Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tariffs, Courts & Treasuries

A U.S. federal appeals court has ruled that the Trump administration misused emergency powers to impose tariffs that have been bringing in roughly $30 billion per month. If upheld, the decision could force Washington to repay importers and remove the steepest trade taxes in a century. The case is now on an expedited track to the Supreme Court, with a key October 14 deadline looming. What’s at stake? - Congress relied on these tariff revenues to help offset this year’s tax cuts. A rollback could leave a deeper fiscal hole, unsettling Treasury buyers. - Importers say nothing changes until the court outcome, but market uncertainty is rising. - Steel and aluminum duties (1962 Act) and other tariffs (1974 Trade Act) are not affected — the dispute centers on the 1977 emergency powers. Trade policy and fiscal stability are deeply intertwined.

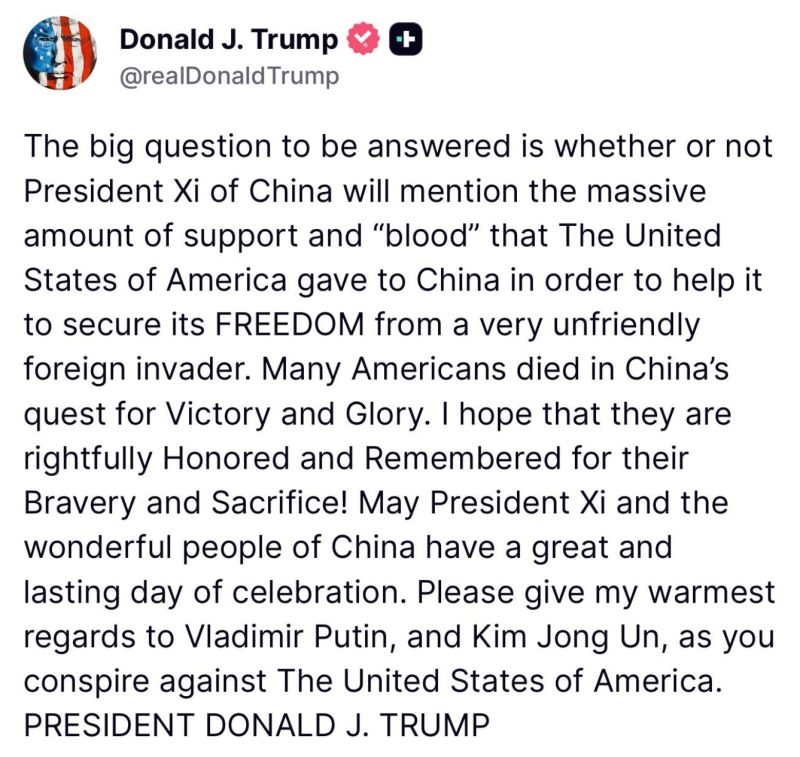

BREAKING: Trump tells Xi Jinping to 'please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America.'

Source: The Spectator Index @spectatorindex on X

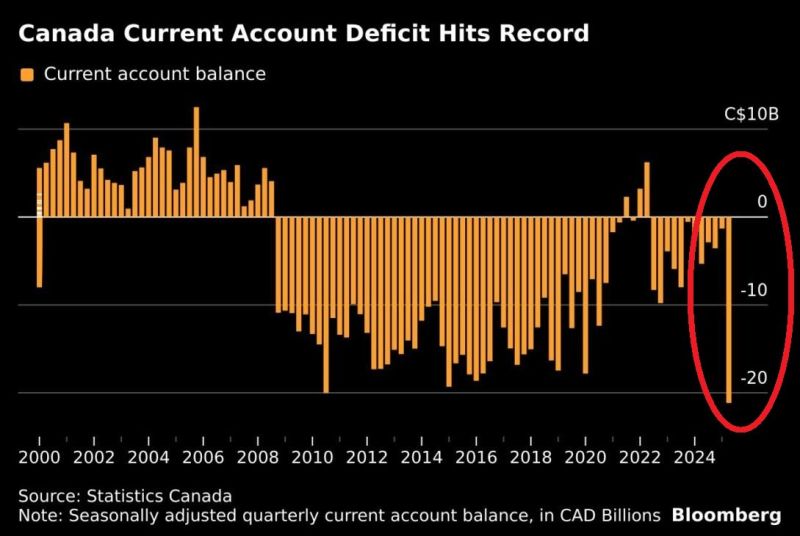

⚠️ Way more more money is flowing out of Canada than coming in

Canada’s current account deficit reached C$21.16 billion in Q2 2025, AN ALL-TIME HIGH. Additionally, trade deficit in goods widened to a record C$19.6 BILLION. US tariffs seem to be hurting Canada's economy. Source: Global Markets Investor, Bloomberg

Tariffs are forcing countries to make new partnerships

Do you remember the proverb? "The enemy of my enemy is my friend" Source: @krassenstein on X

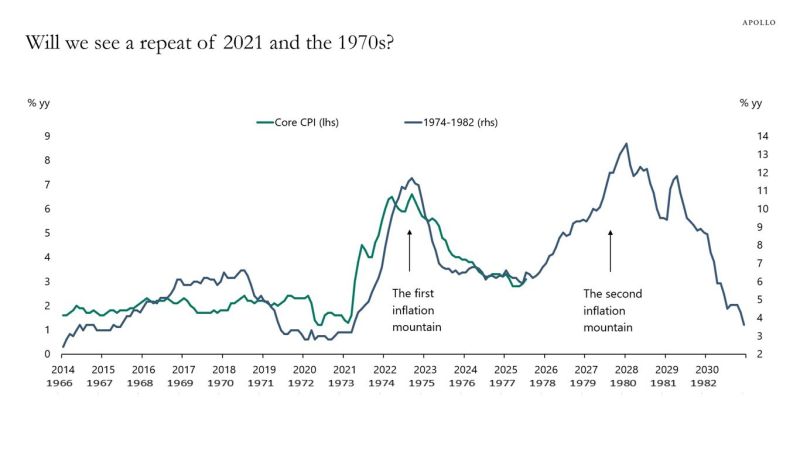

Apollo: "Yes tariffs are inflationary - so too is a US dollar depreciation - that results in a coming inflation mountain"

See chart below inflation 2021 cycle relative to 1970s. Source: Apollo, Samantha LaDuc on X

Despite ballooning debt, scare of Fed independence, tariffs, etc. the market's perception of USA sovereign risk is back at pre-Trump lows.

Source: zerohedge

‼️Caretaker Prime Minister Dick Schoof is staring down a no-confidence vote today that could force his entire cabinet to resign.

➡️ His fragile government was gutted Friday when the New Social Contract party quit over disagreements on taking a tougher stance against Israel’s war in Gaza. ➡️ The NSC supported stronger measures, while the rest of the cabinet - including Schoof - refused to take that line. ➡️ Now left with just 32 of 150 seats, Schoof’s survival hinges on backing from opposition parties - many of whom are making demands he can't meet. ➡️ A collapse would plunge the Netherlands into uncharted political chaos, just months before a scheduled October election. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks