five years out from a real breakout... a practical application that you can only solve on a quantum computer." Following Google’s December breakthrough in quantum error correction, momentum is building fast. These supercomputers could soon tackle physics problems and generate data beyond the reach of today’s machines. Quantum computing is no longer a far-off dream — it’s becoming a near-term reality. Source: CNBC thru Mario Nawfal

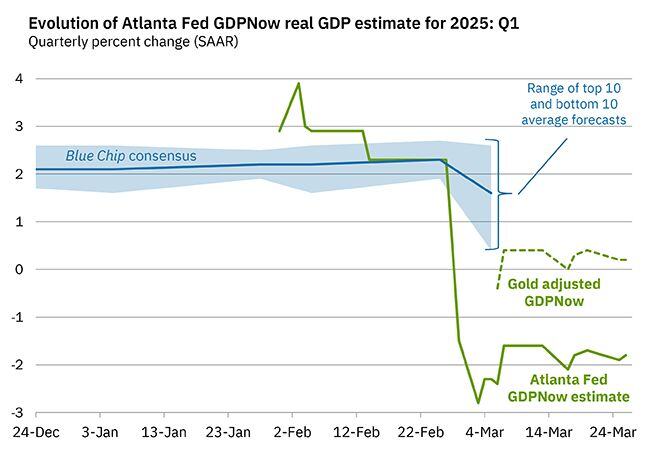

On March 26, the GDPNow model nowcast of real GDP growth in Q1 2025 is -1.8%

The alternative model forecast, which adjusts for imports and exports of gold, is 0.2%. Source: AtlantaFed

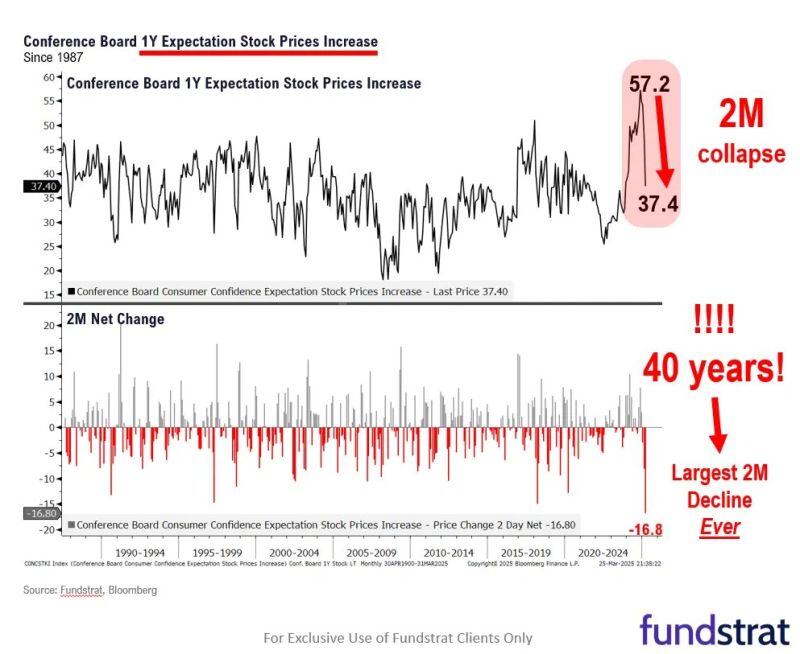

Tom Lee: Conference Board shows largest ever plunge in stock expectations, which is a contrarian buy signal

Source: Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi, FundStrat

Investing with intelligence

Our latest research, commentary and market outlooks